This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sichuan Languang’s Dollar Bonds Selloff Over Liquidity Concerns

April 30, 2021

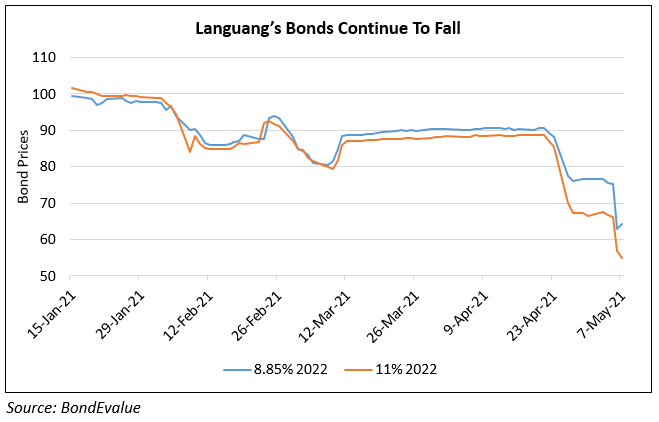

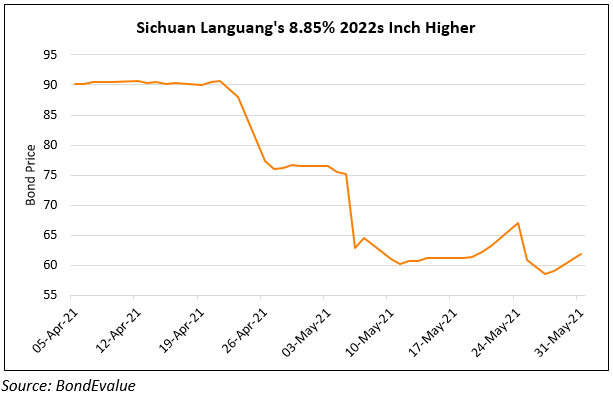

Chinese real estate developer Sichuan Languang Development Co. saw its dollar bonds, issued through subsidiary Hejun Shunze Investment, selloff this week on liquidity concerns. Bloomberg reported that Languang, which has about $1bn of offshore bonds and $2bn of onshore debt outstanding, is mulling a sale of a stake in the company and/or in some of its property projects. This comes after it sold a stake in a former unit to redeem a dollar bond that was due this week. It’s 8.85% bonds due January 2022 and 11% bonds due June 2022 have fallen to 76.74 and 66.75 from 90 and 88 levels last week respectively.

Go back to Latest bond Market News

Related Posts: