This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sichuan Languang’s Dollar Bond Jumps After Local Repayment

May 31, 2021

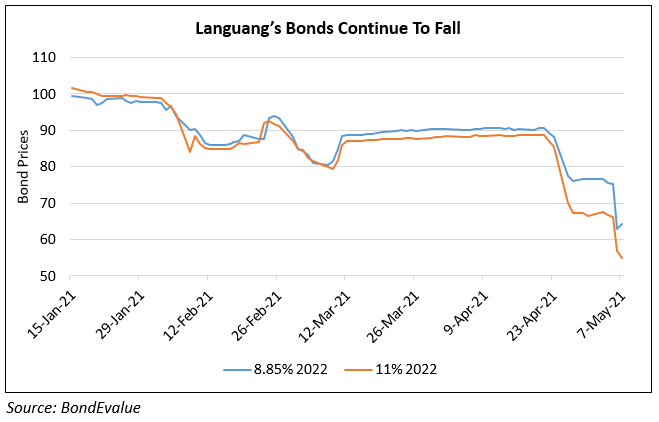

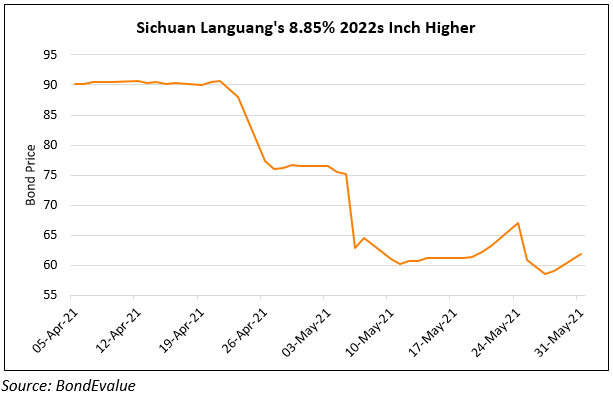

Sichuan Languang’s dollar bonds jumped after a report said that they wired funds for the repayment of an onshore bond. The company wired funds for the full repayment of its CNY 600mn ($94.3mn) 7.9% bonds due May 29. The Chinese property developer’s dollar bonds plummeted earlier this month after a rating downgrade by Moody’s to B2 citing a low liquidity buffer, as the company has large upcoming debt maturities in the next 12-18 months.

While their USD 8.85% 2022s traded up, their USD 10.4% 2023s were down 1.5 points to 51.5 and their USD 11% 2022s were marginally higher to 54.6.

Go back to Latest bond Market News

Related Posts: