This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Seazen Downgraded to BB; KWG Local Bondholders Seek Early Repayment

Seazen Group was downgraded to BB from BB+ by S&P, noting that its sales could “significantly decline due to its market positioning and weak homebuyer sentiment”. The rating agency expects Seazen’s sales to decline by 33-38% to RMB 145-156bn ($21.2-22.8bn) in 2022. In the period ranging January-July 2022, Seazen’s contracted sales has dropped 44% YoY. Over 50-60% of the developer’s saleable resources are located in lower-tier cities where demand is typically weaker, thereby possibly slowing its sales recovery process. Historically, Seazen has relied on cash inflow from property sales to fund its mall construction, but given weaker demand this may not continue to sustain. Seazen has a thin landbank and the company may further deplete it. S&P estimates that the group had about RMB 8bn ($1.2bn) in accessible cash at the end of 1Q 2022, down 33% vs. end-2021. Furthermore, while the developer managed to obtain new financing of $100mn and RMB 1bn ($150mn) from capital markets in 2022, it is marginal as compared to its RMB 10bn ($1.5bn) equivalent of capital-market financing that repaid till date in 2022. Seazen’s liquidity buffer is expected to narrow further, with more margin compression and worsening debt-to-EBITDA ratios.

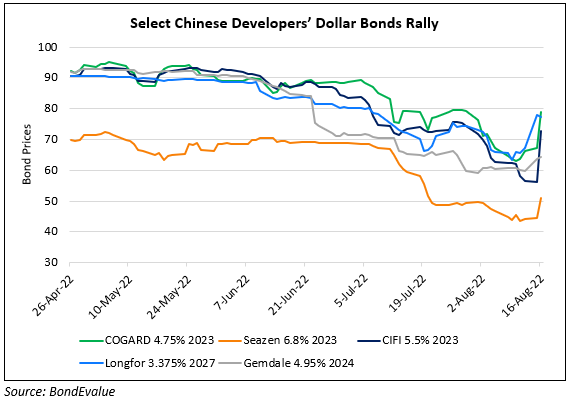

Seazen’s dollar bonds were trading higher despite the downgrade – its 4.8% 2024s were up 2.9 points to 44.1 cents on the dollar.

Separately, an onshore unit of KWG Group said that nearly all investors of its local RMB 1.8bn ($263mn) note are seeking early repayment by exercising the put option on it. This comes ahead of almost $1bn in onshore and offshore bonds that mature in September. KWG’s dollar bonds due September are trading at distressed levels of 22-24 cents on the dollar, highlighting a high likelihood of non repayment.

In other property sector news, Agile Group repurchased $39.57mn of its 4.85% bonds due August 31, with a new amount outstanding of $360.43mn. The buyback came after Agile warned of a 51-57% drop in net profits in 1H 2022 to RMB 2.32.6bn ($335.8-379.6mn). Its bond due next week is currently trading at 97.99, while its other dollar bonds are at distressed levels of over 19 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

KWG Downgraded to B+ by Fitch

December 6, 2021