This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

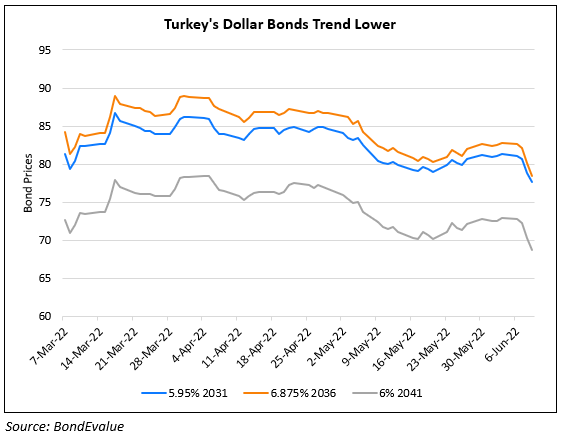

Turkey’s Dollar Bonds Drop Across the Curve

June 9, 2023

Turkey’s dollar bonds fell 1.5-2.5% across the curve yesterday. While the reason for the move was not clear, there were two updates on the sovereign. First, Erdogan appointed Hafize Gaye Erkan as the new central bank governor replacing Sahap Kavcioglu, which market participants see as a positive signal to return to conventional monetary policy. However, it remains to be seen about how much autonomy she would have. Nick Stadtmiller of Medley Global Advisors said, “Erkan’s appointment hopefully marks an improvement over the policies of her predecessor. The lingering question is whether Erdogan will allow the central bank to raise rates sufficiently to bring down inflation.”

Separately, Bloomberg cites traders saying that Turkish state banks had halted sales of dollars to protect the depreciation of the lira. Analysts note that it may be a sign that the new cabinet is turning toward conventional economic policies following the re-election of Erdogan. Following this move, the lira depreciated by over 7% against the dollar to 23.50. Since the re-election, the lira has weakened over 13%.

Turkey’s 9.375% 2033s were down 1.3 points to trade at 99.75, yielding 9.41%.

Go back to Latest bond Market News

Related Posts: