This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SoftBank to Issue Dollar/Euro Bonds After 3Y Hiatus

June 29, 2021

SoftBank plans to issue USD and/or EUR denominated bonds for the first time since 2018. Sources say that the issuance would span tenors from 3Y to 12Y with Deutsche Bank, Barclays and HSBC mandated for the planned offering. SoftBank last tapped offshore bond markets in 2018 when they raised $1.25bn via dollar bonds and €2.62bn via euro denominated bonds. The planned issuance comes after they priced Japan’s largest domestic bond offering (JPY 405bn or $3.7bn) so far this year earlier this month. A spokesperson for the company said they were considering the bond deal due to good market conditions and to expand their investor base.

SoftBank’s bonds were flat – USD 6% Perp is trading at 101.5, yielding 5.22%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

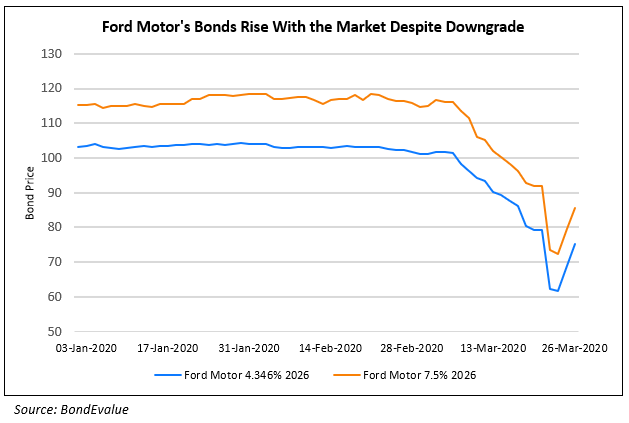

SoftBank Downgraded; Ford Becomes Junk

March 26, 2020

Are We Really Out of The Woods?

April 29, 2020