This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

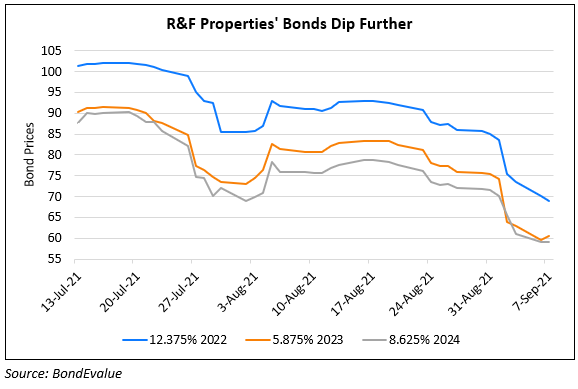

R&F Properties’ Bonds Fall 3-5% after Moody’s Downgrade

September 7, 2021

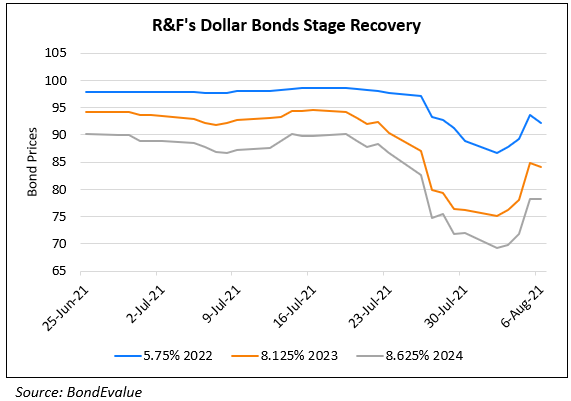

Bonds of R&F Properties fell over 3-5% post the downgrade by Moody’s to B2 on refinancing risks. Easy Tactic’s bonds guaranteed by R&F have been trending lower since mid-August with concerns over peer Evergrande also spilling over. R&F Properties reported 1H earnings a couple of weeks earlier with its revenues rising 18% YoY while net profits fell 15%. Its gross margins dipped considerably to 22.3% from 33.5% during the same period last year.

Go back to Latest bond Market News

Related Posts: