This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

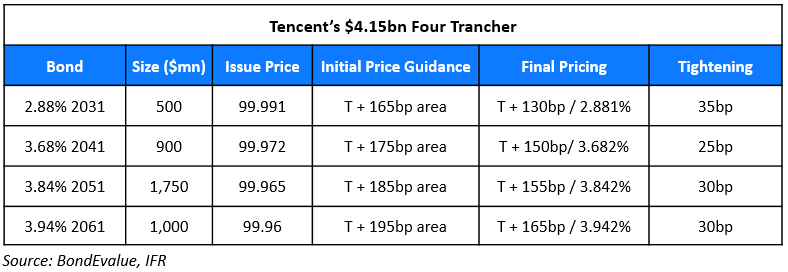

Tencent Raises $4.15bn via Four Trancher

April 16, 2021

Tencent raised $4.15bn via a four-part offering, details of which are in the table:

Tencent’s dollar bonds were steady – their 3.28% 2024s at 106.6, yielding 0.96%, their 2.39% 2030s at 96.6, yielding 2.81% and their 3.29% 2060s at 92.43, yielding 3.66%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Tencent Beats Estimates with a 175% Jump in Q4 Profits

March 25, 2021

Tencent Profits Rise 65% Led By Gaming

May 21, 2021