This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

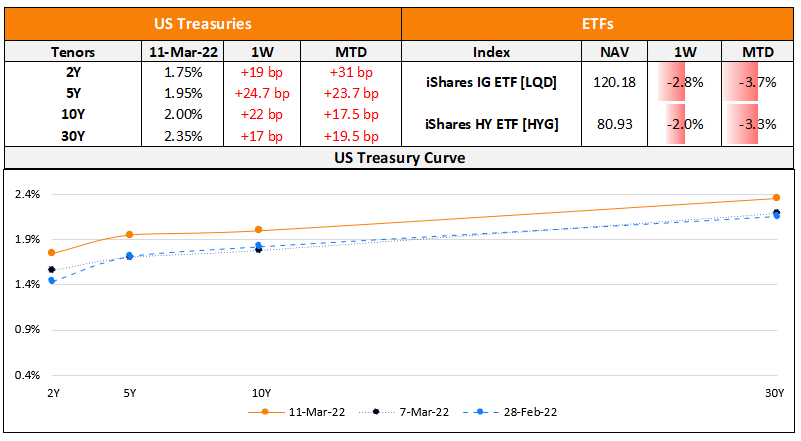

The Week That Was (7 – 13 March, 2022)

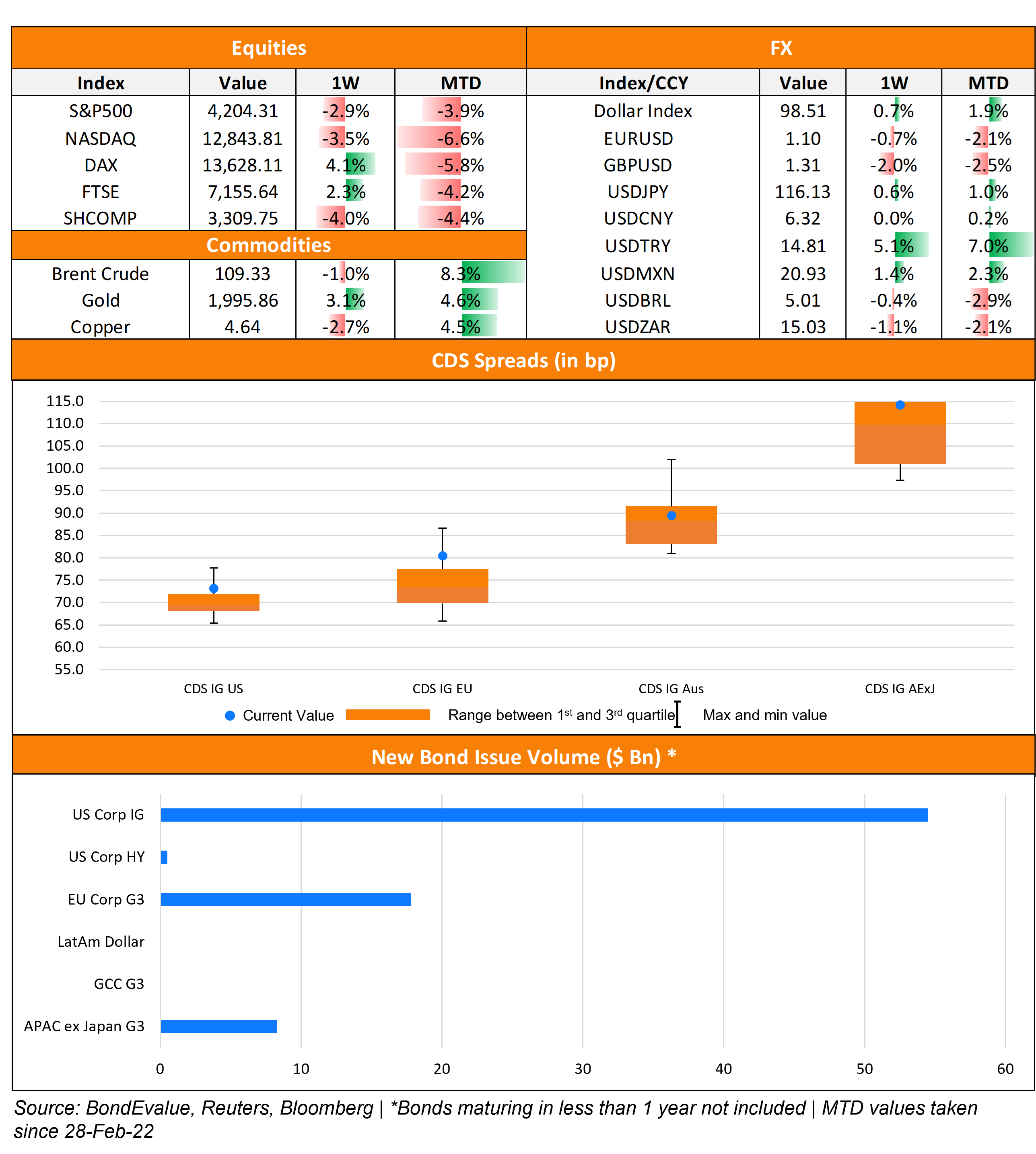

US primary market issuances picked-up to a massive $55bn vs. $43bn in the week prior, primarily driven by AT&T-Discovery’s jumbo $30bn 11-part deal, the fourth largest bond deal ever in corporate issuance history. Investment grade (IG) corporates once again dominated, with $54.5bn of deals while high yield (HY) issuance stood at a mere $500mn. Other prominent IG deals included Goldman Sachs’ $6bn four-trancher and Citigroup’s $5.25bn three-trancher In the HY space, Carpenter Technology and Guitar Center raised $300mn and $200mn each. In North America, there were a total of 35 upgrades and 19 downgrades combined across the three major rating agencies last week. LatAm issuance was muted vs. $2bn in the prior week, solely from Chile’s sustainability-linked bond deal. In South America, there was 1 upgrade and 5 downgrades across the major rating agencies. EU Corporate G3 issuances stood at $17.8bn vs. $12.8bn in the