This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (25 – 31 Oct)

November 1, 2021

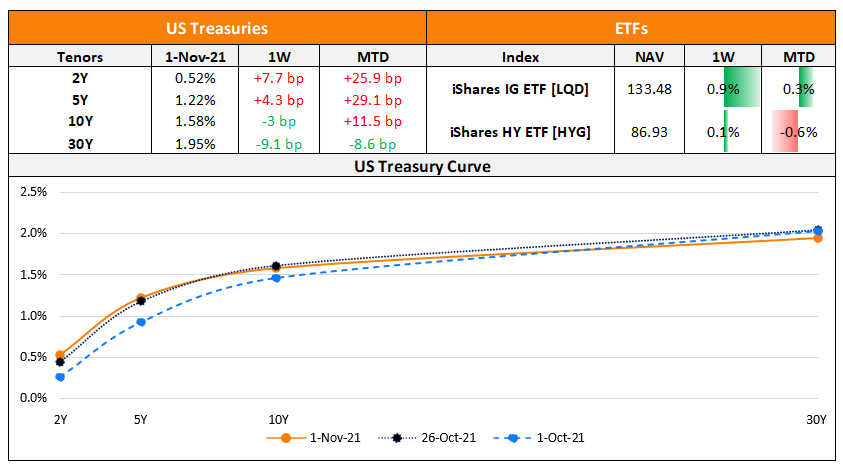

The US yield curve saw a massive flattening – the 2s10s curve flattened 11bp to 106bp and the 5s30s flattened 13bp to 173bp as the narrative on growth slows while rising inflation risks have lead to a faster path of rate hikes expected by markets. US primary markets saw an decrease in issuances to $21.1bn vs. $28.2bn in the prior week. IG issuances dropped to $17.2bn vs. $20bn in the prior week while HY issuances fell to $3.3bn vs. $7.7bn in the prior week. The largest deals in IG space were led by Citigroup’s $4bn three-trancher and US Bancorp’s $1.75bn issuance. In the HY space, Grow Escrow II Inc’s $1.3bn deal and Roblox’s $1bn issuance. In North America, there were a total of 20 upgrades and 7 downgrades combined across the three major rating agencies last week. LatAm saw $6.5bn vs. $1.4bn in issuances in the week prior with Peru’s $4bn three-trancher leading the table followed by Ecopetrol’s $2bn dual-trancher. In South America, there were 1 upgrade and 3 downgrades each combined across the major rating agencies. EU Corporate G3 issuances saw a sharp fall to $21.8bn vs. $36.9bn in the week prior with UBS’s €2.5bn two-trancher followed by Nordea, Swedbank, Swensa Handensbaken and Banco Santander’s €1bn issuances. Across the European region, there were 15 upgrades and 7 downgrades across the three major rating agencies. The GCC G3 saw just $665mn in issuances vs. nil issuances in the prior week led by EI Sukuk’s $500mn. Across the Middle East/Africa region, there were no upgrades and 5 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances saw a sharp decrease to $7.1bn vs. $19bn in the week before. The largest deals were led by China Cinda’s $1.7mn issuance, ICBCIL Finance’s $1.35bn two-trancher and CA Magnum’s $1.01bn deal. In the Asia ex-Japan region, there was 1upgrades and 11 downgrades combined across the three major rating agencies last week – 10 of the 11 downgrades were of Chinese property developers including names like Kaisa, Modern Land (China), Greenland Global and R&F Properties. The sole upgrade was of Manappuram Finance by S&P.

Go back to Latest bond Market News

Related Posts:

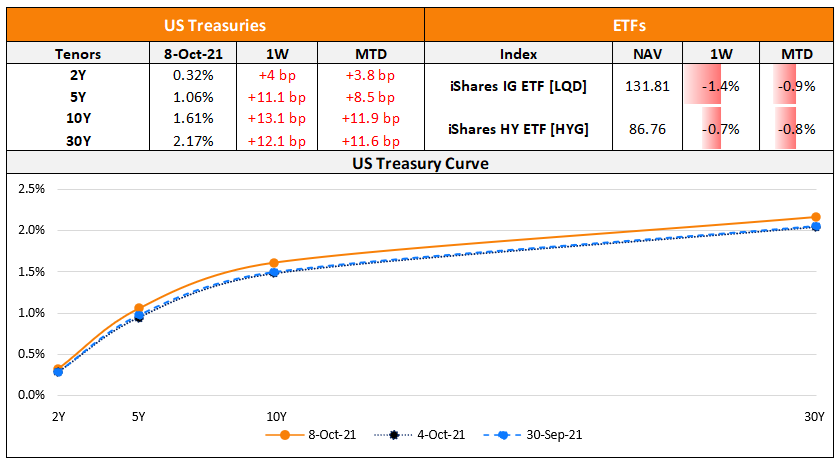

The Week That Was (Oct 4th – 11th)

October 11, 2021

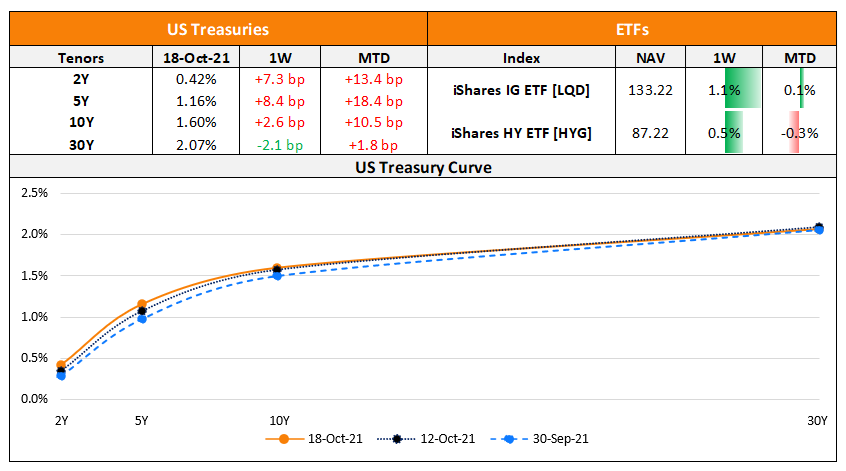

The Week That Was (11 – 17 Oct 2021)

October 18, 2021