This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

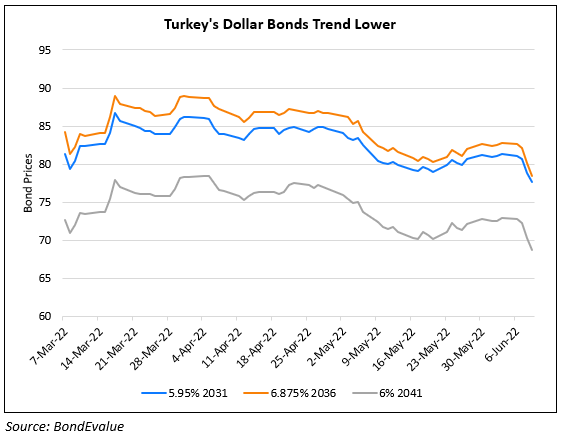

Turkey’s Dollar Bonds Rise By 3% on Appointment of Simsek as Economy Minister

June 6, 2023

Turkey’s dollar bonds rose by over 3% after President Erdogan announced the cabinet of ministers that included Mehmet Simsek as the new finance minister. Simsek is an important appointment to the ministry as he had won markets’ confidence during his prior terms as finance minister and deputy prime minister between 2009 and 2018. Given Erdogan’s policy of cutting interest rates amid high inflation, markets were hoping for Simsek’s appointment to provide a sense of balance to monetary policy. Simsek said after being appointed that “Turkey has no choice left to return to a rational basis” in terms of economic policies. Markets now expect some concrete steps to pave the way to fixing the country’s economy. Besides, the focus also shifts to whether Şahap Kavcıoğlu, the current central bank governor would be replaced. Sources said that Hafize Gaye Erkan, a former Goldman Sachs executive met Mehmet Simsek and if selected, would be the first female governor. This comes after Erdogan fired Kavcıoğlu’s three predecessors for tightening monetary policy too much even as inflation was rising. Separately, Turkey’s inflation cooled to 39.6% in May, a 16-month low and compared to 43.7% in the previous month. This comes after Erdogan’s pre-election free natural gas giveaway helped ease price pressures.

Turkey’s 9.375% 2033s were up over 3 points to trade at 101.7, yielding 9.11%.

Go back to Latest bond Market News

Related Posts: