This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

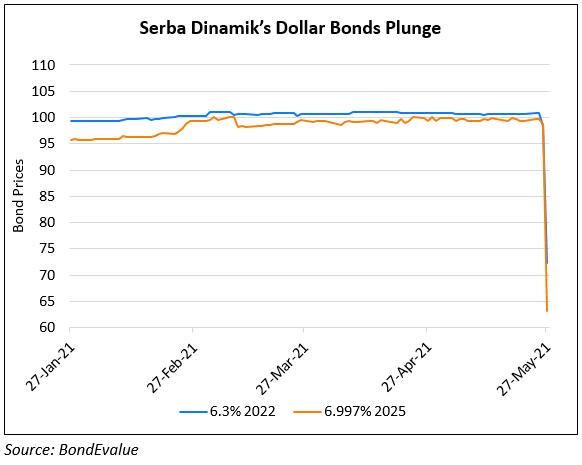

Serba Dinamik Changes Auditor; 4 Independent Directors Resign

June 28, 2021

KPMG has resigned as external auditors for Serba Dinamik Bhd on Thursday after the oil services and engineering company took legal action on the auditor for alleged negligence, breach of contract and breach of statutory duty. The legal action was initiated as a response to the concerns raised by the auditor on some of the company’s past sales transactions and trade receivables. KPMG had not been able to verify contracts and transactions totalling MYR 3.5bn ($850mn) with 11 customers, prompting an investigation by Malaysia’s Securities Commission. KPMG in a notice stated that the suit filed by the company on June 22 against them in regard to the ongoing statutory audit of the company for the financial period ending June 30, 2021 has compromised their ability to independently continue the audit engagement and discharge their professional duties as auditor of the company. Serba Dinamik’s board is likely to appoint Ernst & Young Advisory Services as its independent reviewer to assess the issues highlighted by KPMG. The tit for tat between the auditor and the Malaysian oil and gas services company has led to resignation of four of its non-executive directors due to a difference of opinion over the legal action. Meanwhile, the company posted revenues of MYR 1.38bn ($332.4mn) and a profit of MYR 113.32mn ($27.3mn) for the quarter ended March.

Serba Dinamik’s latest earnings for the quarter ended March 31, 2021 saw profits fall 44% QoQ to MYR 112.52mn ($27mn) driven by significantly higher administrative expenses. The company also trimmed its FY21 and FY22 expected earnings by 8% and 9% following lower work order recognitions and also removed any dividend assumptions for the rest of FY21, and for FY22. Due to the lack of 2020 results, like-to-like comparison is not available. Kenenga Research says that Serba’s “corporate governance and reliability of its reported financial statements may remain a point of contention… As such, we believe the group may need to undertake capital preservation efforts e.g. reducing capex and cessation of dividends in order to keep its borrowings manageable,” adding that the company’s condition heightens refinancing risk for its USD $222.22mn 6.3% 2022 Sukuk.

Serba Dinamik’s bonds were trading at distressed levels. Its 6.3% 2022s were stable at 44.89 and its 6.997% 2025s were up 1.48 at 36.98.

For the full story, click here

Go back to Latest bond Market News

Related Posts: