This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Some of Evergrande’s Local Bonds Halted; EV Unit Road-Tests Cars Ahead of Possible Stake Sale

September 6, 2021

Trading of some of China Evergrande’s local bonds on the Shenzen exchange were halted on Friday as per FT after falling over the daily limit of 20%. Another bond on the Shanghai stock exchange was halted on account of abnormal volatility. Separately, Bloomberg reported that two of its biggest non-bank creditors had demanded immediate repayment of some loans.

In related news, Evergrande said that its EV business has started road-testing a fleet of 53 cars across five models, in an effort to lift prospects of a potential stake sale in the unit. This comes just days after Evergrande New Energy Vehicle warned in its earnings report that production of electric cars may be delayed due to lack of short-term capital. The subsidiary reported a first-half loss of CNY 4.8bn ($740mn). Evergrande previously has said that it was in discussions with third parties to sell its stakes in its electric car and property management units.

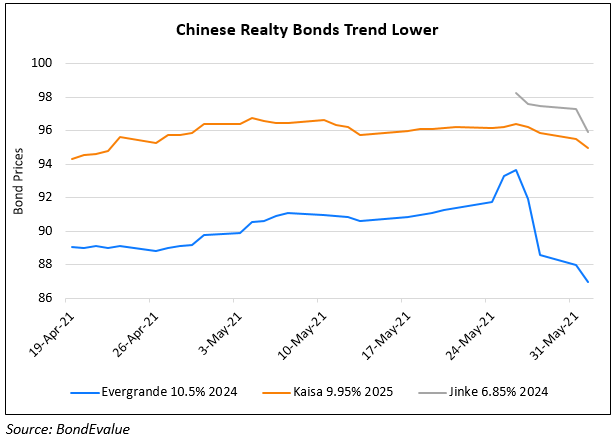

Evergrande’s dollar bonds were lower – its 11.5% 2022s and 7.5% 2023s are down 1.3 each to 26.8 and 26.1 respectively.

Go back to Latest bond Market News

Related Posts: