This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Shimao Upgraded to IG Status at BBB- by S&P

April 9, 2021

S&P Ratings upgraded Chinese property developer Shimao Group to BBB-, putting it in the investment grade category giving a stable outlook. They also raised the issue level rating to BB+ from BB. S&P cited stable profitability and prudent financial management as the primary reasons. S&P expects Shimao’s diverse land acquisition methods to support profitability with higher margins and its growing non-property segment giving support. While they see gross margins from the property development segment to slim to 25%-27% by 2023-2024 vs 27.3% in 2020, it is expected to be stronger than the sector average. The primary reason for margin contraction in the property segment would be due to half of Shimao’s land acquisition coming from public auctions and caps on property prices in higher-tier cities. S&P notes that Shimao has high visibility on future revenue and contracted sales they expect Shimao to see 15%-20% revenue growth in 2021 compared with 20% in 2020. Besides, Shimao’s JV project deliveries are expected to pick-up and add to profits after contributing 40% of contracted sales in the last two years. They expect that Shimao’s look-through leverage (impact of leverage from subsidiaries, JVs etc. on the parent) may improve to 3.8x-4.0x over the next two years, from ~4.1x-4.2x in 2020. The rating agency did add that the possibility of an upgrade is limited over the next 1-2 years, given Shimao’s scale and product diversity are weaker than those of higher rated peers.

Shimao’s dollar bonds were stable with its 3.45% 2031s up 0.3 to 97.35, yielding 3.8%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Sinopec Returns to the Dollar Bond Market for a Second Time in 2017

September 13, 2017

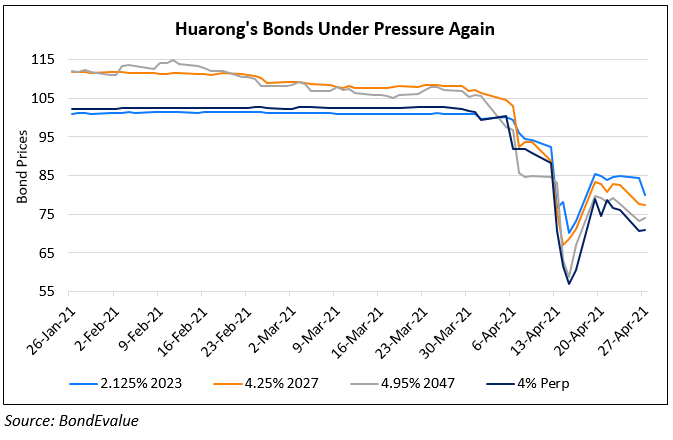

Huarong Downgraded Three Notches To BBB By Fitch

April 27, 2021