This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

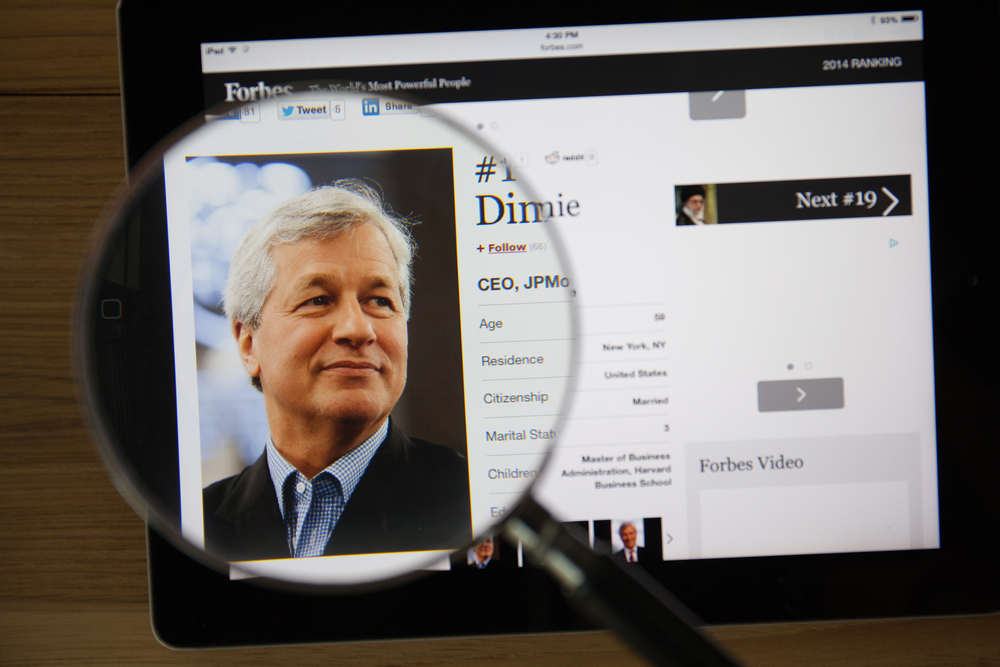

Traders Refute Jamie Dimon’s View that the 10-year Bond Yield Could Rise to 4% in 2018

April 6, 2018

JP Morgan Chase CEO Jamie Dimon has said that the 10-year U.S. Treasury could reach 4% this year, roughly 120 bps higher than current levels. He had been similarly pessimistic about the state of the bond markets during an interview with CNBC back in mid-August. U.S. rates have been on the rise especially in recent months as markets price in the chance of tighter monetary policy from the Federal Reserve, with the possibility of 4 interest rate hikes in 2018 instead of the previously expected 3 hikes. The markets have priced in two more 25 bp rate hikes this year, likely in June and September, following the March increase, putting the fed funds rate at an expected 2% to 2.25%. 10-year yields started 2018 at 2.4% and hit 2.94% on February 21, its highest level since January 2014. It has not crossed the 3% threshold since more than four years’ ago.

Bond market watchers Boris Schlossberg of BK Asset Management and Mark Tepper of Strategic Wealth Partners have a different view on Dimon’s forecast. Schlossberg says that global monetary policy should keep rates subdued even if the Fed goes full on with hiking rates this year. He cites that with Japanese rates still low and the European Central Bank unlikely to hike soon, foreign capital should continue to flow into 10-year Treasury bonds and support its price. Nevertheless, Schlossberg adds a caveat that “some sort of a buyer strike of U.S. security assets, which means that there’s got to be some sort of a very big geopolitical refusal of U.S. assets” could push yields unexpectedly north. Tepper believes that yields should hold under 4% as market expectations for the Fed’s 2018 rate hike path are too aggressive, and expects that a more dovish central bank would emerge as economic growth and inflation remain modest.

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed’s Dudley Shakes Up Complacent Markets

June 20, 2017