This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

REC, Sino-Ocean, Nomura Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

July 6, 2021

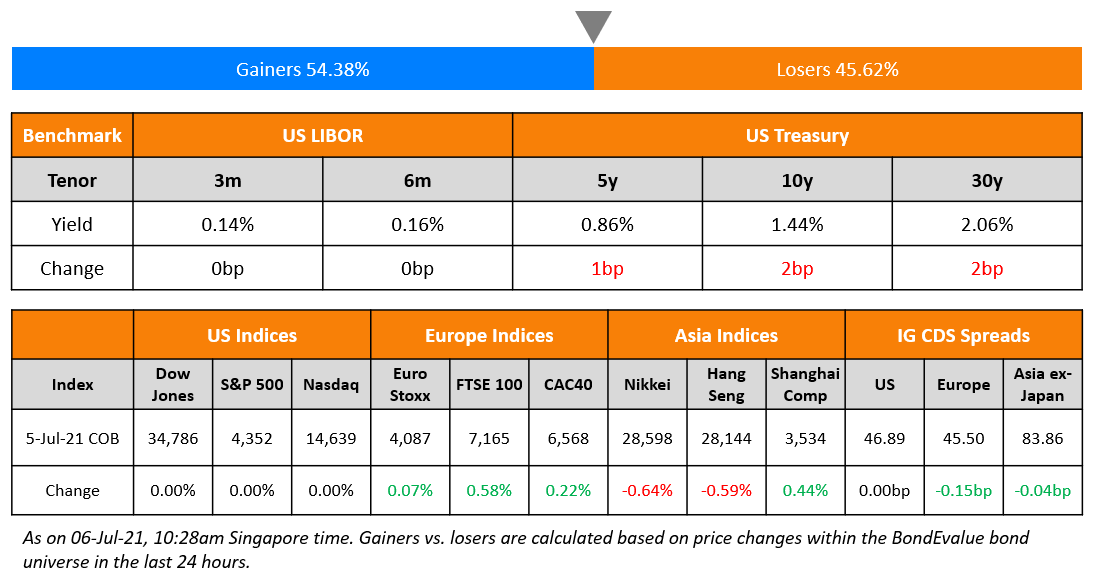

US markets remained closed yesterday to celebrate its 245th founding anniversary. US 10Y Treasury yields were up 2bp at 1.44bp. Meanwhile, European bourses closed higher with Eurozone business activity surging to 15Y high in June with the Markit PMI for the Eurozone at 59.5, up 2.4 MoM and above flash estimates of 59.2 – FTSE, CAC and DAX closed 0.6%, 0.2% and 0.1% higher respectively. Banks up 1.8% led the gains, while health care down 0.4% dragged. EU main and crossover CDS tightened 0.2bp and bp respectively. Brazil’s Bovespa was down 0.3% despite its PMI coming at 53.9 up from 48.3 last month. OPEC+ postponed the much awaited talks to resolve the standoff between Saudi and UAE over extension of the duration of oil production cuts as UAE seeks better terms. UAE’s PMI slipped from 52.3 in May to 52.2 in June while Saudi saw the fastest rise in employment since November 2019. UAEs Saudi TASI ended 0.3% down while Abu Dhabi’s ADX was up 0.7%. Singapore’s private sector also stagnated in June after witnessing a strong growth in May – its PMI fell sharply to 50.1 in June from 54.4 last month. China’s Caixin Services PMI fell to 50.3, a 14-month low. The pace of expansion of Hong Kong’s private sector also eased in June even as demand and output increased for the third month running – its PMI came in at 51.4 in June vs. 52.5 in May. Shanghai opened lower by 0.2% as the Beijing’s crackdown on Didi expanded to three more tech firms. Nikkei and Singapore’s STI were up 0.5% and 0.3% respectively while HSI was broadly flat. Asia ex-Japan CDS spreads were flat.

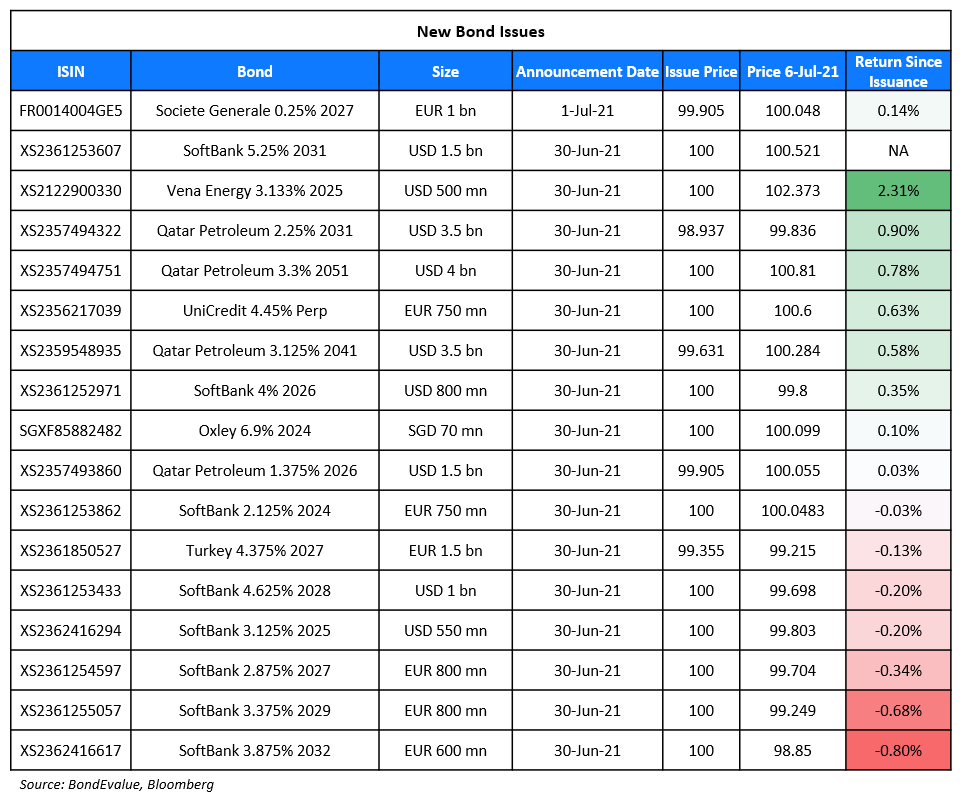

New Bond Issues

- Korea Gas $ 5Y/10Y at T+70bp/T+95bp areas

- Nomura $ 5Y/7Y/10Y at T+110bp/T+130bp/T+150bp areas

- Sino-Ocean Group capped $320mn 3.5Y green bond at T+270bp area

- REC $ 5.5Y bond at T+225bp

- Hongkong Land $ 10Y green bond at T+125bp area

- Shanghai Pudong Development Bank HK branch $ 3Y at T+85bp area

New Bond Pipeline

- Fujian Investment & Development Group hires for $ bond issue

- Hyundai Assan Otomotiv Sanayi hires for US$ 5yr bond with HMC guarantee

-

Zhejiang Expressway hires for $ bonds

-

China Modern Dairy Holdings hires banks for bond offering

-

Shenwan Hongyuan Securities hires for $ bonds

-

Xiaomi hires for $ offering, including green tranche

-

Mitsubishi hires for $ 5Y bond

Rating Changes

- Fitch Upgrades BNP Paribas Fortis’ CASHES Hybrid Capital Notes to ‘BBB’

- Fitch Revises Virgin Money UK plc’s Outlook to Stable; Affirms at ‘BBB+’

- Fitch Revises Santander UK Group Holdings’ Outlook to Stable; Affirms at ‘A’

- Fitch Revises Nationwide Building Society’s Outlook to Stable; Affirms at ‘A’

- Fitch Revises Lloyds Banking Group’s Outlook to Stable; Affirms at ‘A’

- Fitch Revises NatWest Group’s Outlook to Stable; Affirms at ‘A’

- Fitch Revises Outlook on Access Bank to Stable from Negative; Affirms at ‘B’

- Fitch Revises LBBW’s Outlook to Stable on Similar Action on Sparkassen-Finanzgruppe

- Fitch Revises NORD/LB’s Outlook to Stable on Similar Action on Sparkassen-Finanzgruppe

Term of the Day

Local Government Financing Vehicle

Local government financing vehicles or LGFVs are debt-issuing entities set up by local governments in China to fund infrastructure and related projects. LGFVs came into existence because local governments were prohibited from raising debt directly. Hence, these local governments set up off-balance sheet entities known as LGFVs. LGFVs have become popular over the past decade and are regular issuers of Chinese yuan and US dollar bonds. While these issuers are backed by local governments, there were concerns among investors about their ability and willingness to repay debt driven by events in the past when LGFVs defaulted on their bonds. Recently, yields on Chinese LGFV bonds have tightened in the last three months according to CreditSights (story above).

Talking Heads

In a note by Morgan Stanley economists

“Even in a more benign Delta scenario, we now expect more restrictions on international travel, hitting the crucial tourism sector in southern Europe for a second summer.”

In a note by ING rates strategists

“The outlook for risk sentiment remains clouded by the rise in COVID-19 cases in many places in the world. Interestingly, these worries are more clearly observed in rates than in other markets.” “This is not unusual in times when central banks retain a heavy hand in the pricing of financial assets. The logic goes like this: a further worsening of the outlook would prompt an even slower unwind of monetary support measures.”

On Sri Lanka’s default risk rising, highest in Asia

Nivard Cabraal, Sri Lanka’s state minister for money and capital markets

“The other bonds also we will pay,” Cabraal said.

Sagarika Chandra, primary sovereign analyst for Sri Lanka at Fitch Ratings

“These resources should enable Sri Lanka to meet its remaining debt maturities through the rest of 2021.” “Nevertheless, Sri Lanka’s debt repayment challenges will continue into the medium-term. Authorities have not yet specified plans for meeting the country’s foreign-currency debt-servicing needs for 2022 and beyond.”

