This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

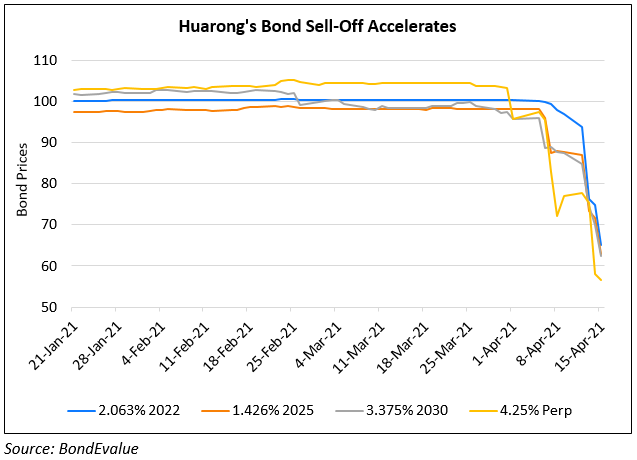

Sea of Red for Huarong’s $ Bonds With Most Trading in The 60s

April 15, 2021

Distressed asset manager China Huarong Asset Management Company (CHAMC) saw some of its dollar bonds plummet to new lows, dominating the top losers list on Wednesday. The acceleration in the sell-off now sees most of their bonds trading in the 60s from around par a couple of weeks back. The sharp fall was seen across the curve with their 2021s falling over 16% and their 2047s down 24%.

The Communist Party has yet to comment on the asset manager, which is controlled by the finance ministry. Meanwhile, China’s State Council in a statement urged local government financing vehicles to restructure or enter liquidation if they cannot repay their debts. Bloomberg notes that while it is unclear if the statement was targeted at Huarong, it implies a tough stance on risk controls. “It’s too early to buy since there is not enough information available to assess the recoveries for offshore bonds in the absence of support from the shareholders,” said Michel Lowy, CEO of alternative asset manager SC Lowy. Even as worries continue, Morgan Stanley says that Huarong is unlikely to cause systemic risks. Restructuring possibility continues to worry investors with the delay in publishing its results while global major ratings agencies have put the asset manager on review for a downgrade. Huarong’s bonds continue to tumble today with Z-Spreads (Term of the day, explained below) widening.

Go back to Latest bond Market News

Related Posts: