This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Tencent Profits Rise 65% Led By Gaming

May 21, 2021

Chinese tech major Tencent beat estimates after it reported a rise of 65% in Q1 profits buoyed by a growth in its gaming and fintech units. The company reported a profit of CNY 47.8bn ($7.4bn), ~40% higher than expectations. Revenues rose 25% to CNY 135bn ($21bn). The value-added services (VAS) including gaming and social networks represented 54% of the total revenues, online advertisements 16% and fintech and business services 29%. The company gained from increased online trends among its users as the gaming business expanded 17% YoY with the extended stay-at-home model. While the VAS revenue was up 14% YoY, the music subscriptions expanded 43% to 61mn users. The company had also reported 2.75x YoY profits in Q4 in March earlier this year. The news of the strong performance comes at a time when the tech giant is being probed by Chinese antitrust regulators. The company was recently fined by the State Administration for Market Regulation (SAMR) for failing to disclose M&A deals to the state.

Tencent’s 1.81% 2026s and 3.68% 2041s were up 0.22 and 0.48 respectively to trade at 101.53 and 101.56 on the secondary markets.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Tencent Beats Estimates with a 175% Jump in Q4 Profits

March 25, 2021

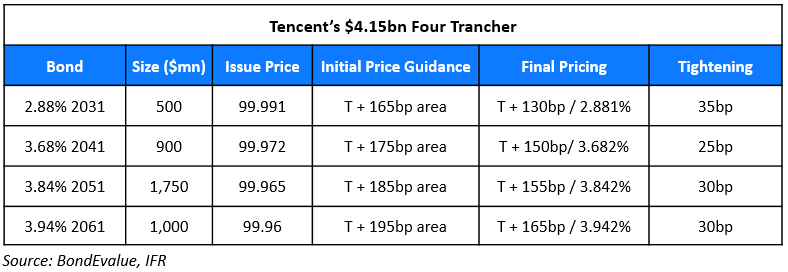

Tencent Raises $4.15bn via Four Trancher

April 16, 2021