This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

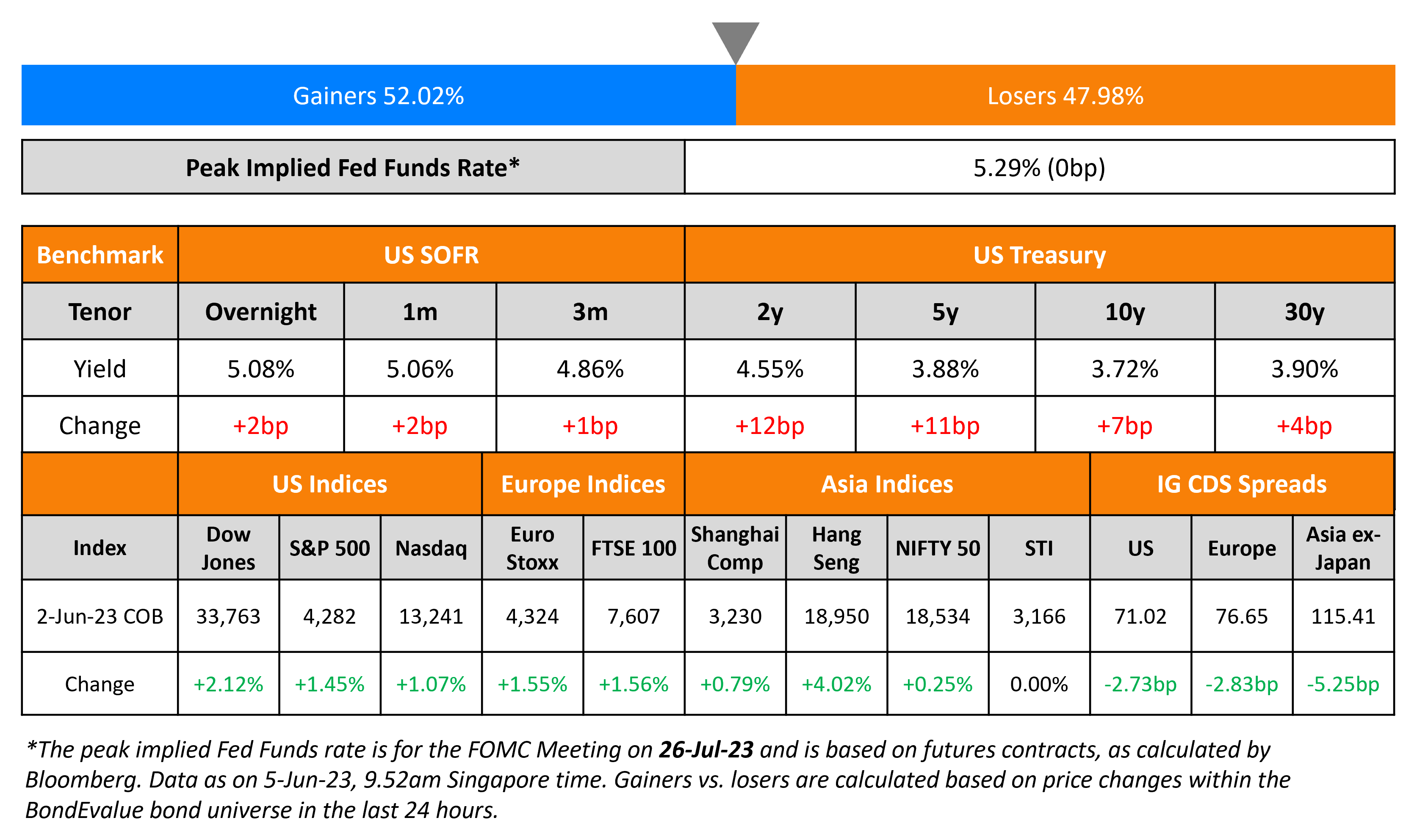

Treasury Yields Soar on Strong Jobs Data

June 5, 2023

US Treasury yields jumped across the curve after a strong jobs report on Friday. US Non-Farm Payrolls for May came at 339k, higher than the surveyed 195k and last month’s 253k. The Unemployment Rate ticked higher to 3.7%, higher than the surveyed 3.5%. In terms of wage growth, Average Hourly Earnings (AHE) YoY rose by 4.3%, lower than the surveyed 4.4%, indicating a slower pace of wage increases.

