This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Rolls Royce Warns of £2bn Cash Burn in 2021; Flying Hours to Be 55% of Pre-Covid Levels

January 27, 2021

British aerospace company Rolls-Royce warned of a £2bn ($2.75bn) cash burn/free cash outflow in 2021, a number worse than market expectations of ~£1-£1.5bn ($1.4-$2bn), as per a company statement. The cash outflows are weighted towards the first half of the year, expecting it to turn positive in the second half and at least £750mn ($1.03bn) of free cash flow ex-disposals as early as 2022. The company expects flying hours this year to be only around 55% of pre-Covid levels as against expectations of 70%. The company generates profits in its aerospace division through long-term contracts under which it is paid for the number of hours its engines fly. The company stated that its liquidity of £9bn ($12.4bn) keeps them well-positioned for the future. The company stated, “Enhanced restrictions are delaying the recovery of long-haul travel over the coming months compared to our prior expectations, placing further financial pressure on our customers and the wider aviation industry, all of which are impacting our own cash flows in 2021”. Rolls Royce’s GBP 5.75% 2027s were down 0.8 to 109.6, yielding 4.04% and their 3.625% dollar bonds due 2025 were down 0.5 to 100.5 cents on the dollar, yielding 3.5%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

American Airlines Is Planning a Return to The Bond Market

February 15, 2021

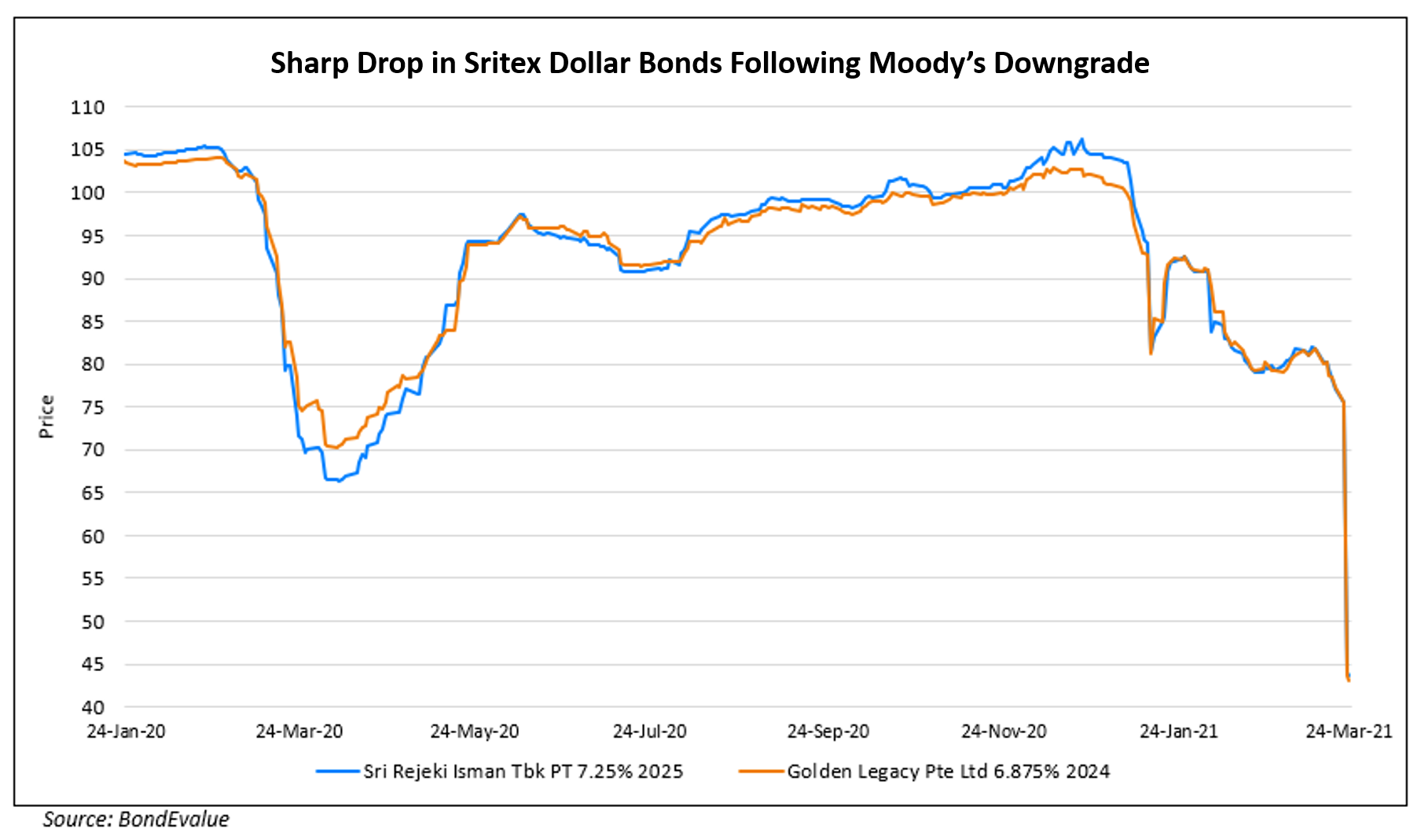

Sritex’s Dollar Bonds Nosedive Over 40% Post Downgrade

March 24, 2021

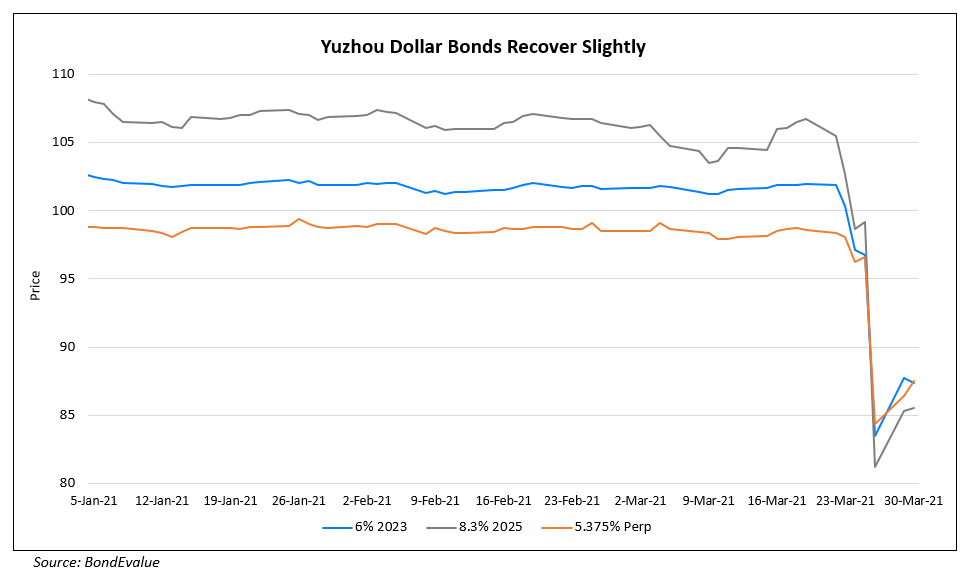

Yuzhou’s Bonds Recover Slightly

March 30, 2021