This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

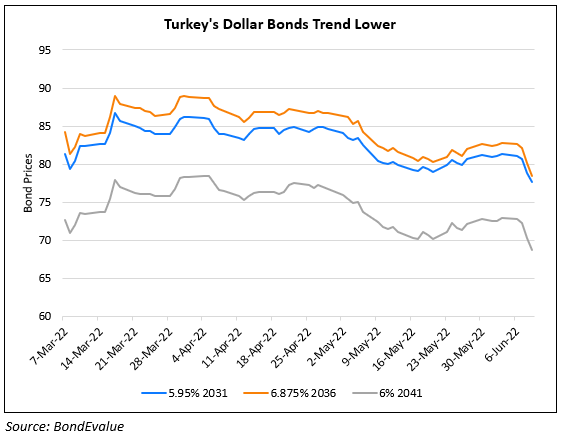

Turkey’s Dollar Bonds Slip as Inflation and Rate Cut Worries Persist

June 9, 2022

Dollar bonds of Turkey fell by 1-2 points yesterday and the lira fell over over 2%. The nation has seen a massive surge in inflation to 73.5%, its highest in over 23 years. Equally worrying were the comments of Turkish President Erdogan who said that Turkey will not raise rates but rather continue cutting them in the face of high living costs. Besides, its forex reserves have been on the decline and stood at $12.2bn at end-May. Reuters notes that their reserves would be deeply negative once their currency swaps are deducted. They note that its 5Y CDS jumped 32bps yesterday to 769bp levels, which were last seen during the 2008 global financial meltdown.

Go back to Latest bond Market News

Related Posts:

Turkey Lining Up Sukuk Issuance; Qatar Plans to Refinance Debt

February 8, 2022

Turkey Launches $2bn 5.5Y Dollar Bond at 8.625%

March 18, 2022