This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Raiffeisen Bank Skips Call on Its €650mn Perp Again

June 5, 2023

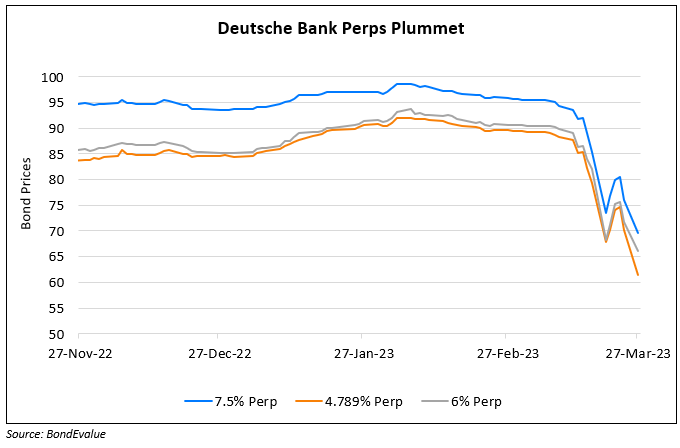

Austria’s Raiffeisen Bank International (RBI) will skip its call date of June 15 on its €650mn Perp. This is not the first time it has skipped a call on these bonds after having done the same in December last year where the coupon was reset 595.5bp above the Euro 5Y Swap rate to 8.659%. A spokesperson for the bank said, “RBI is committed to calling and refinancing at the earliest possible date, provide the economics make sense”. The decision by RBI follows two smaller German banks, Deutsche Pfandbriefbank and Aareal Bank, that also chose to skip the call dates on their perps earlier this year. This also comes a couple of months after the AT1 write-down of Credit Suisse that caused a scare in the banking system and most notably, in the AT1 bonds’ space. Alessandro Cameroni, a portfolio manager at asset manager Lemanik said, “The AT1 market is splitting. Wary of the stigma attached to not calling (repaying), big banks will act accordingly. But for smaller issuers, that would also like to reimburse investors … it is now increasingly difficult.” Another analyst noted that extension risk would be an event more likely to be seen with smaller banks.

RBI’s €650mn 8.659% Perp was trading at 89.4. Its next call date is on December 15 with a reset formula of the Euro 5Y Swap plus a spread of 595.4bp.

For more details, click here

Go back to Latest bond Market News

Related Posts: