This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ratings Cut for China Grand Auto & Columbia; ADB, Baidu & Carnival Raise Funds

April 2, 2020

Not a good first day of the new quarter as stocks tumbled everywhere. All three indices DJIA, S&P and Nasdaq ended the day around 4.4% lower. Treasuries had a biddish tone and yields declined 4-5bps in the long end. European shares saw similar losses with the FTSE, DAX, CAC 40 and FTSE Milan all down between 3% to 4%. CDS spreads in US and Europe jumped by 10.5bps and 7bps respectively. This morning, Asian markets are opening unchanged to little down but futures on US indices are up 1.3%. Firms in the US and Europe continue their rush to raise funds via bond deals while the primary bond market in Asia remains quiet.

New Bond Issues

Outlook Cut To Negative by Moody’s for Lippo Malls Indonesia (LMIRT)

Moody’s changed its outlook on Lippo Malls Indonesia Retail Trust or LMIRT citing impact of the virus and weakness in the Indonesian rupiah. At the same time, the Ba3 corporate family rating of the mainboard-listed REIT was affirmed. Moody’s also affirmed the Ba3 backed senior unsecured rating on the bond guaranteed by LMIRT’s trustee and issued by LMIRT Capital, a wholly owned subsidiary of LMIRT. The REIT’s Ba3 rating reflects a well established presence, the huge portfolio of malls and retail spaces spread across ten cities and targeting the country’s middle and upper-middle income consumers. However, the REIT is closing the entire portfolio of 23 malls and 7 retail spaces except for essential services for at least two weeks starting April 1.

For the full story, click here.

Fitch Cuts China Grand Auto to B+, Outlook Negative

Fitch Ratings has downgraded China Grand Automotive Services Group Co., Ltd.’s (CGA) Long-Term Foreign-Currency Issuer Default Rating (IDR) to B+ from BB- citing a deterioration in CGA’s liquidity. CGA redeemed $328mn in senior perpetual notes in December 2019 and another $21mn in senior notes due February 2020. The redemption had no replacement with other long-term borrowings and has negatively affected CGA’s financial structure by increasing its reliance on short-term financing.

For the full story, click here.

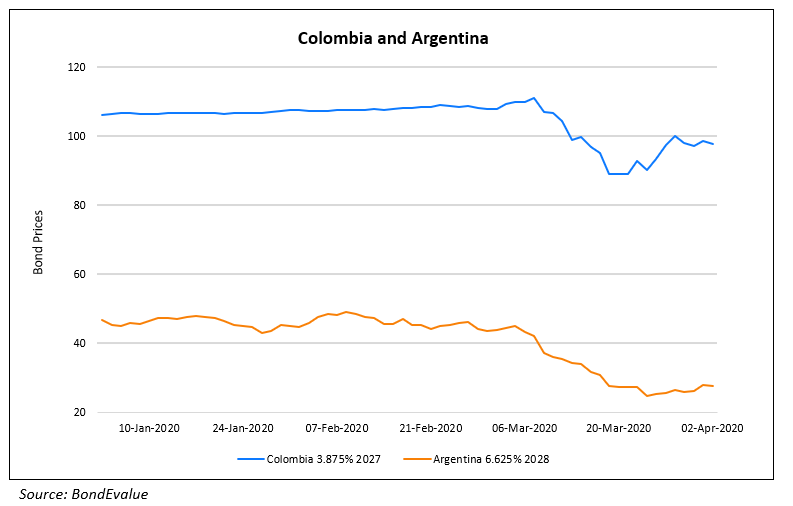

Coronavirus Delays Argentina’s Debt Restructuring, Fitch Cuts Columbia to BBB-

After failing to meet an ambitious deadline of March 31, the centre-left government will continue restructuring talks with creditors for at least two more weeks. A deal will be necessary before the country can start a new program with the IMF that has already lent Argentina $44bn since it came to its rescue during a currency crisis in 2018. The pandemic has pushed Argentine bond prices lower, some trading below 30 cents on the dollar. This is fueling concerns that distressed funds are buying up the country’s debt and that this could lead to a repeat of the decade long legal battle with creditors during its last major default in 2001. Fitch Ratings cut Columbia to BBB- and maintained its Negative Outlook citing the weakening of fiscal metrics in the wake of the economic downturn and fall in oil prices.

For the full story, click here.

Top Gainers & Losers – 2-Apr-20*

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed Survey Results Supportive of Funds Flow into Bonds

September 10, 2017