This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

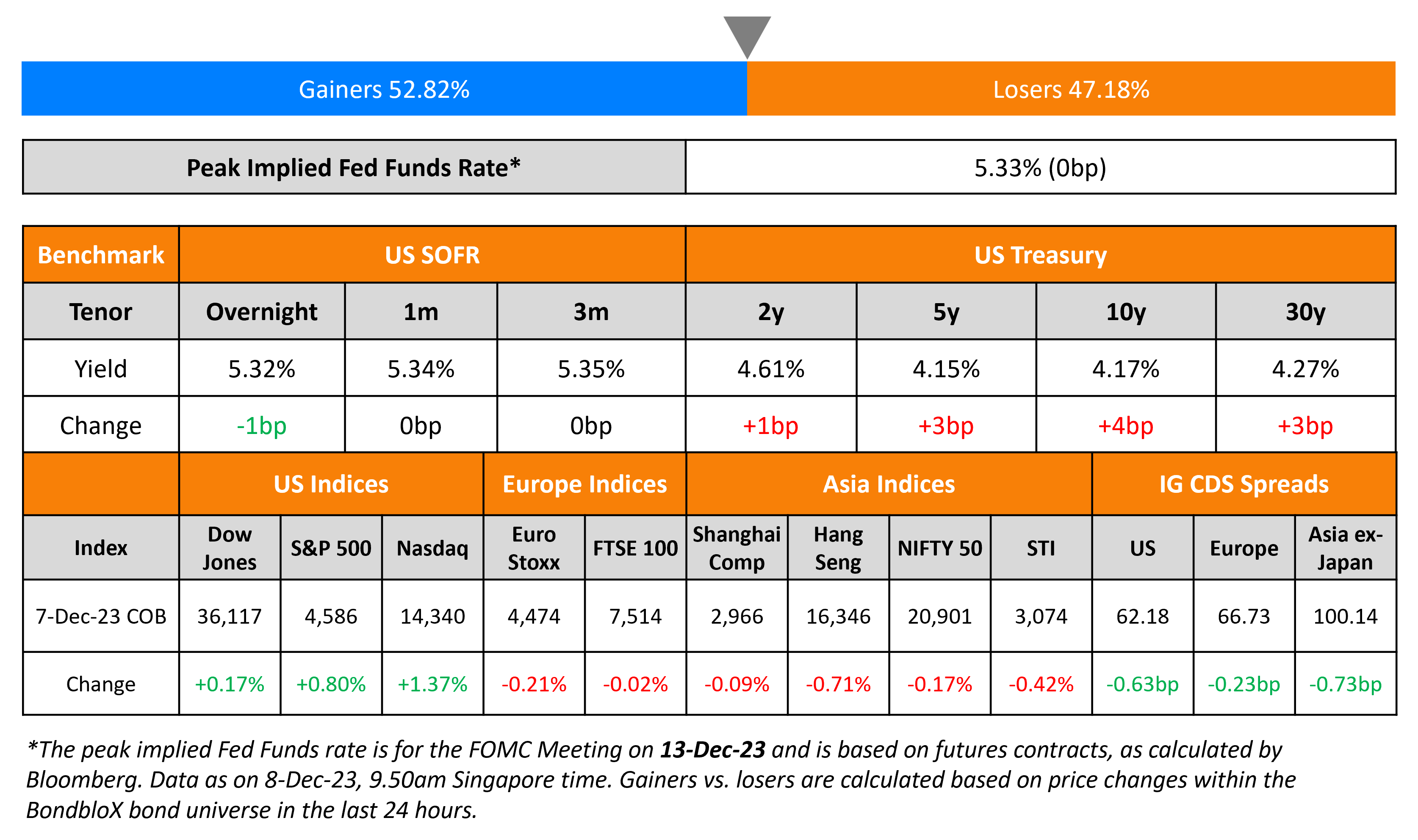

Treasury Yields Rise Marginally. Markets Await NFP

December 8, 2023

US Treasury yields rose marginally across the curve with the 10Y up by 4bp to 4.17%. Initial jobless claims for the prior week came in at 220K, higher by 1K over the previous week’s data, indicating a slight cooling of the US labor market. However, continuing jobless claims for the week fell to 1.86mn, decreasing by 64k compared to the previous week and against estimates of 1.91mn. US credit markets saw IG CDS spreads tighten by 0.6bp and HY by 2.2bp. Equity markets ended in green on Thursday, breaking a three day losing streak, with the S&P and Nasdaq up by 0.8% and 1.4% respectively.

European equity markets ended slightly lower. In credit markets, European main CDS spreads tightened by 0.2bp and crossover spreads tightened by 2bp. Asian equity markets have opened slightly higher today. Asia ex-Japan IG CDS spreads were tighter by 0.7bp.

One-day course on bonds in Singapore | 14 Dec | 50/70% Funding for Locals

.png)

New Bond Issues

- Changxing Urban Construction $ 3Y at 7% area

Changchun Urban Development raised $100mn via a 2.5Y green bond at a yield of 7%, 30bp inside initial guidance of 7.3% area. The senior unsecured bonds have expected ratings of BBB (Fitch). Proceeds will be used to refinance medium-term or long-term offshore debt due within one year in accordance with the green finance framework.

New Issues Pipeline

- India Vehicle Finance hires for $ 6.5Y Sr Secured bond

Rating Changes

- Moody’s upgrades Oman to Ba1, changes outlook to stable

- Moody’s upgrades Freeport-McMoRan Inc.’s ratings to Baa2; stable outlook

-

Petrofac Ltd. Downgraded To ‘B-‘ From ‘BB-‘; Placed On CreditWatch Developing Due To Unexpected Liquidity Concerns

- Moody’s affirms Sun Hung Kai Properties’ A1 ratings; changes outlook to negative from stable

- Moody’s places the ratings of Cinda AMC, Orient AMC, their subsidiaries and Chengtong HK on review for downgrade, following sovereign rating action

Term of the Day

Outcome Bonds

Outcome bonds are bonds whose return are linked directly to a successful outcome. These bonds thus track the performance on pre-defined metrics to share the risk and reward of given development projects with investors. These bonds aim to produce benefits for all parties involved in the transaction. Since 2021, the World Bank has issued three outcome bonds. They include one that provided funding for a water purifier project in Vietnam (Carbon Bond), one for a wildlife conservation project in South Africa (Rhino Bond), and a third for UNICEF to support its response to Covid19 (UNICEF Bond).

The World Bank is planning to broaden its range of outcome bonds, adding to a deal to tackle plastic pollution.

Talking Heads

On Opting for Cash or Bonds Over Stocks – JPMorgan’s Chief Market Strategist Marko Kolanovic

“Regardless of whether a recession happens or not, ex-ante, the risk-reward in equities and other risky assets is worse than in cash or bonds… we are not positive on the performance of risky assets and the broader macro outlook over the next 12 months”

On Treasury Rally on Fed Bets Just Getting Started – BofA

“The Treasury market has rallied substantially after the last hike in each of the five hiking cycles back to the 1988 cycle… It is a simple application of historical moves… lingering inflation pressures could limit the rally”

On the Market Being Convinced the Fed Will Finally Cut

Anthony Saglimbene, the chief market strategist at Ameriprise Financial

“The market now sees a visible path for rate cuts in 2024, and stock and bond prices are beginning to reflect that potential for easier monetary policy”

Neil Dutta, director of economic research at Renaissance Macro Research

“The data’s lining up, and we’re on a glide path now to a rate cut—probably by March”

Priya Misra, a portfolio manager at JPMorgan Chase

“A soft landing and risk assets are OK. Hard landing is a big problem for risk assets”

On Finding China Credit ‘Uninvestable’ – Distressed Debt Firm SC Lowy

“We believe that the lack of clear legal process and financial information means that the opportunity is a macro thesis, opposed to our investment philosophy of detailed corporate analysis coupled with downside protection”

Top Gainers & Losers- 08-December-23*

Go back to Latest bond Market News

Related Posts: