This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

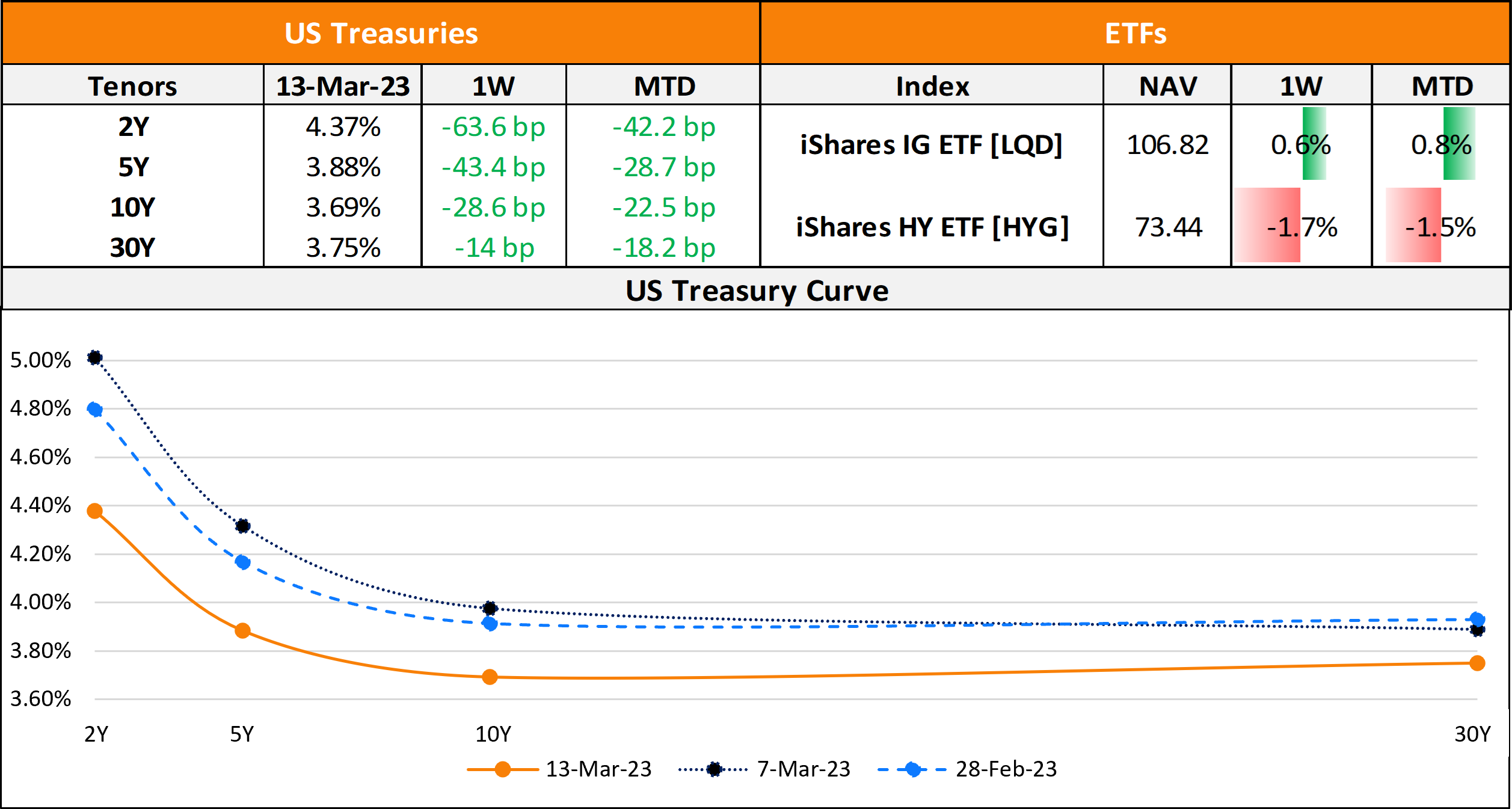

The Week That Was (06 Mar – 12Mar, 20223)

US primary market issuances stood at 28.2bn last week vs. $31.6bn a week prior. IG issuances stood at $27.6bn led by Kenvue (J&J’s spinoff) that raised $7.75bn 8-part deal and Nestle raising $3bn via a four-trancher. HY issuances stood at $667mn led by Jackson Financial’s $550mn deal. In North America, there were a total of 31 upgrades and 40 downgrades across the three major rating agencies last week. As per Lipper data, US IG bond funds saw inflows of $717.4mn in the week ended March 8, reversing outflows of $238mn seen in the week prior. HY bond funds saw a meagre $10.1mn in inflows during the week, following the prior week’s $2.31bn of outflows.

LatAm saw $1bn in new deals with Cemex being the sole issuer after three consecutive weeks of no deals. Cemex priced a PerpNC5.25 green bond at an attractive yield of 9.125%, which has since traded lower to 99.19 currently. In South America, there were 5 upgrades and 14 downgrades across the major rating agencies. EU Corporate G3 issuance stood at $33bn vs. $34bn a week prior. Issuance volumes were led by KfW’s $5bn issuance followed by banks like Intesa Sanpaolo that raised €3bn, UBS and HSBC that raised €2.75bn, all via dual-tranche issuances. Across the European region, there were 27 upgrades and 20 downgrades. The GCC dollar primary bond market saw $2.5bn in new deals after seeing no deals for two consecutive weeks. This was led by Islamic Development Bank’s $2bn 5Y sukuk and Bank of Sharjah’s $500mn deals. Across the Middle East/Africa region, there were 2 upgrades and 1 downgrade across the major rating agencies.

The APAC ex-Japan G3 region saw $7bn in issuances vs. $4.1bn raised in the week before that, led by Rio Tinto’s $1.75bn, CBA’s $1.5bn and Bank of East Asia’s $1bn two-part deals each. In the APAC region, there were 4 upgrades and 23 downgrades combined across the three rating agencies last week. In the SGD market, HSBC raised S$1bn via a Tier 2 10NC5 bond (rated Baa1/BBB/A-) at a yield of 5.3% that were priced 22bp wider to Credit Agricole’s 4.85% 2033s (rated Baa1/BBB+/A-), issued a week prior that yielded 5.08%.

Go back to Latest bond Market News

Related Posts:

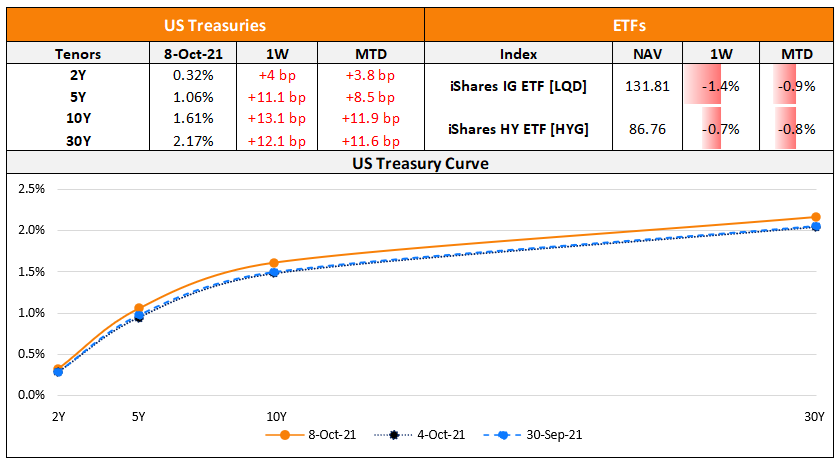

The Week That Was (Oct 4th – 11th)

October 11, 2021

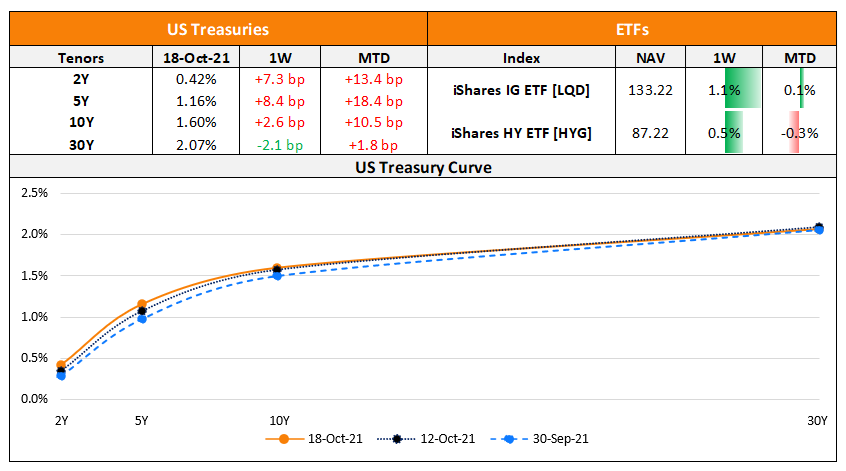

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

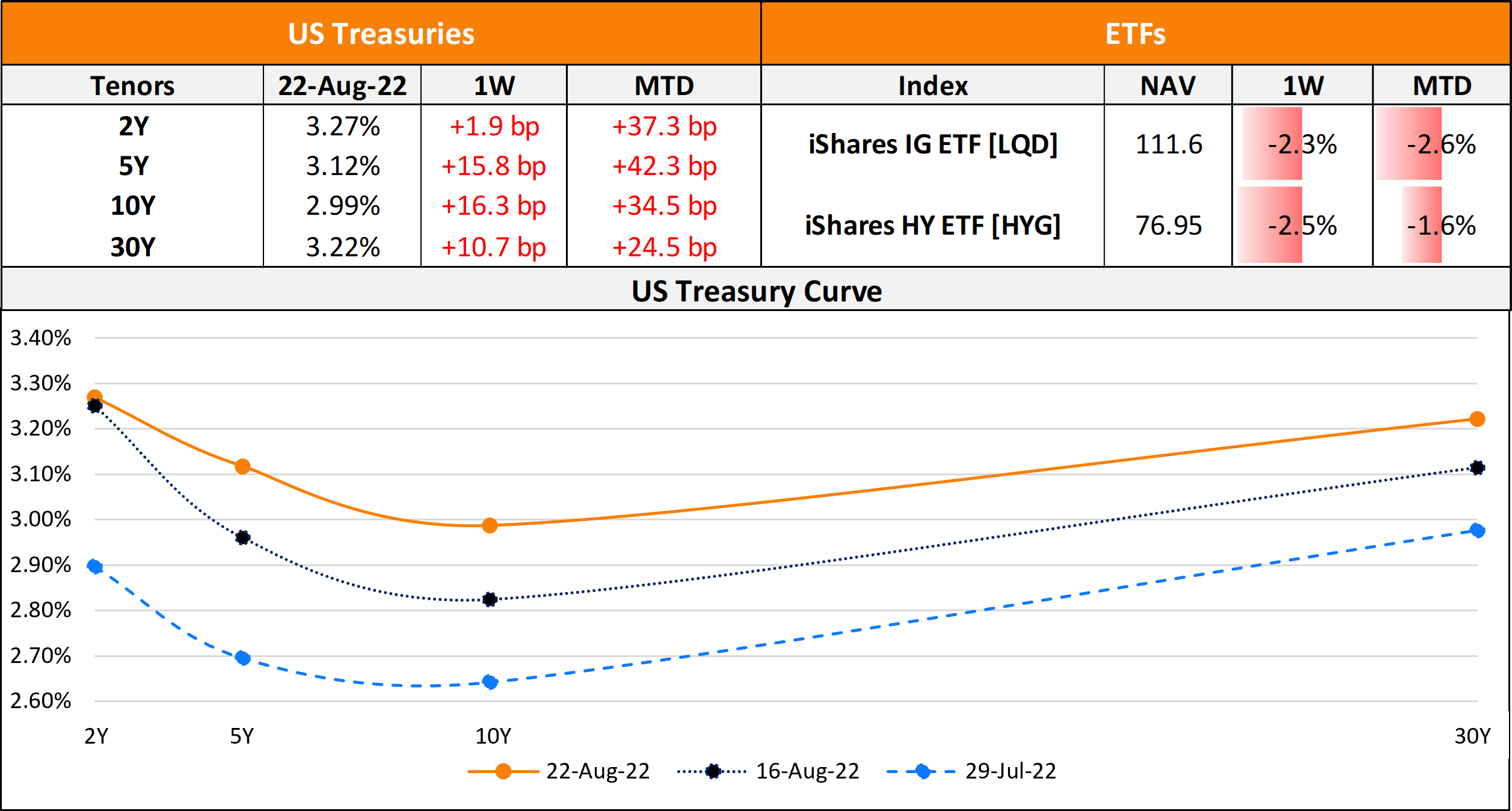

The Week That Was (15 August – 20 August, 2022)

August 22, 2022