CME probabilities for a status quo at the Fed’s June meeting are now at 70% vs. a 36% probability a week ago. Markets are now pricing in a 25bp rate hike in July with a 54% probability. The peak Fed Funds Rate was unchanged at 5.29% for July. Separately, US President Joe Biden signed the debt ceiling bill into law, thereby successfully averting a default by the government. Equity indices jumped higher on Friday with the S&P and Nasdaq up by 1.5% and 1.1% each following the strong jobs report. US IG and HY CDS spreads tightened 2.7bp and 14.9bp respectively.

European equity indices closed lower too. European main CDS spreads tightened 2.8bp and Crossover spreads were 14bp tighter. Asia ex-Japan CDS spreads saw a sharp 5.3bp tightening and Asian equity markets have opened in the green this morning.

Exclusive Event for BondEvalue Subscribers in Dubai | 19 June

New Bond Issues

- ANZ $ 3Y covered bond at SOFR MS+75bp area

- Zhejiang Changxing $ 3Y at 7.15% area

New Bonds Pipeline

- H&H International hires for $ 3Y bond

- BGK hires for $ 10Y bond

- GS Caltex hires for bond

Rating Changes

- Moody’s upgrades Macquarie Group’s ratings, outlook stable

- Moody’s downgrades Belarus’ ratings to C with a stable outlook

Term of the Day

Phillips Curve

The Phillips Curve refers to a graph highlighting the relation between the unemployment rate and wage inflation. The graph shows a curve with an inverse relationship between the two. As the unemployment rate falls, it would imply an increase in the demand for labor thereby leading to an upward pressure on wages. This translates to increasing inflation. The Phillips curve is named after economist A.W. Phillips, who examined U.K. unemployment and wages from 1861-1957. Phillips found an inverse relationship between the level of unemployment and the rate of change in wages.

With the latest move higher in the US unemployment rate and the move lower in average hourly earnings, it remains to be seen if this leads to a consistent decrease in wage inflation over time.

Talking Heads

On Risk of US downgrade still on the cards despite debt deal

Calvin Norris, PM & US rates strategist at Aegon Asset Management

“The risk of a downgrade is exacerbated every time Congress flirts with the debt ceiling”

Wendy Edelberg, director of The Hamilton Project at the Brookings Institution

“A second downgrade would matter, and perhaps more than even the first downgrade… So much of the guidance that people take from ratings is the average rating across the three major rating agencies … The single downgrade didn’t really have any bite in terms of changing the average”

On Bond Bulls Ignoring Fed-Hike Noise and Keep Buying Yield Spikes

Scott Solomon, a fixed-income portfolio manager at T. Rowe Price

“The 5-year and 10-year has been the sweet spot for us, and we’ve been buying there”

Alex Li, head of US rates strategy at Credit Agricole

“If they really mean they are going to come back after June they may have to signal a little bit higher, probably one more hike in the dot plot”

On Fed rate-hike pause still likely despite strong data

Tiffany Wilding, economist at PIMCO

“It’s not clear to us that any of the … participants who expected a 5.125% terminal rate in March have changed their minds.”

Ian Shepherdson, the chief economist at Pantheon Macroeconomics

“I do think they are done” with rate increases, he said, but “I cannot rule out another hike in June.”

Top Gainers & Losers – 05-June-23*

Other News

WeWork bonds sink after top executives resign from cash-burning company

Go back to Latest bond Market News

Related Posts:-1.png)