This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sino-Ocean Cut to Ba1 by Moody’s; Central China Repurchases Bonds Due in Aug 22

August 2, 2022

Sino-Ocean is the latest Chinese developer to become a fallen angel after Moody’s downgraded it from Baa3 (investment grade) to Ba1 (high yield). The downgrade mainly stems from Moody’s expectation that support from Sino-Ocean’s largest shareholder, China Life (rated A1 stable) will dwindle in the next 12-18 months in light of the deteriorating property market in China. Aside from downgrading Sino-Ocean to high yield territory, Moody’s has also revised the outlook to negative. The rating agency’s rationale is that Sino-Ocean has a weakening standalone credit profile. In terms of operating cashflow, the company’s sales have decreased 18% to RMB 43bn ($6.3bn) since the start of 2022 compared to the same period last year and operating revenues are expected to further decline ~25% to RMB 100bn ($14.8bn) in 2022. Moody’s also expects Sino-Ocean’s debt leverage (revenue/adjusted debt) and adjusted EBIT/interest expenses to decrease to 55-60% and 2.5-2.6x respectively over the short-to-medium term, from 68% and 3.0x respectively in 2021. Despite this, Moody’s believes that Sino-Ocean has sufficient resources to cover its debt maturing in the next 12 months.

Sino-Ocean’s 6% 2024s have ticked upwards by 1.95 points, trading at 81.6 cents to the dollar.

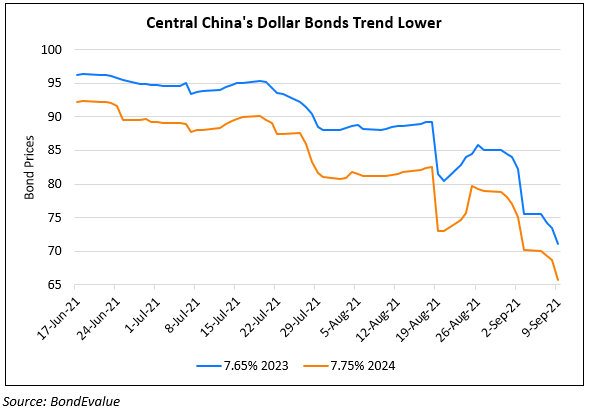

In other news from China, Central China Real Estate has bought back $27.2mn of its 6.875% dollar bonds due in August 2022, which is 5.27% of the total amount outstanding. The remaining amount outstanding stands at $472.7mn. Central China said the move “will help reduce its future financial expenses and lower its financial gearing level”. The bonds in question are trading flat at 97.5 cents to the dollar.

Go back to Latest bond Market News

Related Posts: