This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Turkey Downgraded to B by S&P

October 3, 2022

Turkey was downgraded to B from B+ with a stable outlook by S&P on weak monetary and fiscal policy, and low net foreign currency levels. S&P sees broader fiscal risks on the rise, as measured by the widening overall public deficit, and policymakers’ push for growth over financial and monetary stability ahead of 2023 elections. In the last 12 months, Turkey’s central bank has cut benchmark rates by a cumulative 700bp despite inflation at 80% against its target of 5%. Turkey has also put reserve and collateral requirements for suppressing foreign currency demand and lowered market interest rates, including government domestic yields to levels far below its reported inflation. The rating agency views highly accommodative fiscal and monetary settings as a risk, undermining confidence in the lira amid global tightening conditions. Further, refinancing risk could arise due to its sizeable short-term external debt of $182bn, or 25% of GDP. S&P believes that policy missteps could stem from the 2023 general elections and policy direction remains uncertain. They forecast that inflation will average 74% in 2022, the highest among all rated sovereigns, and higher energy prices will drive current account deficit to $40bn, around 5.5% of GDP in 2022.

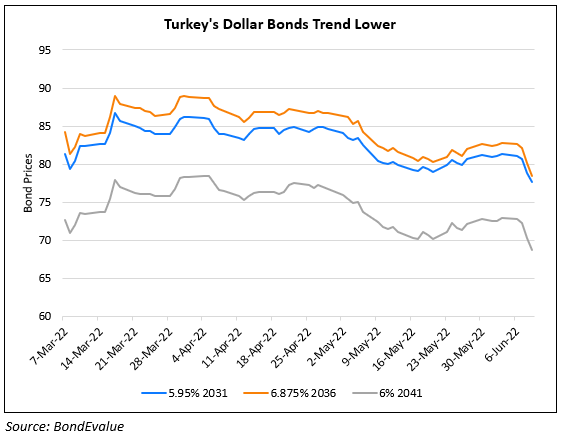

Turkey’s 5.95% in 2031 traded 0.47 points higher to 73.82 to yield 10.81%.

Go back to Latest bond Market News

Related Posts: