This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

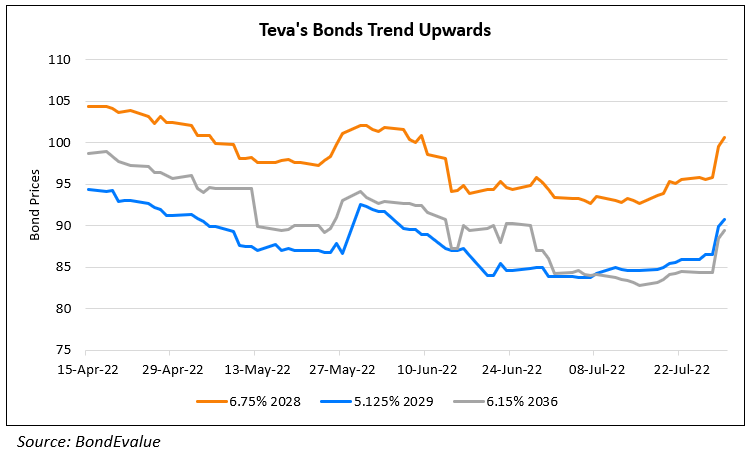

Teva’s Bonds Rally on News of $4.35bn US Opioid Crisis Settlement

July 29, 2022

Teva Pharmaceuticals is close to finalizing a $4.35bn nationwide settlement regarding its alleged role in the US opioid crisis, following years of negotiations. The agreement in-principle is expected in a few weeks pending a host of approvals. The settlement amount will be paid out over the next 13 years with annual charges expected at $300mn and $400mn. The news was well received by shareholders and bondholders, with its stock rallying 21% and some of its bonds up 5-6 points on Thursday following the announcement.

Further, the company expects mid-single digit revenue growth over the next 5 year. Looking past the settlement at hand, Teva has already repaid $15bn in debt over the last 5 years and expects to reduce its outstanding debt from $20bn to 12bn in the next 5 years. Revenue expectations are at up to $15.6bn this year with CEO Kare Schultz confident that they will “stay the world leader in generics.”

For the full story, click here

Go back to Latest bond Market News

Related Posts: