This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Shimao’s Dollar Bonds Fall after Being Placed on Review for Downgrade by Moody’s

November 25, 2021

Chinese developer Shimao Group was placed on review for downgrade by Moody’s. Shimao is currently rated Ba1 by Moody’s. Moody’s said that the review reflected their expectation that Shimao’s contracted sales will fall over the next 6-12 months after it fell 32% YoY in October 2021 following a 24% decline in 3Q 2021. It also reflects Shimao’s uncertainty over its ability to get new funding at reasonable cost to address its sizable maturities. However, Moody’s expects Shimao will have sufficient internal cash of RMB74.8bn ($11.7bn) to repay its short-term debt of RMB44.4bn (~$7bn), but this will in-turn reduce its liquidity buffer and funding available for operations. Moody’s expects its interest coverage (EBIT/Interest) to decline to 3.5-4x over the next 12-18 months with a decline in profit margins vs 4x for the twelve months ending June 2021. Leverage, measured by revenue/debt, is expected to remain stable at ~85% but both the above metrics are weak for its Ba1 rating, they note. Shimao is rated at BB+ and BBB- by S&P and Fitch currently.

Shimao’s dollar bonds fell over 4% yesterday with its 5.6% 2026s falling 5% to 78 cents on the dollar, yielding 11.9%.

For the rating action, click here

Go back to Latest bond Market News

Related Posts:

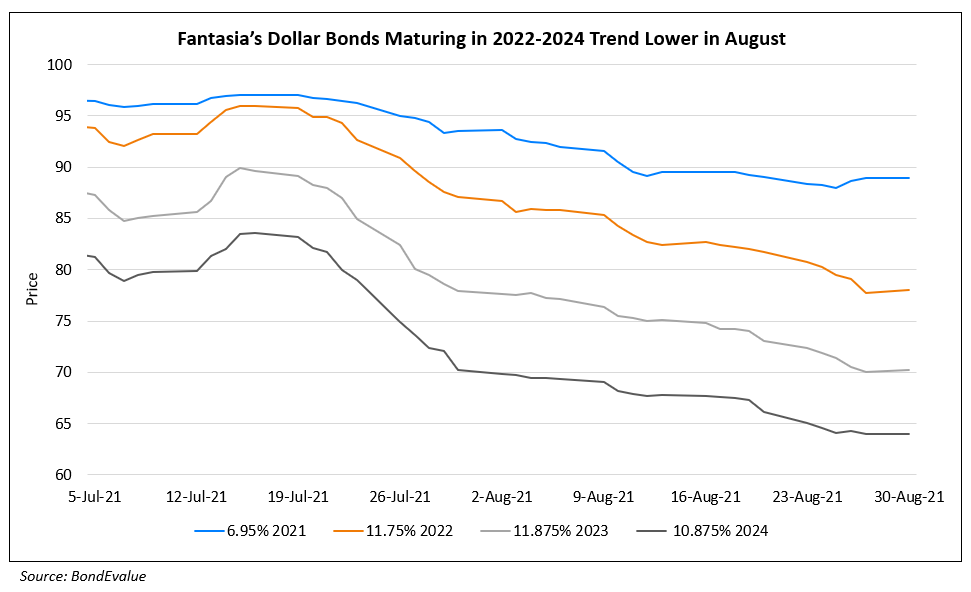

Fantasia Reports 1H Earnings, 2022s-2024s Trend Lower

August 30, 2021

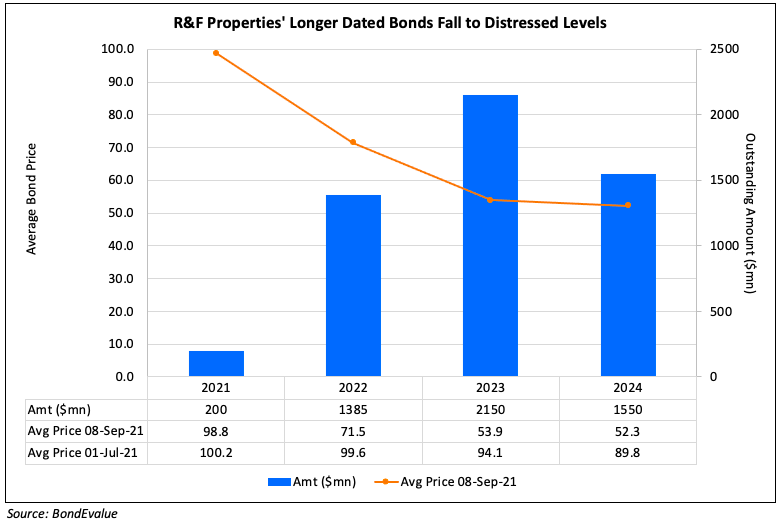

R&F Properties’ Bonds Continue Fall to Fresh Lows

September 8, 2021