This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Shriram, MGM Launch $ Bonds; Macro; Rating Changes; New Bond Issues; Talking Heads; Top Gainers & Losers

March 25, 2021

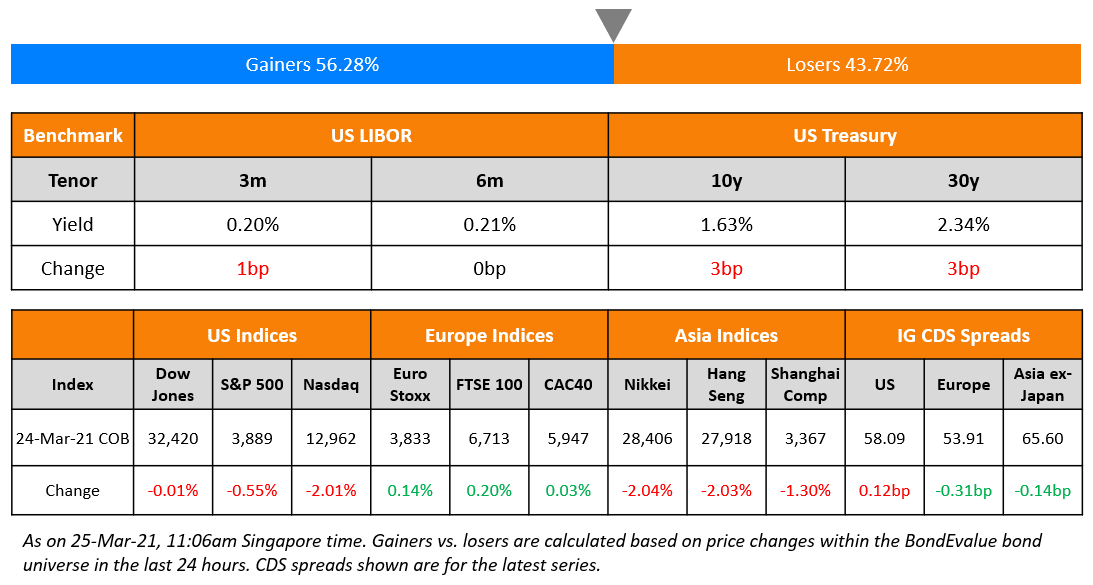

S&P ended 0.6% lower while Nasdaq saw another beat down by 2% as tech shares continued to tumble. The US 10Y Treasury yield rose 3bp to 1.63%. As per IFR, many see US 10Y yields settled within a range of 1.60%-1.75%, with the major worry for equities being an upside breakout towards 2%. New lockdowns in Germany and France contained European equities with the DAX down 0.4% while CAC was flat. US IG CDS spreads were 0.1bp wider and HY was 0.7bp wider. EU main CDS spreads were 0.3bp tighter and crossover spreads tightened 2.2bp. Asian equity markets are off to a soft start, up 0.2% and Asia ex-Japan CDS spreads are tighter 0.1bp.

Bond Traders’ Masterclass | Today at 6pm SG/HK | US$320 for 4 Session Bundle

Keen to learn bond market fundamentals from industry professionals? Sign up for our Bond Traders’ Masterclass with Bond Valuation & Risk today at 6pm SG/HK. Avail a 20% discount on a bundle of four sessions!

The modules are specially curated for private bond investors and wealth managers to develop a strong fundamental and practical understanding of bonds. Given the ultra-low interest rate environment, flurry of new bond deals particularly from junk-rated issuers and tightening credit spreads, it is now more important than ever for investors to understand bond valuation, portfolio construction and new bond issues to help them get better return for risk. The sessions will be conducted by debt capital market bankers who have previously worked at premier global banks such as Credit Suisse, Citi and Standard Chartered.

New Bond Issues

- Power Construction Corporation of China $ PerpNC5 at 3.55% area; books over $2.2bn

- MGM China Holdings $ 5.8NC2.8 bond at 5.125% area; books over $2bn

- Shriram Transport Finance tap of $ 4.40% 2024 social bond at 4.4% area

AVIC International Leasing raised $500mn via a 3Y bond at a yield of 1.855%, or T+155bp, 45bp inside initial guidance of T+200bp area. The bonds have expected ratings of A- and received orders over $1.3bn, 2.6x issue size. Asia took 98% and Europe 2%. Banks/financial institutions got 67%, fund/asset managers 20%, private banks 11% and central banks 2%. The bonds have a change of control put at 101. Proceeds will be used for debt replacement and leasing projects.

Goho Asset Management raised $100mn via a 2Y11M SBLC-backed bond at a yield of 4.5%, same as initial guidance of 4.5% area. New Momentum International is the issuer and the bonds are unrated and guaranteed by Goho AMC. The bond have the support of a standby letter of credit (SBLC) from Bank of Jiujang. Around 33% of the proceeds will be used to repay offshore debt, 57% to acquire distressed assets, and the remainder for working capital purposes.

Kuwaiti lender Boubyan Bank raised $500mn via a Perpetual non-call 6Y (PerpNC5.5) Tier 1 Sukuk at a yield of 3.95%, 30bp inside initial guidance of 4.25% area. The bonds were unrated. The bonds have an optional redemption at par in whole and not in part on any day falling between (and including) the first call date (October 1, 2026) and the first reset date (April 1, 2027). If not called, the coupon will reset on the first reset date and every six years thereafter at the 6Y UST plus a margin of 289.6bp. Boubyan Tier 1 Sukuk is the issuer and Boubyan Bank is the obligor. Boubyan’s issue has the third lowest coupon on a GCC Perpetual Tier 1 sukuk after NBK and NCB’s offerings earlier this year at a coupon of 3.625% and 3.5% respectively.

New Bond Pipeline

- Lionbridge Capital 364-day $ bond

- London Stock Exchange planning USD/EUR/GBP offering

- KNOC $ bond

- CAR Inc $ bond

- Maldives $ 5Y sukuk

- IRFC $ 5Y bond

- Doha Bank bond

- Tunas Baru Lampung $ bond

- Pakistan sovereign bond

- Nickel Mines $ 3NC2 bond

- Merck $10.5bn offering

- Meinian Onehealth Healthcare $ bond

Rating Changes

- JD.com Upgraded To ‘BBB+’ By S&P On Improving Business Position In China’s E-Commerce Market; Outlook Positive

- Chile Long-Term Foreign Currency Rating Lowered To ‘A’ On Weaker Fiscal Flexibility By S&P; Outlook Stable

- The GEO Group Inc. Downgraded To ‘B’ By S&P On Heightened Refinancing And Business Risk; Outlook Negative

- Moody’s downgrades Total’s senior unsecured rating to A1 and affirms its P-1 rating; stable outlook

- Moody’s downgrades CoreCivic’s corporate family rating to Ba2, outlook revised to negative

- CoreCivic Inc. Downgraded To ‘BB-‘ By S&P On Heightened Business Risk; Outlook Negative

- Fitch Downgrades Harley-Davidson’s IDR to ‘BBB+’; Outlook Negative

- Fitch Downgrades Engie S.A. to ‘A-‘; Outlook Stable

- Fitch Revises Outlook on Iraq to Stable; Affirms at ‘B-‘

- Moody’s changes Shell’s outlook to stable, affirms Aa2 ratings

- Nordstrom Inc. Ratings Affirmed By S&P, Outlook Revised To Stable; New Debt Rated

- ViacomCBS Inc. Outlook Revised To Stable By S&P From Negative On Equity Offering; Ratings Affirmed

- Outlook On Cathay Group Units Revised To Stable By S&P From Negative On Restored Capital; Ratings Affirmed

Term of the Day

Rhino Bonds

Rhino bonds are bonds designed to raise funds for growing the population of endangered black rhinos in South Africa. These will be issued by the World Bank this year, looking to raise ZAR 670mn ($45mn) via 5Y bonds as the world’s first wildlife conservation bond. Investors’ returns will be determined by the rate of growth in the population of these rhinos in two South African reserves.

Talking Heads

“We’re looking for actual improvement in the economy and inflation to get back up to our dual mandate objectives of maximum inclusive employment and 2% inflation on average,” Evans said.

The Fed will use a “dose of patience” and will not get “overly joyous” as the jobless rate falls, Daly said. “We are not going to take this punchbowl away….We are committed to leaving the monetary policy accommodation in place until the job is fully and truly done.”

“I don’t know when we will take the next policy action because it will be driven by what happens in the economy,” Williams said. “I see the U.S. economy recovering really nicely over the next couple of years,” Williams said. “I don’t see inflationary pressures really building during that time.”

“Past experience shows that whenever US yields go up, capital markets in emerging and developing markets take a major hit,” he said. “We are very concerned about the potential risks surrounding the debt pile-up.”

“We will eventually get down to a pace of QE purchases that maintains — but no longer increases — the amount of stimulus being provided,” Gravelle said. “It won’t necessarily mean that we have changed our views about when we will need to start raising the policy interest rate,” Gravelle said.

Top Gainers & Losers – 25-Mar-21*

Go back to Latest bond Market News

Related Posts: