This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Tencent Reports Profit Slowdown

November 11, 2021

Tencent reported a slowdown in its Q3 net profits to RMB 39.5bn ($6.2bn), a 3% growth YoY, its slowest growth in two years. Revenue increased 13% YoY to RMB 142.4bn ($22.2bn), the slowest since its listing in 2004. The revenue split is given below:

- Revenues from Valued Added Services (VAS) increased 8% YoY to RMB 75.2bn ($11.7bn) with domestic games, international games and social networks revenues rising 8%, 20% and 7% each.

- Revenues from Online Advertising increased by 5% to RMB 22.5bn ($3.5bn). Consumer staples and Internet services advertising held-up while it was largely offset by weakness in categories like education, insurance and games.

- Revenues from FinTech and Business Services increased by 30% to RMB 43.3bn ($6.8bn) thanks to increasing commercial payment volume.

Mr. Ma Huateng, Chairman and CEO of Tencent, said, “During the third quarter, the Internet industry, including the domestic games industry, and certain advertiser categories, adapted to new regulatory and macroeconomic developments. We are proactively embracing the new regulatory environment which we believe should contribute to a more sustainable development path for the industry”.

Tencent’s dollar bonds were lower with its 3.24% 2050s down 1.2 points to 95.71, yielding 3.48%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Tencent Beats Estimates with a 175% Jump in Q4 Profits

March 25, 2021

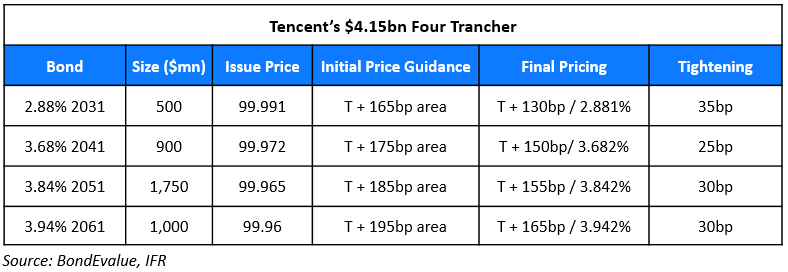

Tencent Raises $4.15bn via Four Trancher

April 16, 2021

Tencent Profits Rise 65% Led By Gaming

May 21, 2021