Tay Ek Pon, senior portfolio manager for emerging-market debt at BNP Paribas Asset Management

“The sovereign’s near-term liquidity is not a concern.” “In the medium term, however, a renewed risk is a widening trade deficit given rising oil prices.”

Tim Ash, a strategist at BlueBay Asset Management

The capital controls “risk the emergence of parallel exchange rates, disrupt access to imports and ultimately may well stall the economy.” “They might all just make the end game more painful, rather than actually resolving anything.”

Becky Liu, head of China macro strategy at Standard Chartered Plc

“As foreign capital inflows increase, China’s focus will be to unleash domestic demand for global assets.” “The goal is to eventually enable two-way opening of China’s capital account.”

Paul Sandhu, head of multi-asset quant solutions Asia Pacific at BNP Paribas Asset Management

“In China, the risk part of it is still difficult to quantify because we still don’t have a tool to do that.” “Having derivatives and a robust derivative market will help us quantify the risk and that will make investors like myself put higher allocations into China.”

Wei Yao, chief economist for the Asia-Pacific at Societe Generale

“China has been pacing its capital liberalisation according to external environments.” “Faster relaxation on outflow channels since late last year makes good sense against the backdrop of yuan strength and strong inflow pressures.”

Xiaomeng Lu, a senior analyst at Eurasia Group

“Beijing is not pleased to see its national champions cozying up to foreign stakeholders.” “It also wants tech companies to keep their core assets — data and algorithms — in China.”

Joshua Crabb, a senior portfolio manager at Robeco

“We have entered a new period globally where the regulatory scrutiny on tech has increased and will be ongoing for some time.”

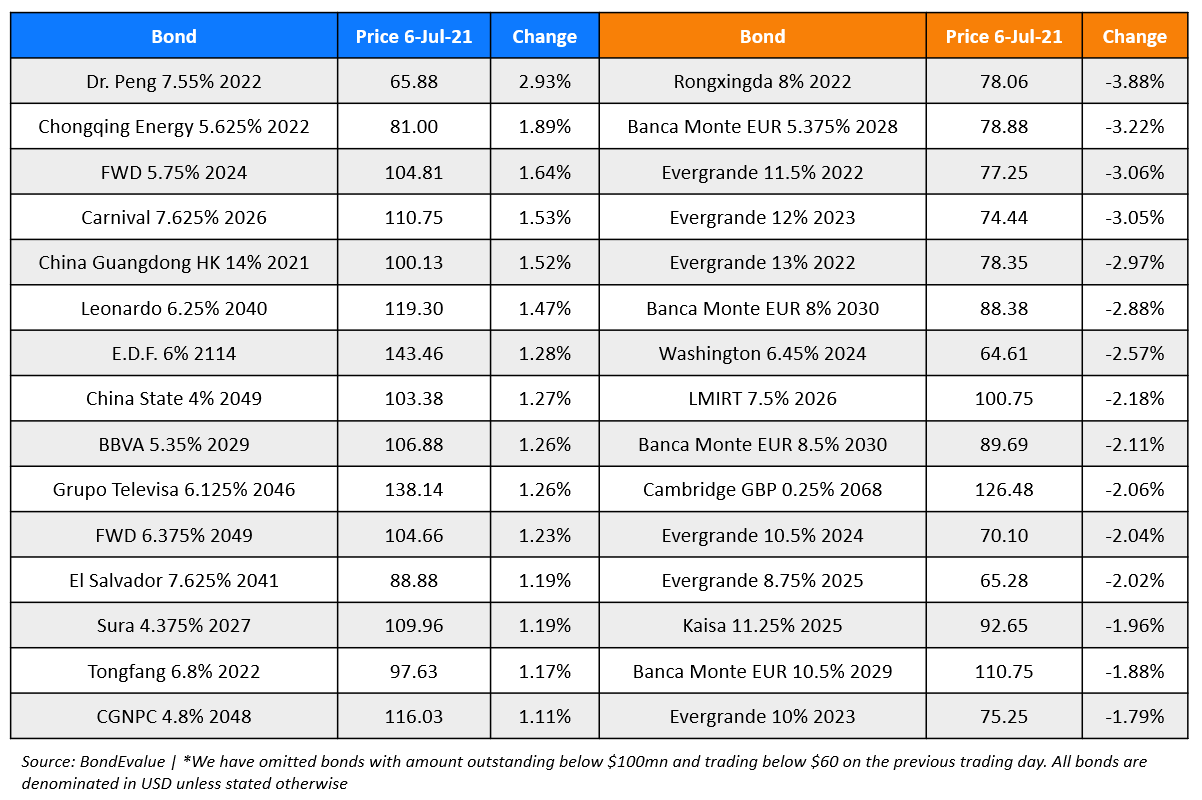

Top Gainers & Losers – 06-Jul-21*

Go back to Latest bond Market News

Related Posts: