This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

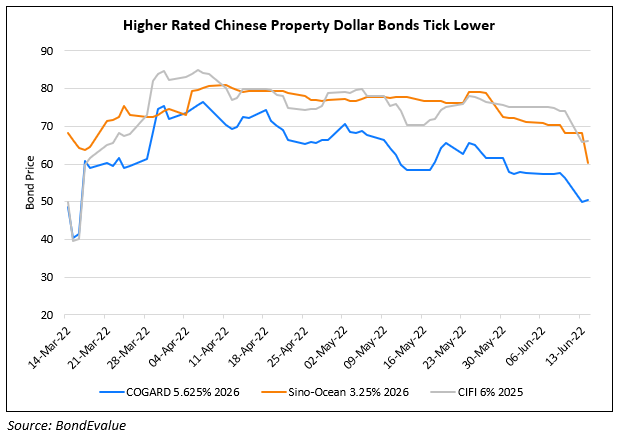

Sino-Ocean, COGARD, CIFI’s Dollar Bonds Drop over 10%

June 14, 2022

Chinese property developer Country Garden (COGARD) saw its dollar bonds drop sharply yesterday. Last week, Fitch put COGARD on rating watch with a possible downgrade to junk. The company is expected to miss its annual sales target of RMB 455bn ($67.5bn) as only 33% of it was achieved in the first five months of 2022, as per Bloomberg analysts. Dollar bonds of another Chinese property developer Sino-Ocean dropped as much as 10% on Tuesday. Sino-Ocean is among the few investments grade rated developers rated at Baa3/BBB- (Moody’s/Fitch). Separately, another peer, CIFI Holdings’ offshore bonds also slumped by over 10%. After initial rumors that its liquidity was not sufficient, in May, the company clarified that its business was in good condition and that it had sufficient and available cash reserves. CIFI is rated BB- by Fitch.

Go back to Latest bond Market News

Related Posts: