This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

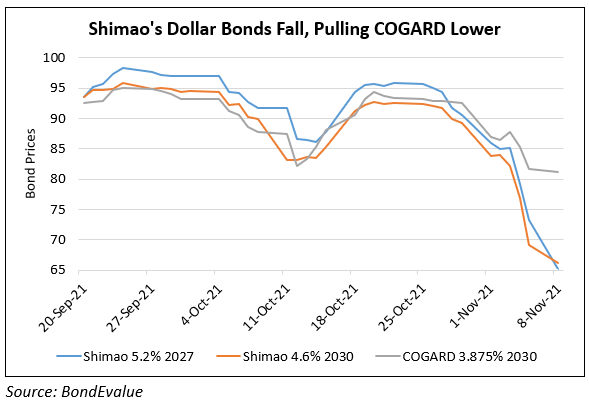

Shimao’s Dollar Bonds Fall Over 10%; Set to Miss 2021 Sales Target

November 8, 2021

Chinese property developer Shimao told investors that its sales in 2021 will be 12% below its RMB 330bn ($51.6bn) target at around RMB 290bn ($45bn) citing a national credit tightening. Further, Shimao could consider selling assets like its commercial and hotel assets if prices are good, as per Reuters citing investors who attended an investor call. Shimao also said it would start repurchasing some shares and bonds; it recently bought back $1.5mn of its 4.75% 2022s. Due to tight credit conditions, Shimao, China’s 13th-biggest property developer by sales, said it started cutting home-selling prices since July to boost sales, and stopped buying land to reserve capital. Following Kaisa’s WMP defaults, Shimao said that it has only a limited amount of WMPs. Shimao, rated Ba1/BBB-/BBB- (Moody’s/S&P/Fitch) saw its dollar bonds fall sharply by over 10% on Friday, affecting its other IG-rated peer Country Garden (Baa3/BB+/BBB-) too. “There is definitely more room for rating downgrades of Chinese investment-grade property companies considering this is an industry issue,” said Andrew Chan, a Bloomberg Intelligence analyst. On the other hand, research firm Lucror Analytics said, “In our view, there has been little change to Shimao’s liquidity profile. Overall, the market has been fragile, resulting in rumours having a big impact on prices.”

For the full story, click here

Go back to Latest bond Market News

Related Posts: