This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sunac Raises $953mn via Share Sales; Chairman Lends $450mn

November 15, 2021

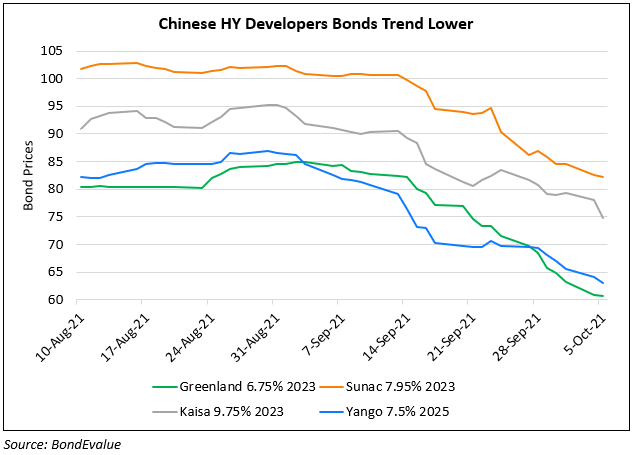

China Sunac raised $953mn via share sales, helping build its coffers when funding markets have remained tight and asset sales have slowed for property developers. It sold 335mn shares at HKD 15.18/share, raising ~$653mn. It additionally sold 158mn shares in its property management arm Sunac Services Holdings via a subsidiary, raising $300mn. Besides the above share sales, Sun Hongbin, the controlling shareholder and Chairman of Sunac’s board, provided $450mn from personal funds to the company in the form of an interest-free loan. Sunac, rated Ba3/BB/BB is the nation’s fourth largest developer by sales and is among the few companies that has not been downgraded in the last few months since the crisis in Evergrande began. However, the company did have negative news flow in late September when a leaked letter said that Sunac requested help from a local government to ease pressure on sales. Sunac later said that the letter was only an internal draft and had not been sent to the local government, but accidently leaked on a local social media group adding that construction operations were going normally. Bloomberg adds that Sunac is also planning to sell its culture and tourism business to raise cash.

Sunac’s dollar bonds rallied on Friday with its 6.5% 2023s up 15%. The bonds are up 0.1 points today to 80.85 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Sunac Upgraded To BB By S&P

March 17, 2021

Sunac’s Dollar Bonds Drop on Liquidity Concerns after a Leaked Letter

September 28, 2021