This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

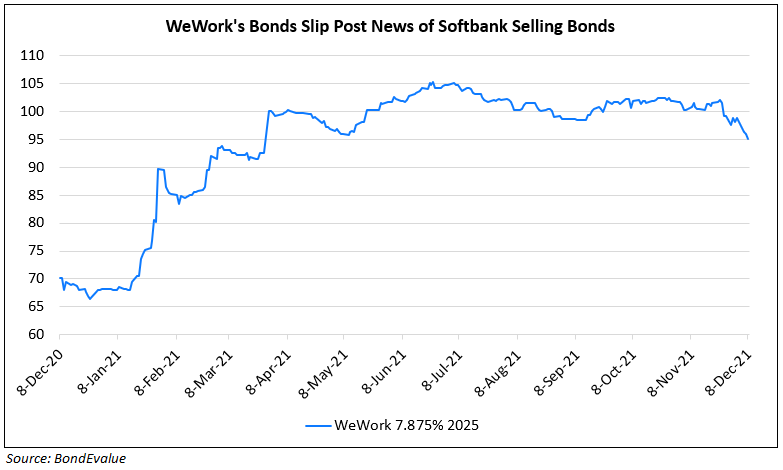

Softbank Looking to Dump $500mn of WeWork Bonds

December 8, 2021

According to people familiar with the matter, Softbank is looking to dump $500mn worth of WeWork debt that the former offered to the latter over a year ago to ease WeWork’s liquidity issues. Softbank had purchased $2.2bn worth of 5% bonds maturing in 2025 from WeWork in July 2020, and it is now selling $500mn worth of those bonds whilst still holding about $1.65bn worth, Bloomberg notes. Sources said that Softbank will be selling the bonds to institutional investors at a massive discount to par at a price of ~85.6 cents on the dollar for a yield of ~9.875%. A Softbank spokesperson said that the proposed sale is a sign of confidence in WeWork and “is consistent with ongoing efforts to diversify WeWork’s investor base.”

The news sent WeWork’s $669mn 7.875% bonds due 2025 tumbling down to 95 cents on the dollar from ~102 levels in late-November.

For the full story, click here

Go back to Latest bond Market News

Related Posts: