This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

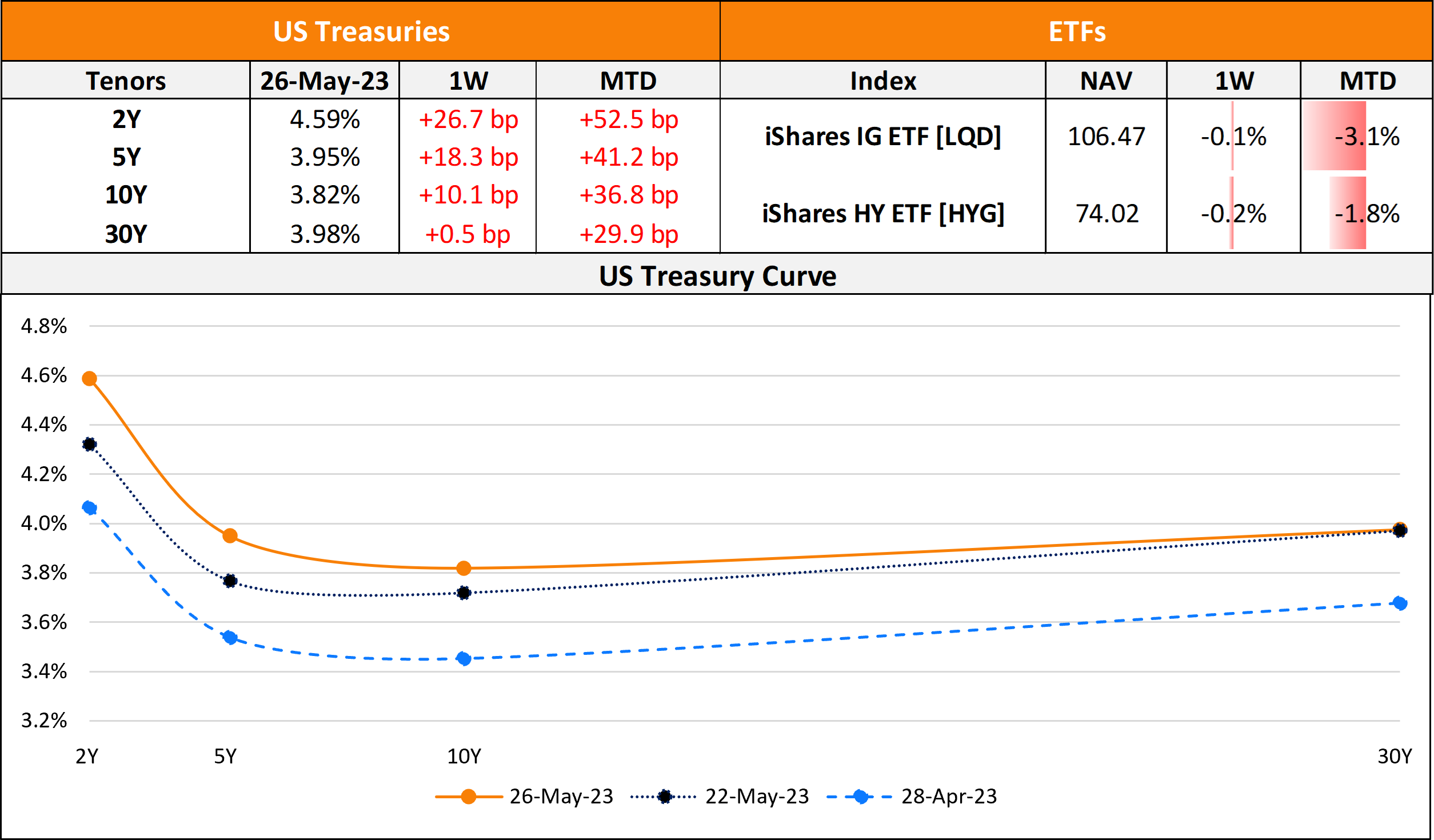

The Week That Was (22 – 28 May, 2023)

With a massive change in market expectations of a rate hike amid continued growth and sticky inflation, treasury yields have soared. The 2Y yield was up by over 26bp last week and almost 53bp higher MTD. 10Y yields were up 10bp last week with the MTD rise at 37bp. US primary markets saw a large drop in new deals last week to $19.8bn as compared to $64.8bn in deals a week prior to it. Of this, IG deals accounted for $15.6bn led by Citigroup’s $3.2bn issuance and Lockheed Martin’s $2bn three-trancher. HY saw $4.1bn in new deals led by Olympus Water’s $1.7bn deal and Seagate’s $1bn two-trancher. In North America, there were a total of 13 upgrades and 44 downgrades across the three major rating agencies last week. US IG bond funds saw $3bn in a fourth straight week of inflows for the week ended May 24, adding to $2.16bn in inflows from the prior week. HY funds on the other hand saw a reversal in flows with $1.4bn in inflows, following four straight weeks of outflows.