week prior, led by Commerzbank’s €3.5bn two-trancher, followed by KfW and BASF’s €2bn two-part deals each. Across the European region, there were 11 upgrades and 224 downgrades across the three major rating agencies, with the chunk of downgrades once again dominated by Ukranian and Russian corporates. The GCC G3 region saw a mere $69mn in issuances vs. no issuances in the week before. Across the Middle East/Africa region, there were no upgrades and 4 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances stood at $8.3bn vs. $5.4bn led by ANZ Bank’s €1.75bn, National Australia Bank’s (NAB) €1.5bn and UOB’s €1.5bn deals. DBS also stood among the large deals raising $1.5bn via Asia’s Asia’s largest USD-denominated covered bond deal (excluding Australia). In the APAC region, there were 2 upgrades and 5 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

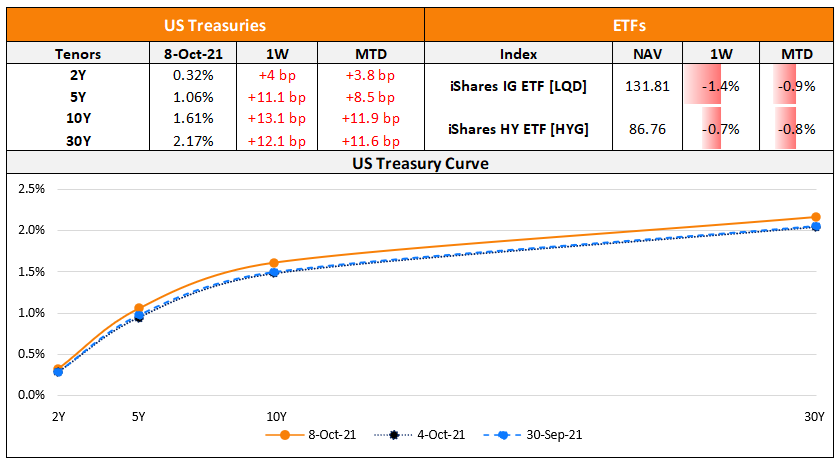

The Week That Was (Oct 4th – 11th)

October 11, 2021

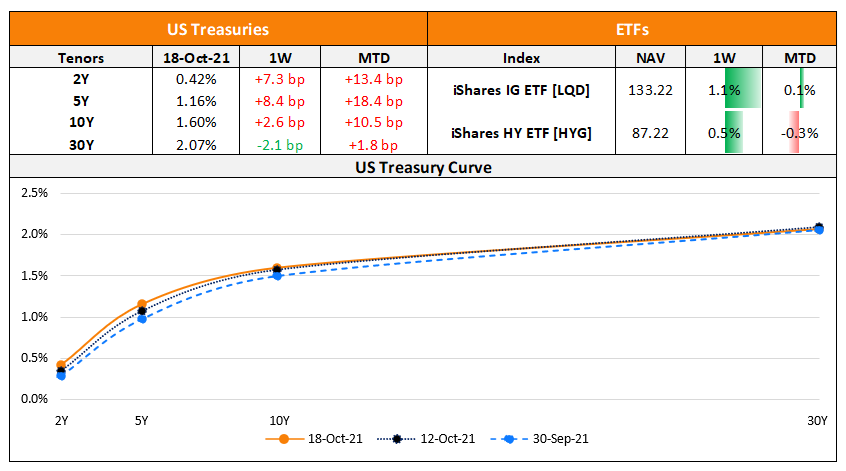

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

The Week That Was (25 – 31 Oct)

November 1, 2021