This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 21, 2022

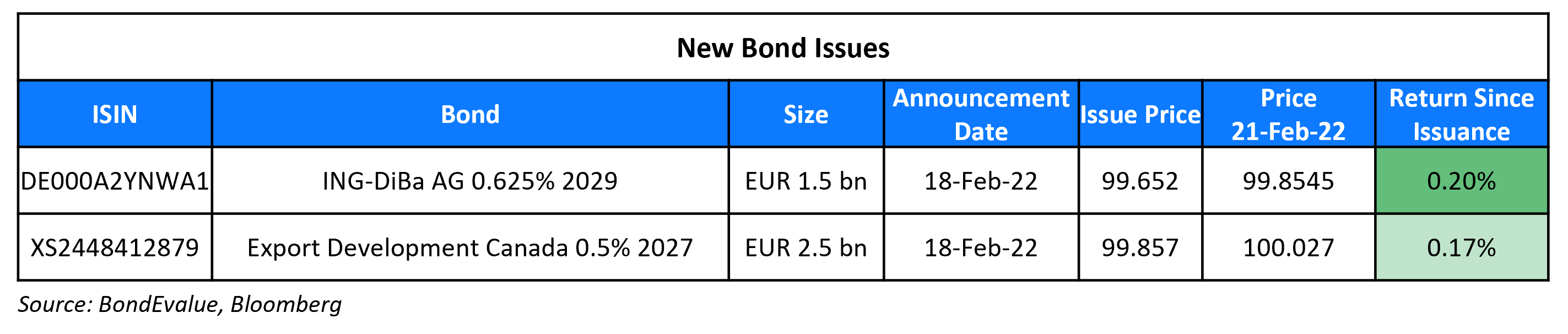

S&P and Nasdaq were lower again on Friday with the indices down 0.7% and 1.2% respectively. Most sectors were in the red, led by IT and Industrials down 0.9-1%. The US 10Y Treasury yield dropped 6bp to 1.93% as risk-off sentiment around Russia–Ukraine tensions weighted on markets. European markets were also lower with the DAX down 1.5% and the CAC and FTSE down 0.3% each. Brazil’s Bovespa closed 0.6% lower. In the Middle East, UAE’s ADX was down 0.6% and Saudi TASI closed 0.1% lower. Asian markets have opened broadly lower with Shanghai, HSI and Nikkei down 0.4%, 0.7% and 0.8% respectively, while STI was up marginally by 0.1%. US IG CDS spreads were 0.9bp wider and HY CDS spreads were 4bp wider. EU Main CDS spreads were 2.4bp wider and Crossover CDS spreads were 15bp wider. Asia ex-Japan CDS spreads were 0.7bp wider.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

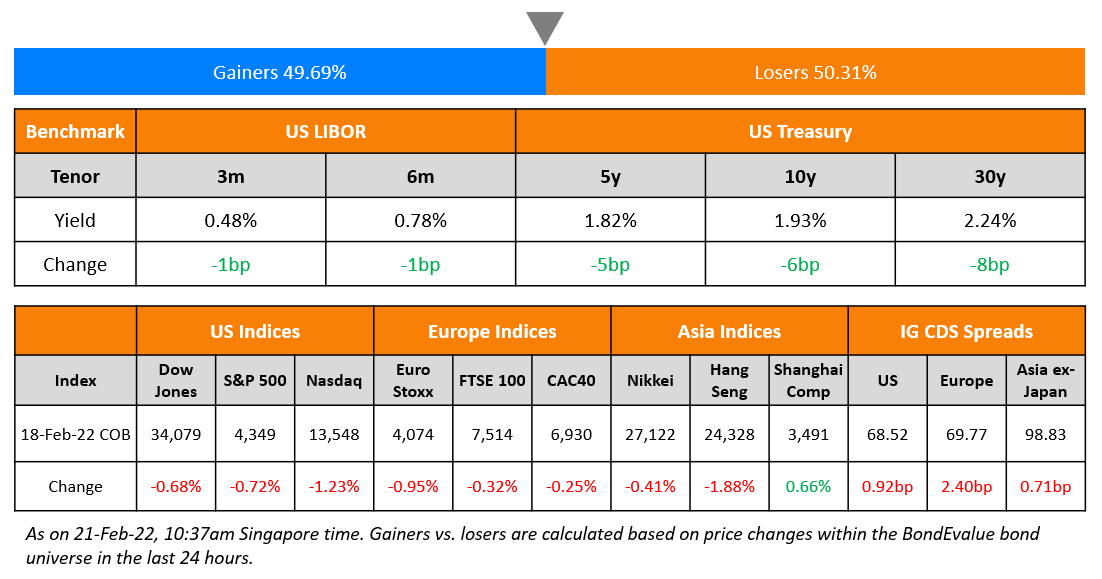

New Bond Issues

- Danyang Investment Group $ 3Y at 2.5% final

New Bonds Pipeline

- China Tourism Group hires for $ 5Y bond

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- Fitch Upgrades Piraeus Bank to ‘B-‘; Outlook Positive

- Fitch Upgrades Alpha Bank to ‘B’; Outlook Positive

- Moody’s downgrades Zhongliang to B2, changes outlook to negative from stable

- Fitch Revises Greenko Energy’s Outlook to Negative; Affirms IDR, Note Ratings at ‘BB’

Term of the Day

Portfolio Trading

Portfolio trading is a mechanism in which dealers move large baskets of bonds in a single trade often using ETFs, hence pricing and transacting an entire portfolio at one shot. The benefit of portfolio trading it to move large buckets of risk with ease by executing fewer, larger trades to reduce market impact, cost and reducing the time taken to execute on portfolios. As ICE notes, it is an “all or none” execution style. Bloomberg notes that portfolio trading has stalled in recent volatility as it becomes harder for dealers to set prices on those bonds when price are rapidly.

Talking Heads

On Slow-Motion Central Bankers Putting Their Maestro Status on the Line

Derek Tang, an economist with Monetary Policy Analytics Inc.

“They are implicitly making a choice about the distributional effects of their policy….They would rather have a hot economy and higher inflation than a large number of people stuck out of work.”

San Francisco Fed President Mary Daly

“Abrupt and aggressive action can actually have a destabilizing effect on the very growth and price stability we’re trying to achieve”

ECB President Christine Lagarde

“If we acted too hastily now, the recovery of our economies could be considerably weaker and jobs would be jeopardized”

On JPMorgan Expecting String of Nine Straight Fed Rate Hikes

“We now look for the Fed to hike 25bp at each of the next nine meetings, with the policy rate approaching a neutral stance by early next year… [on inflation] We now no longer see deceleration from last quarter’s near-record pace… The risk that central banks shift and perceive a need to generate slow growth — and the corresponding impact on global financial conditions — is now the most significant threat to an otherwise healthy global backdrop”

On Fed officials leaning against large increase to kick off rate hikes

New York Federal Reserve Bank President John Williams

“I don’t see any compelling argument to taking a big step at the beginning… I think we can steadily move up interest rates and reassess”

Fed Governor Lael Brainard

Officials will likely kick off a “series of rate increases”…”The market is clearly aligned with that and brought forward the changes in financing conditions in a way that’s consistent with our communications and data”

Chicago Fed President Charles Evans

“I see our current policy situation as likely requiring less ultimate financial restrictiveness compared with past episodes and posing a smaller risk… We don’t know what is on the other side of the current inflation spike… We may once again be looking at a situation where there is nothing to fear from running the economy hot.”

On Hedge Funds That Won Big in China’s Bond Meltdown Now Seeing Risks

Wei Chong, head of bond research at Hangzhou-based Fuhui Juli

“We locked in the potential sellers, waiting for them to offload when their pressures peaked… The property market is full of big opportunities for us, but both the price declines and the evolution of sector fundamentals have exceeded our expectations. It’s hard for us to tell who can survive”

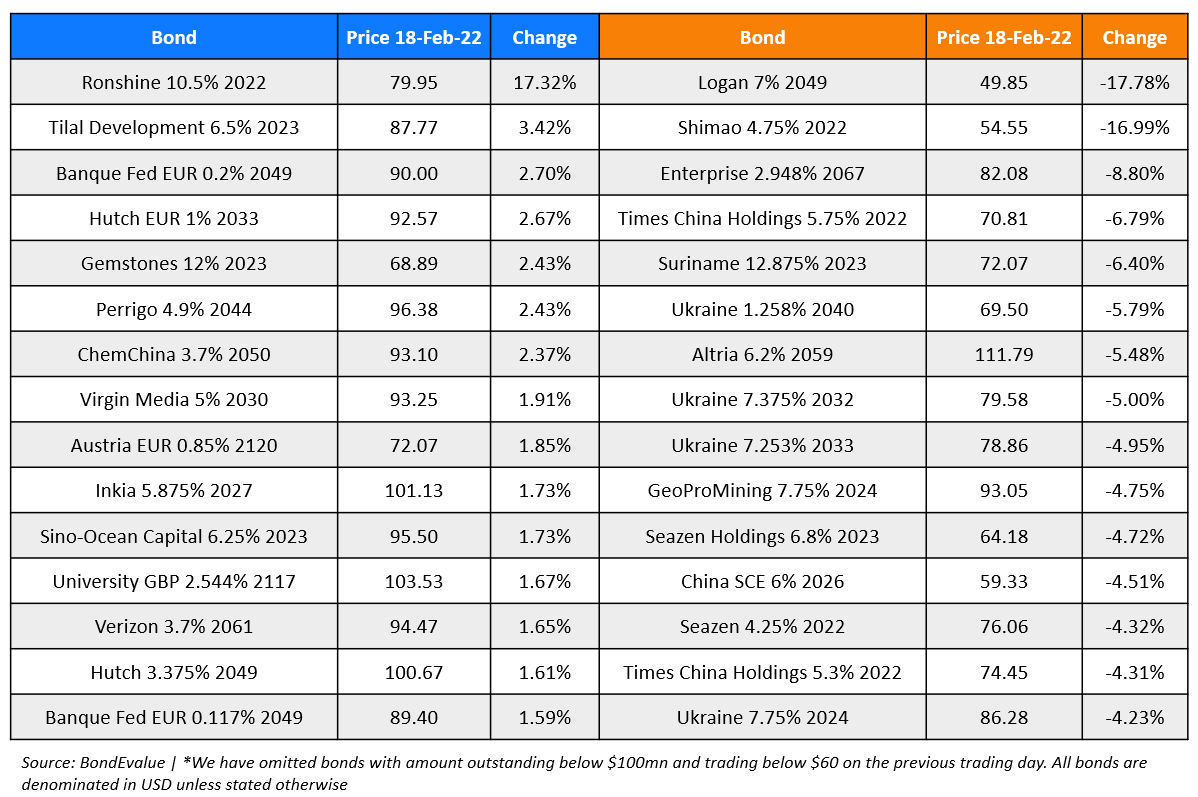

Top Gainers & Losers – 21-Feb-22*

Go back to Latest bond Market News

Related Posts: