This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

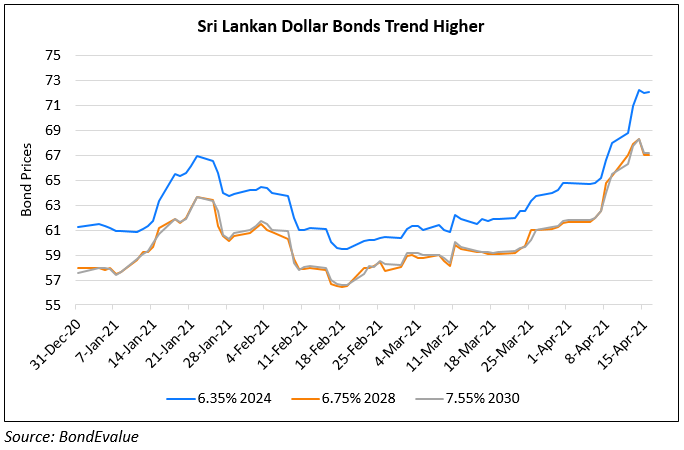

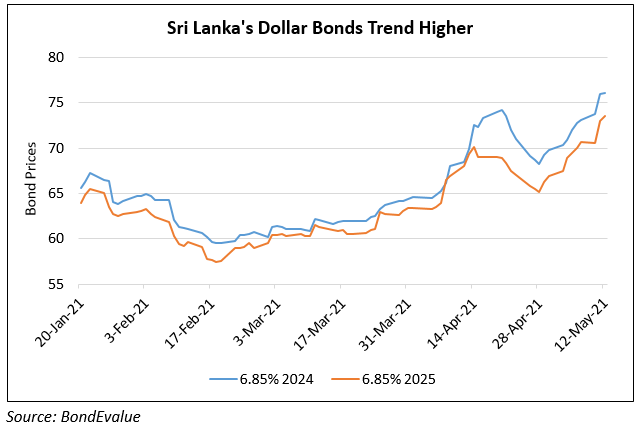

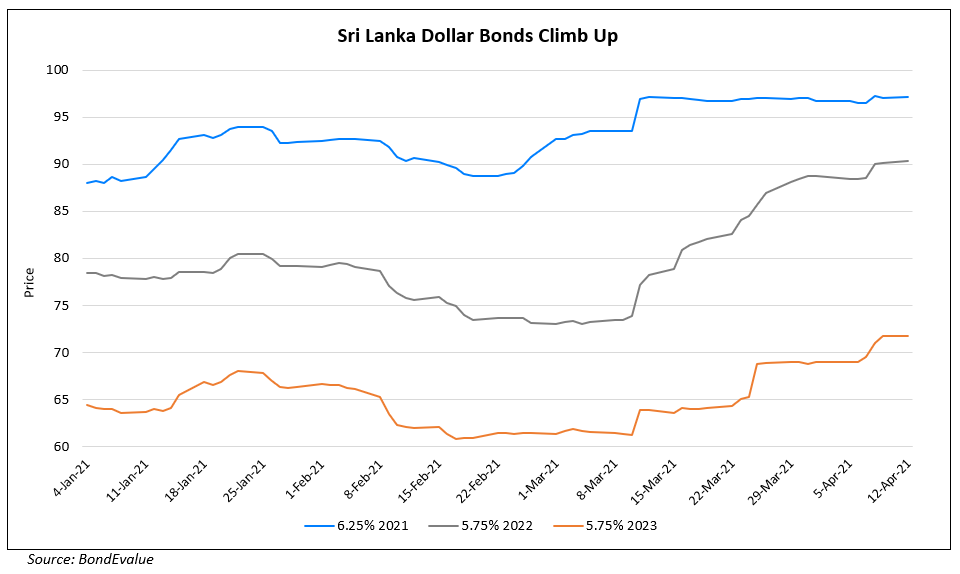

Sri Lanka’s Bonds Trend Higher

April 12, 2021

Island nation Sri Lanka has seen its shorter tenor dollar bonds trend higher through the past month, with its 2022s rising as much as ~12% over the past month.

The rally is likely on the back of an expected increase in Special Drawing Rights (SDR) by the IMF that could see Sri Lanka receiving as much as $800mn as per Nivard Cabraal, State Minister of Money and Capital Markets. The new allocation of SDRs totaling $650bn is set to be backed by the world’s top finance ministers in a bid to help low-income countries that have been adversely impacted by the pandemic. The SDR allocation will help boost Sri Lanka’s forex reserves, which have shrunk to ~$4.5bn as on February from $8.5bn in August 2019. The IMF is likely to make a decision on the SDR allocation in June this year.

For the full story, click here

Go back to Latest bond Market News

Related Posts: