This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Shimao Downgraded by Two Notches to Caa1 from B2; Misses Trust Payments

February 24, 2022

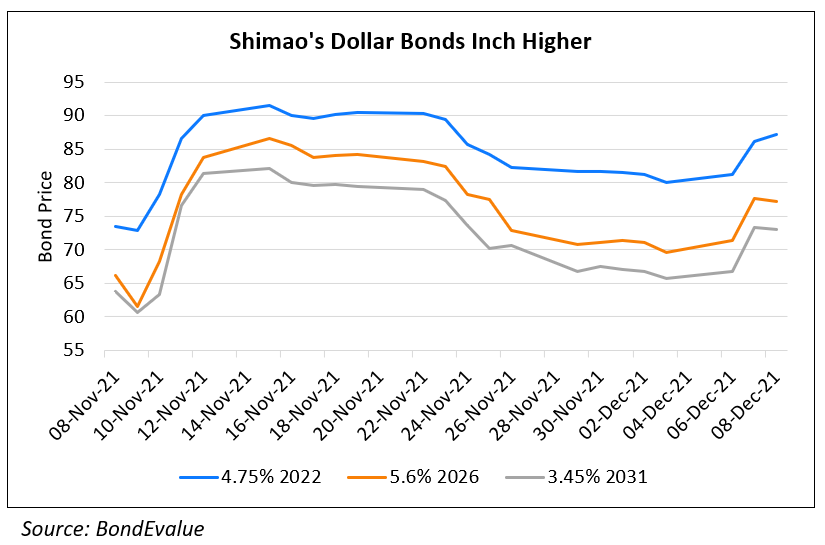

Shimao Group was downgraded by two notches to Caa1 from B2 by Moody’s with a negative outlook. This comes on the back of Shimao’s heightened liquidity risks over the next 6-12 months given the slower-than-expected fundraising progress. This makes it difficult to meet near-term debt maturities. At the holdco level, Shimao has large debt maturities due or puttable by the end of 2022 – this includes offshore and onshore bonds totaling ~$1.7bn and RMB 6.9bn ($1.1bn) respectively. Moody’s estimates that a significant part of Shimao’s cash was held at the project level, which will be used for project-level debt repayment and construction expenses, and hence insufficient to repay maturing debt. Contracted sales are expected to fall significantly in 2022 and 2023 from RMB 269bn ($42.6bn) in 2021, further hurting its profile.

Separately, Bloomberg reported that Shimao missed some trust payments and has not reached an agreement to extend repayments on ~RMB 6bn ($948mn) of high-yield products with Citic Trust Co. The trust company added that it will continue to urge Shimao to repay.

Go back to Latest bond Market News

Related Posts: