This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Select Chinese Developers Receive $30bn Credit Line Support from Major State-Owned Banks

November 24, 2022

Five of China’s large property developers have received a combined $30bn in credit line support from three of the largest state-owned banks to support the property sector.

- BOCOM said it agreed to provide a RMB 100bn ($14bn) credit line to China Vanke and an RMB 20bn ($2.8bn) credit line to Midea Real Estate Holding. BOCOM is likely to offer the two developers property development loans, loans for M&A deals and bond investments.

- AgBank said it signed strategic agreements to provide fundraising support to China Vanke, Longfor Group, Gemdale, China Overseas Land & Investment and China Resources Land. The scale of support was not revealed. AgBank will provide financing for real estate development, personal housing mortgages, M&A, bond underwriting and investment.

- Bank of China said it agreed to provide a line of credit of up to RMB 100bn ($14bn) to China Vanke.

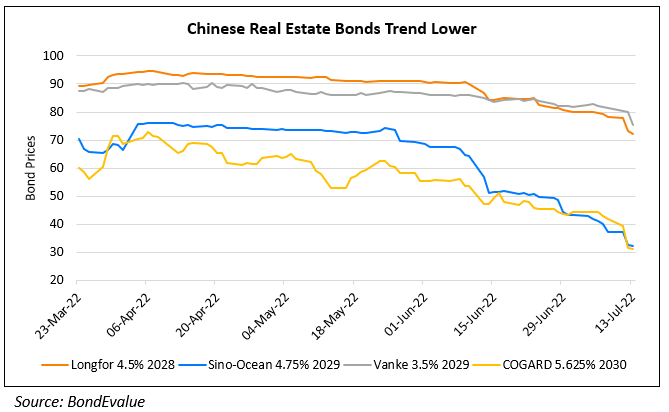

The financing agreements are part of China’s 16-point rescue package plan to support the property sector. Vanke’s, Gemdale’s and Longfor’s dollar bonds were up 1-2 points across the curve.

For the full story, click here

Go back to Latest bond Market News

Related Posts: