This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Times China, Powerlong, Agile Buy Back $132mn of Bonds

March 2, 2022

Chinese developers like Times China, Powerlong, Agile have bought back a combined $132mn of bonds based on Monday filings maturing across March and April 2022. The decline in prices across Chinese real estate company bonds has allowed them to buyback bonds at a steep discount to par:

- Times China reported that it repurchased $82.8mn of two dollar bonds from January 10 to February 28. It bought back $49.576mn of its 5.75% bonds due April 2022 and $33.2mn of its 5.3% bonds due April 2022. Both of the above bonds are trading at 76-78 cents on the dollar

- Agile noted that it bought back $44.1mn of its 6.7% bonds due March 2022. The bond currently trades at 94.1 cents on the dollar.

- Powerlong said it bought back $5mn of its 3.9% bonds due April 2022. The bonds currently trade at 87.4 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

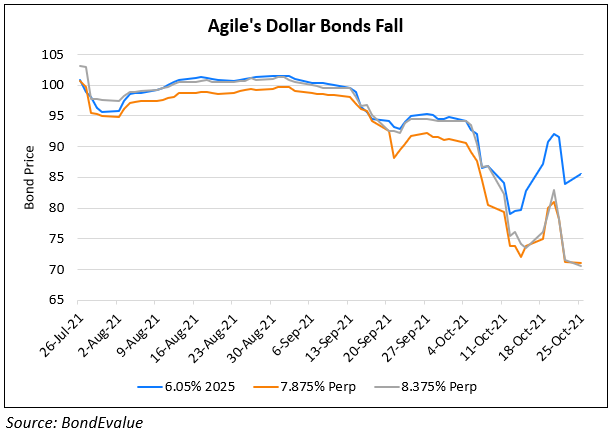

CIFI, Ronshine, Agile Buyback Bonds

November 5, 2021

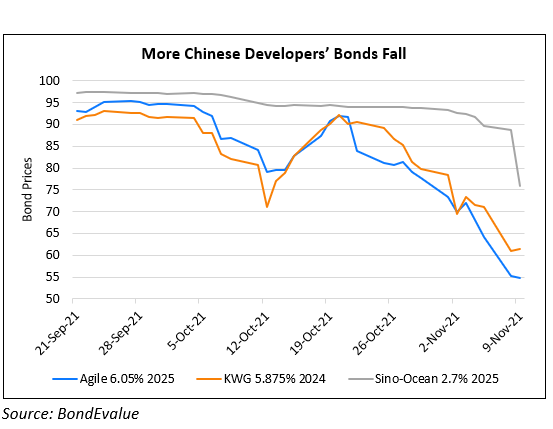

Agile, KWG, Sino-Ocean’s Dollar Bonds Drop 10-14%

November 9, 2021