This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Royal Caribbean Reported Another Miss on Earnings

February 7, 2022

American cruise operator Royal Caribbean missed Q4 earnings estimates and warned that it may not be profitable in 2022 as was earlier expected. Revenues came in at $982.2mn, up massively vs. Q4 2020’s $34.1mn but below FactSet estimates of $1.04bn. Net loss was a tad lower at $1.36bn vs. $1.37bn in Q4 2020. Adjusted loss per share stood at $4.78, wider compared to FactSet’s consensus of $3.92. MarketWatch reported that this was the company’s sixth straight quarter of revenue misses and third straight quarter of wider-than-expected losses. For the full year 2021, it reported a net loss of $5.3bn vs. $5.8bn in 2020. Royal Caribbean managed to operate at 85% capacity by the end of 2021, and guided to operate at 95% capacity in Q1 2022 despite the Omicron impact. The company had liquidity of $3.5bn as of 2021-end, plus $1bn from a bond offering in the first week of January. Against this, it has $2.3bn of debt maturities and $270-275mn of interest expenses in 2022.

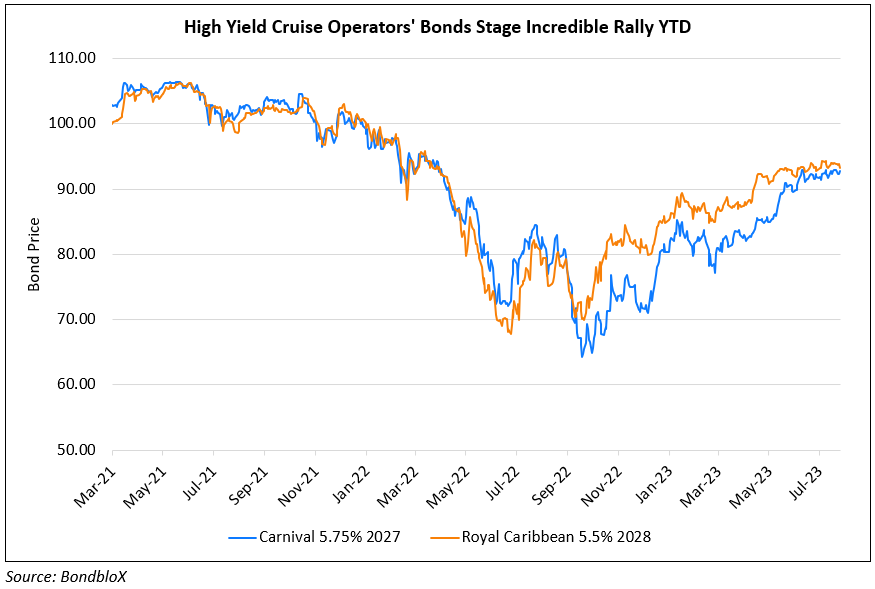

Royal Caribbean’s 5.5% 2028s traded 1.6 points lower to 97 to yield 6.09%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: