This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

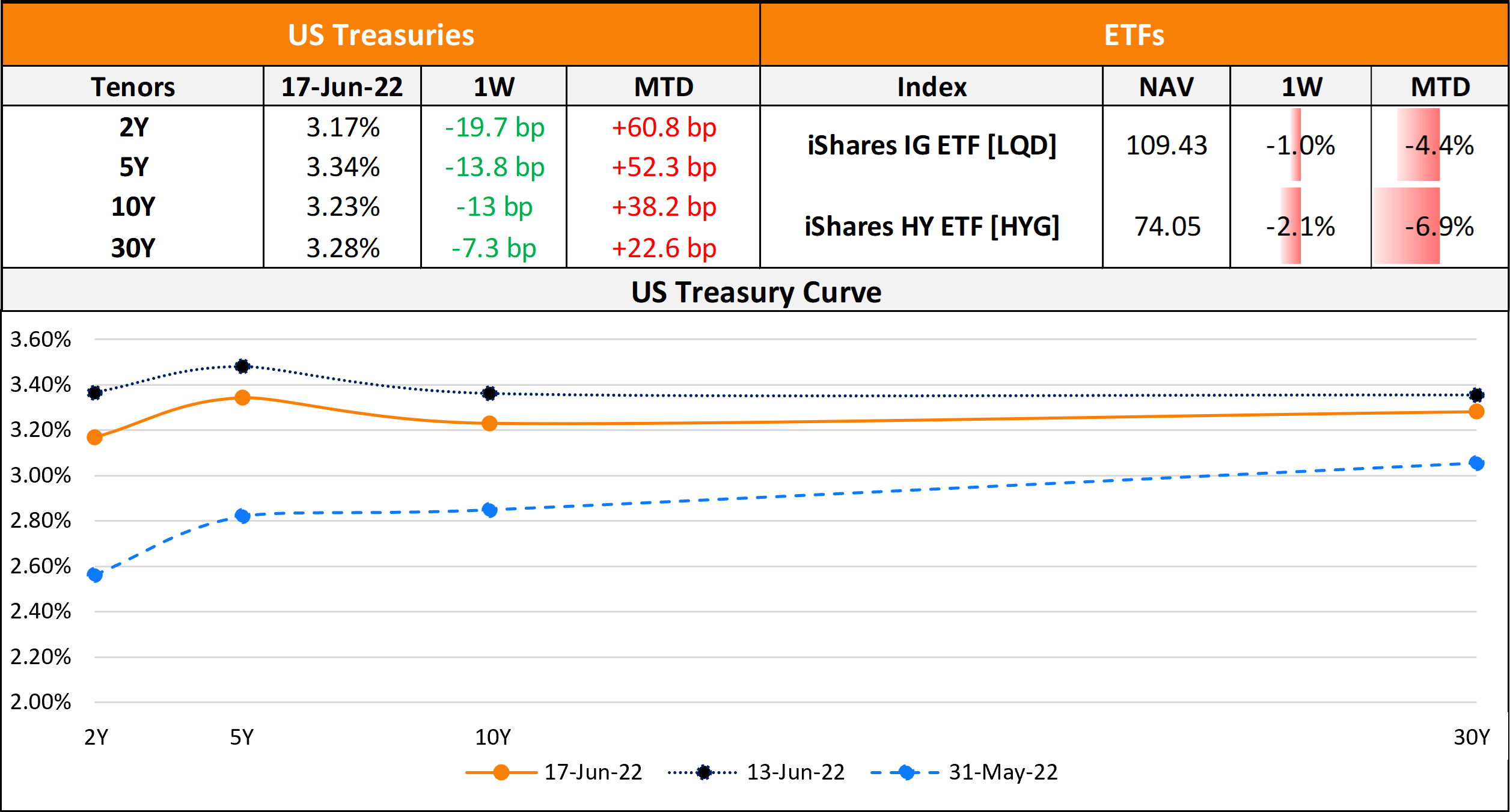

The Week That Was (13 – 19 June, 2022)

US primary markets were largely quiet on the back of the FOMC meeting on June 15. Total issuance stood at $957mn vs. $32.2bn in the week prior, with the chunk of the issuance coming from a single High Yield (HY) deal – Entegris’ $895mn 8Y bond. There were no new Investment Grade (IG) deals last week. US IG funds saw $8.7bn in outflows in the week ended June 15 as per Lipper data, following a pullback of $2.9bn in the week prior. Bloomberg notes that this marks twelve straight weeks of outflows, the longest streak of outflows going back to at least 1992, and the largest since March 2020. HY funds saw $5.7bn in outflows, the most since February 2018. In North America, there were a total of 16 upgrades and 8 downgrades combined across the three major rating agencies last week. LatAm saw no deals yet again for a third straight week. In South America, there were no upgrades and 3 downgrades across the major rating agencies. EU Corporate G3 issuance dropped by over 50% to $10.6bn vs. $22.6bn in the week prior – ING Groep raised €4.5bn via a two-trancher to lead the table, followed by Credit Suisse’s $1.65bn PerpNC5.5 AT1 issuance at an attractive yield of 9.75%. Across the European region, there were 9 upgrades and 2 downgrades across the three major rating agencies. The GCC G3 region saw no deals for a second consecutive week. Across the Middle East/Africa region, there were no upgrades and 5 downgrades across the three major rating agencies. The APAC ex-Japan G3 region saw only $395mn worth of new deals vs. $6.7bn in the week prior – China Development Bank (Hong Kong) raised €100mn followed by Linyi Investment and Shanxi Xinxian raising $100mn each. In the APAC region, there was 1 upgrade and no downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

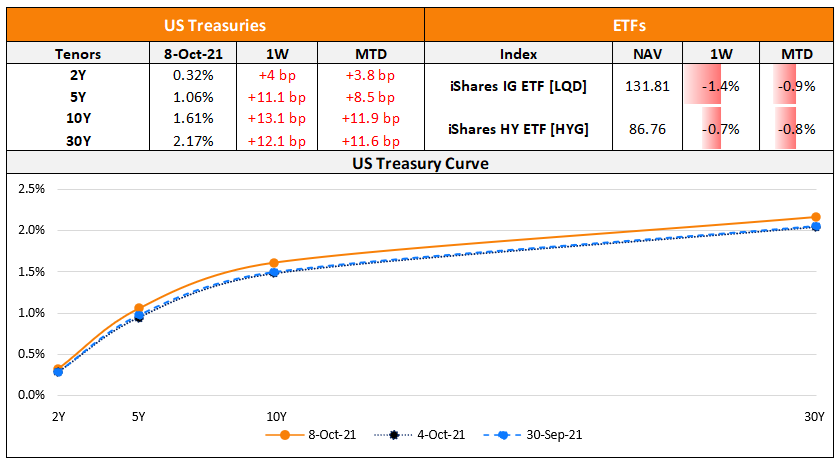

The Week That Was (Oct 4th – 11th)

October 11, 2021

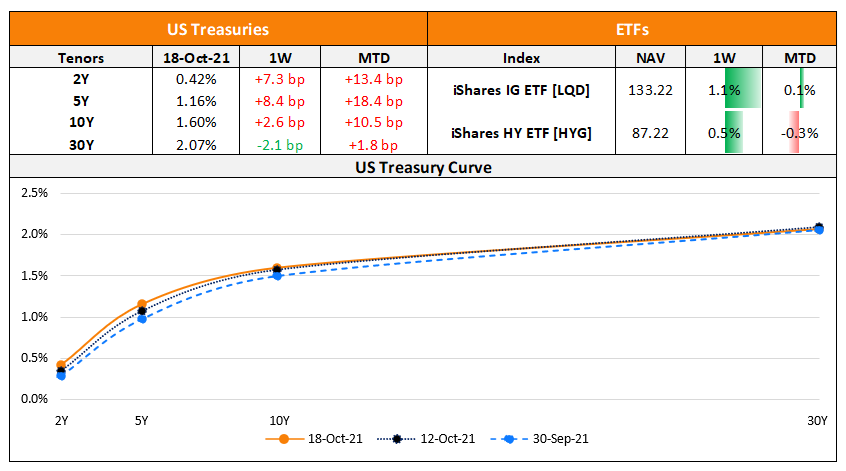

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

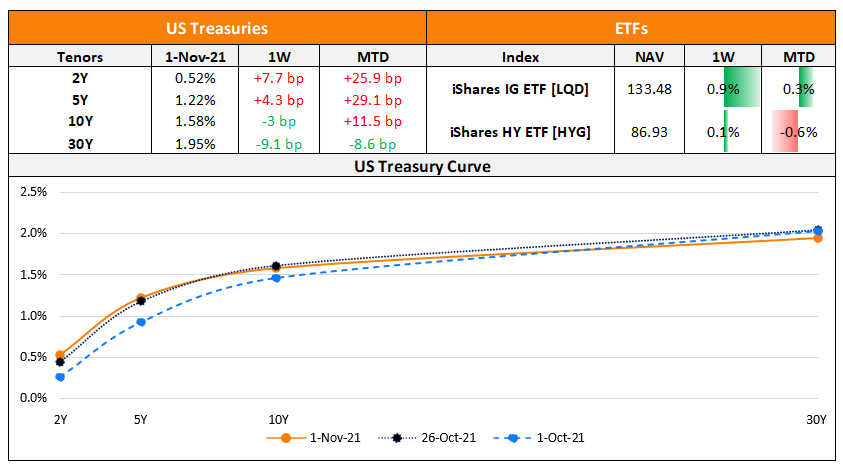

The Week That Was (25 – 31 Oct)

November 1, 2021