This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

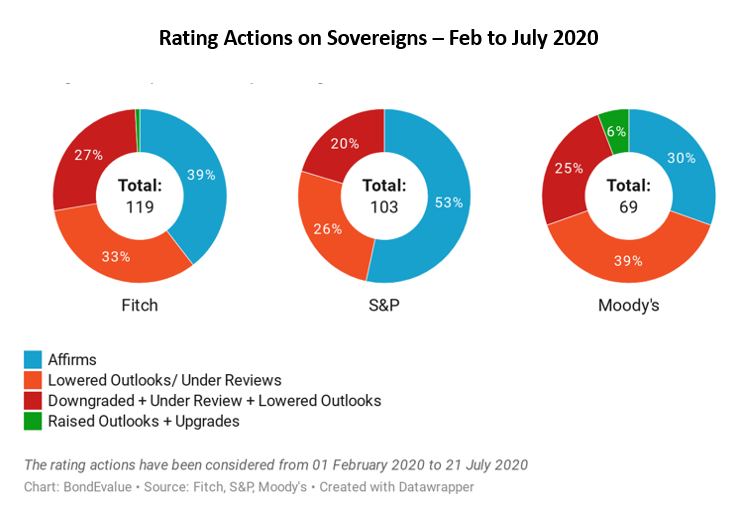

Sri Lanka on Review for Downgrade by Moody’s

July 20, 2021

Sri Lanka’s Caa1 long-term Issuer Default Rating (IDR) and unsecured debt ratings have been put under review for downgrade by Moody’s on the stressed liquidity position of the sovereign. Sri Lanka’s foreign currency country ceiling has been lowered to Caa1 from B3, while the local currency country ceiling remains unchanged at B1 due to high external debt. The rating agency expects the nation’s forex reserves to continue to decline in the absence of sustained capital inflows even though the government has secured financing through bilateral sources. The nation’s forex reserves stood at a mere ~$3.6bn in June end, down 30% YTD. These reserves are expected to slide over the next few years given that the government has repayments of ~$4-5bn over the next 4-5 years. The current account deficit is expected to be 1-2% of GDP with the slower than expected recovery of the tourism sector due to the ongoing Covid-19 wave. Despite the growth of ~3.5% this year, the fiscal deficit is expected to be ~9.5-10% of GDP this year and could average 8.5% over the next two years. The debt burden is forecasted to rise to ~110% of GDP over 2022-2023 from ~100% in 2020. Interest payments are likely to remain 60-70% of the government’s revenue over the next few years.

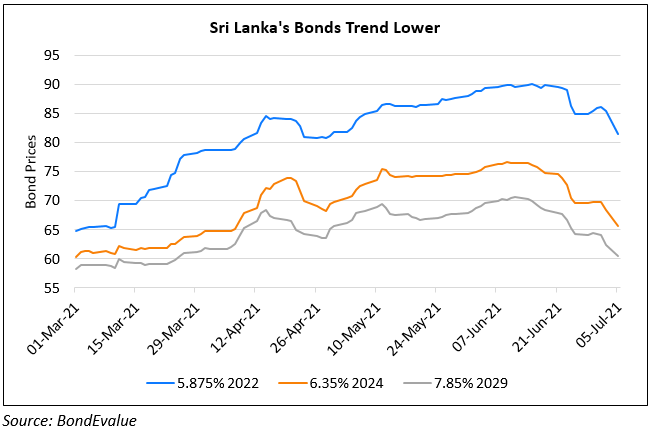

The weak credit metrics, shrinking forex reserves, depreciating exchange rate, rising inflation, higher domestic interest rates, higher debt payments in local currency terms, and a weaker domestic economy weigh on the default risk of the nation and have led to increase in the financing costs of the island nation. The government bond spreads to US Treasuries have widened to more than 1,600bps from ~500bps before the pandemic. The rating could be affirmed if the government demonstrates its capacity to use short-term financing sources as a means to buy time and could be downgraded in a status quo scenario where the financing of Sri Lanka’s large external debt repayments remained uncertain. The rating agency said, “In contrast to the urgency of the situation — and notwithstanding the government’s stated commitment to repay its debt — Moody’s expects a credible and durable financing strategy to only materialize over a number of years.”

Sri Lanka is rated CCC+ by S&P after it was downgraded on December 11, 2020 and is rated CCC by Fitch after a downgrade on November 27, 2020. The nation’s short term bonds with maturity in 2021 are trading close to par. However, its longer dated bonds are trading in the 60s. It’s 6.25% 2021s were up 0.67 to trade at 100.05 while its 7.55% 2030s were down 0.48 to trade at 63.31.

For the full story, click here

Go back to Latest bond Market News

Related Posts: