This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was

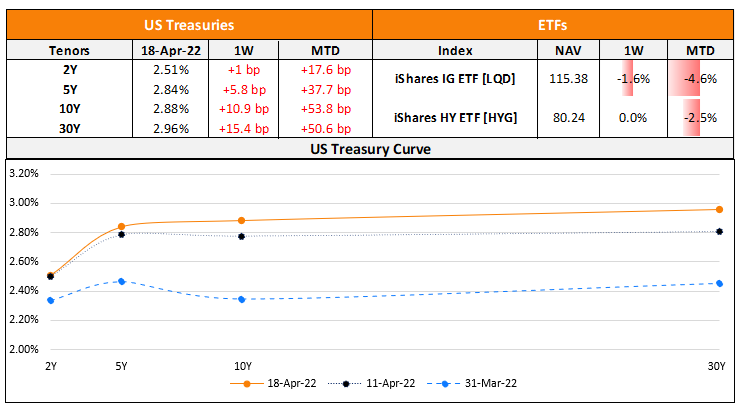

The US yield curve continued to steepen for a second straight week – the 2s10s curve steepened 9bp to 37bp. The steepening comes after the 2s10s curve inverted, reaching a low of -8bp in the beginning of April. US primary market issuances were almost flat at $17bn vs. $17.7bn in the week prior. Investment grade (IG) corporates dominated the table with $16.2bn of deals while high yield (HY) issuance stood at $585mn. The largest IG deals were led by Amazon’s $12.75bn seven-part jumbo deal and Ferguson Finance’s $1bn two-trancher. In the HY space, Oscar Health was the sole issuer. In North America, there were a total of 18 upgrades and 22 downgrades combined across the three major rating agencies last week. LatAm saw $664mn in issuances last week as compared to $1.1bn in the prior week, with Natura & Co raising $600mn. In South America, there was 1 upgrade and no downgrades across the major rating agencies. EU Corporate G3 issuances stood at $9.1bn vs. $16.3bn in the week prior, led by BNP Paribas Home Loan’s 1.5bn deal and Credit Agricole’s $1.5bn two-trancher. Across the European region, there were 7 upgrades and 9 downgrades across the three major rating agencies. The GCC G3 region saw no new deals for a second consecutive week. Across the Middle East/Africa region, there were 3 upgrades and 4 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances stood at $4.1bn vs. $7.5bn in the week before. This was led by China CITIC Bank International’s $600mn deal, followed by Bank of East Asia and Chouzhou International’s $500mn deals each. In the APAC region, there were 4 upgrades and 10 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

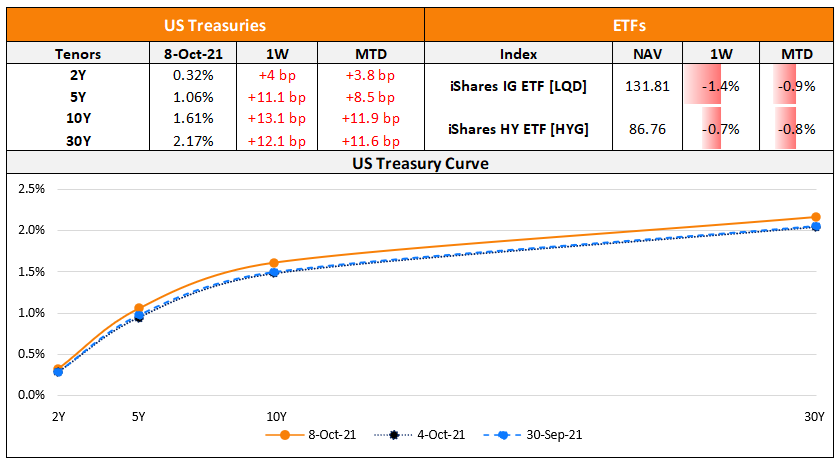

The Week That Was (Oct 4th – 11th)

October 11, 2021

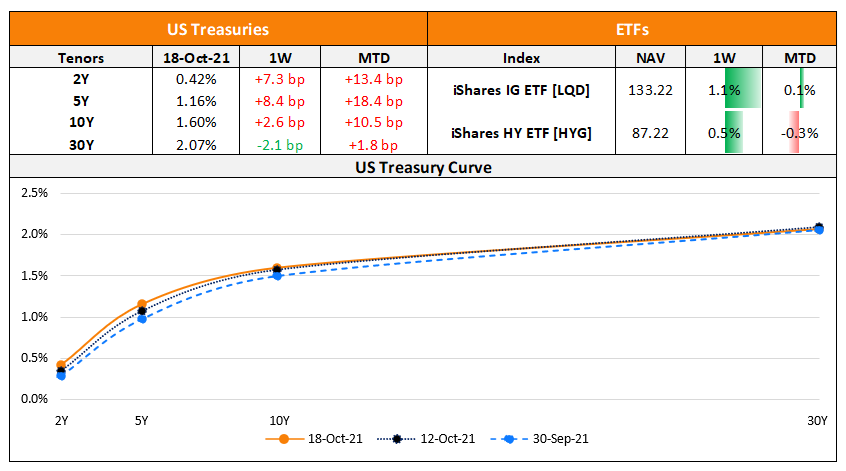

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

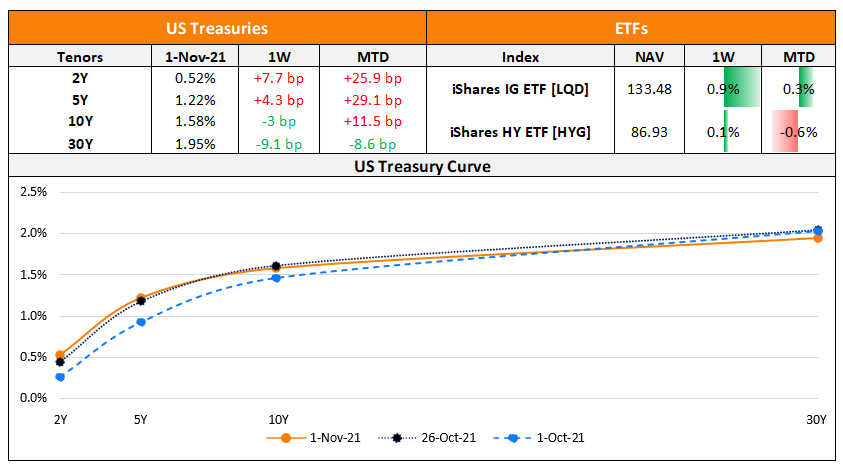

The Week That Was (25 – 31 Oct)

November 1, 2021