EU Corporate G3 issuance were near flat at $41.4bn vs. $43.5bn a week prior. Issuance volumes were led by Bosch’s €4.5bn four-trancher and KfW’s €3.7bn deal. Across the European region, there were 39 upgrades and 29 downgrades. The GCC dollar primary bond market saw $1.4bn in new deals following a large $7.3bn in deals a week prior. There were only two deals, led by Saudi Fransi’s $900mn and Majid Al Futtaim Group’s $500mn deals. Across the Middle East/Africa region, there were 4 upgrades and 6 downgrades across the major rating agencies. LatAm saw no new deals for a fourth consecutive week. The South American region saw 4 upgrades and 11 downgrades across the rating agencies.

G3 issuance volumes from APAC ex-Japan halved to $2.3bn vs. $4.7bn a week prior to it. Deal volumes were led by Khazanah’s $1.5bn dual-trancher and CCB’s $500mn issuance. In the APAC region, there were 4 upgrades and 6 downgrades combined across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts:

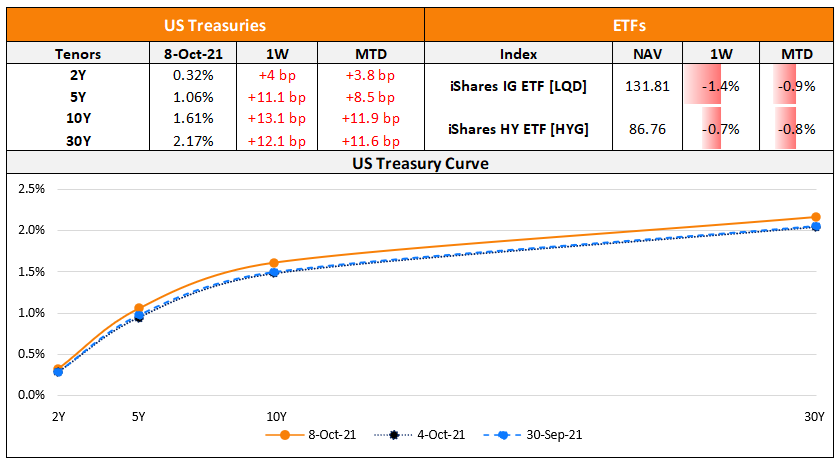

The Week That Was (Oct 4th – 11th)

October 11, 2021

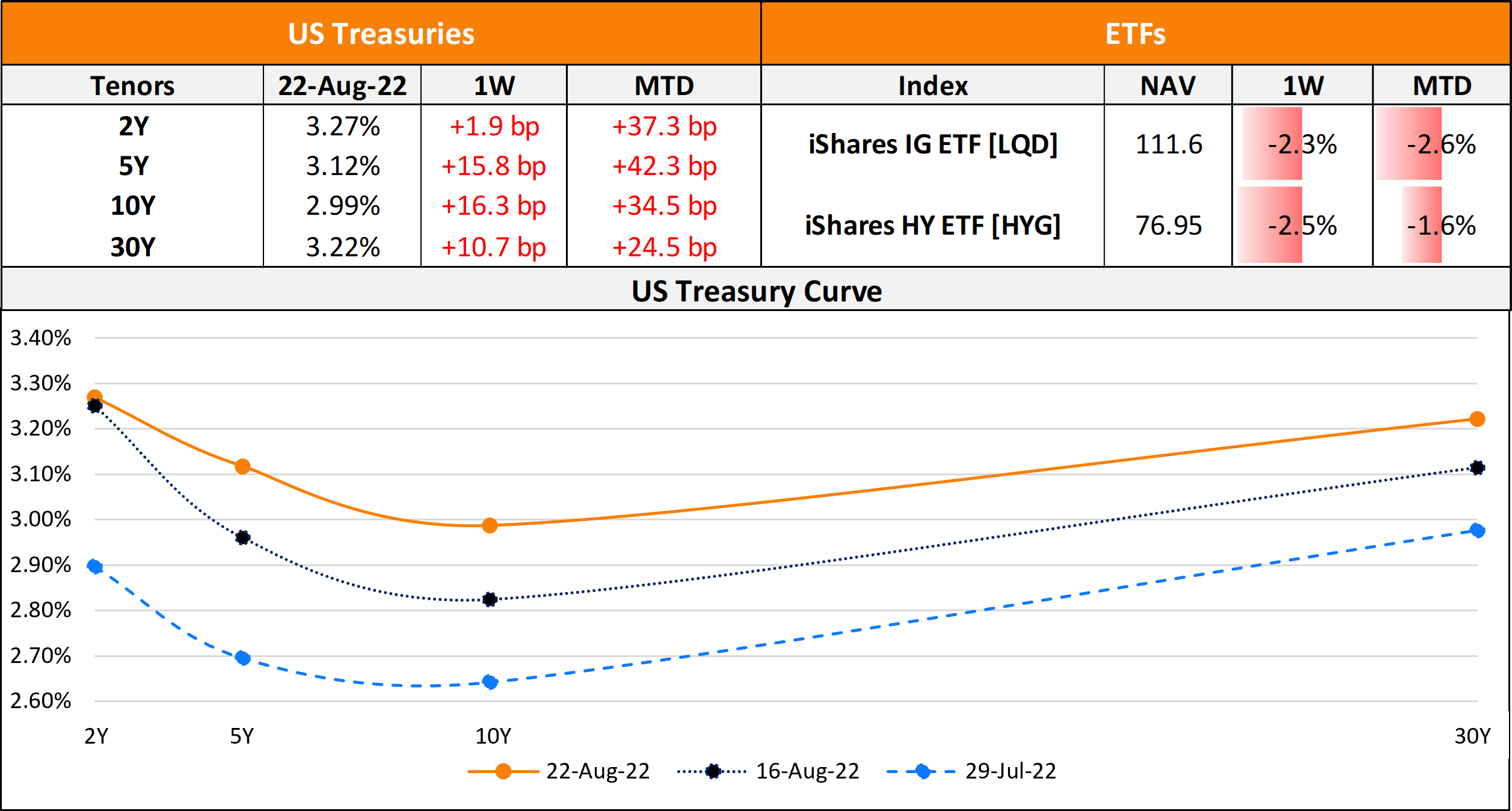

The Week That Was (15 August – 20 August, 2022)

August 22, 2022

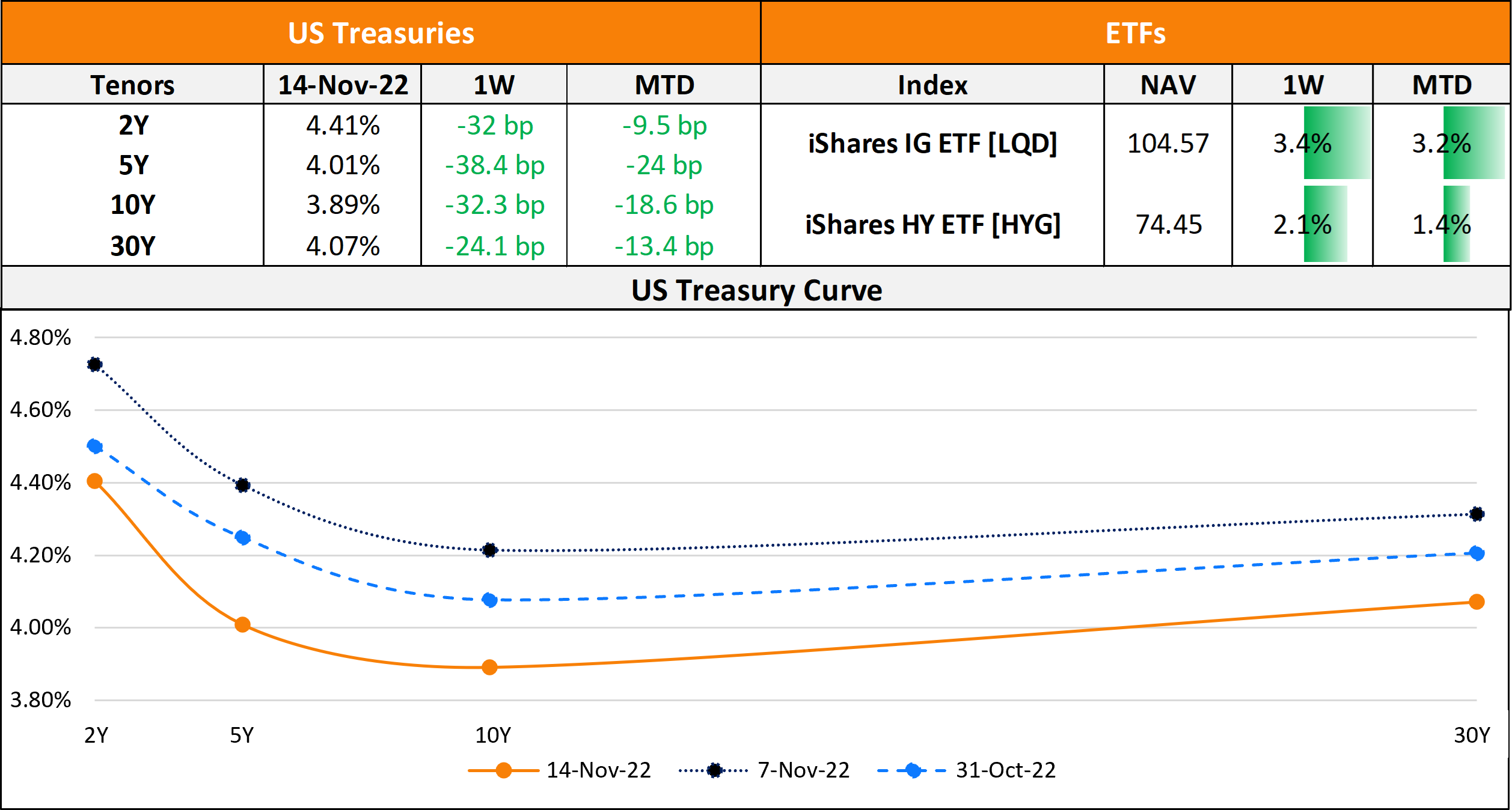

The Week That Was (07 – 14 Nov, 2022)

November 14, 2022