This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Shimao Seeks Buyers for Projects Valued Over $12bn

February 15, 2022

Shimao Group is seeking buyers for about 40 projects to bulk up on its liquidity position including hotels, shopping malls and serviced apartments estimated at around RMB 77.1bn ($12.1bn), as per the Post. As per sources, Shimao approached potential buyers including state-owned peers and financial firms but received a tepid response. Shimao did not comment on the matter explicitly, but noted that an RMB 2.25bn ($350mn) valuation of its quarry hotel, aka, InterContinental Shanghai Wonderland, was incorrect. Shimao has about RMB 20bn ($3.1bn) in onshore and offshore bond repayments due this year, besides other debts like trust financing and ABS of which RMB 5.6bn ($880mn) is due this year.

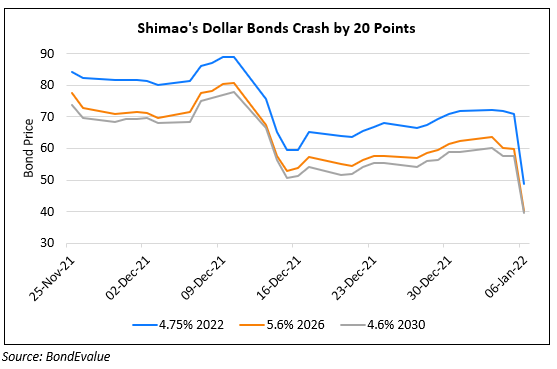

Shimao’s dollar bonds were slightly lower with its 4.6% 2030s down 1.6 points to 41.63 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts: