This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Pemex Returns with $1.5bn 5Y Bond; Evergrande Reports Sales of $21bn; Serba Dinamik Launches Tender for $ Sukuk

October 9, 2020

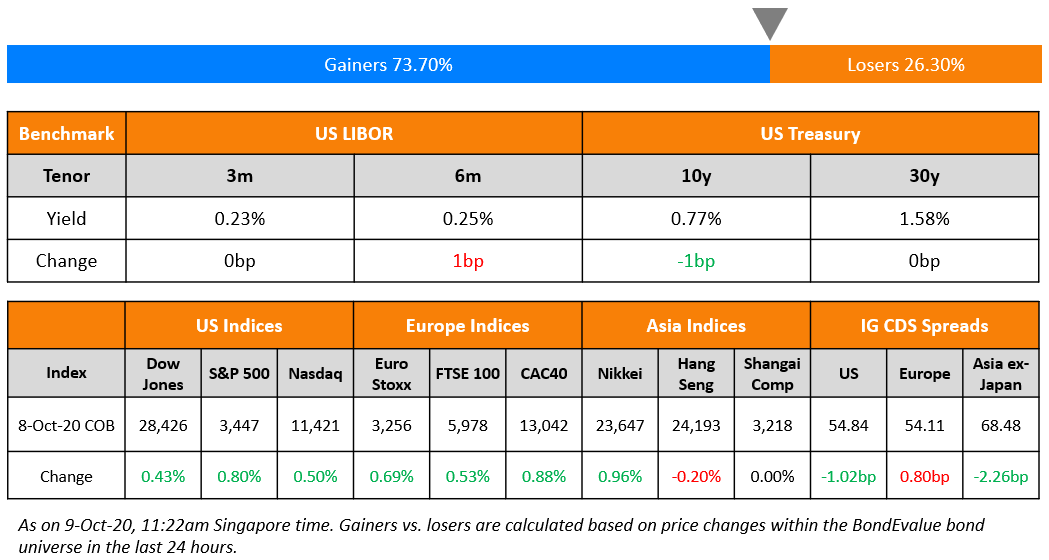

US equities made another leap higher with the S&P up 0.8%. The energy sector led most of the gains going up 3.8% while utilities and financials were up 1.8% and 1.4%. Facebook saw a 2% jump helping the tech index. 10Y Treasury yields moved lower by 1bp, taking a pause from the prior two days’ risk-on sentiment. US Jobless Claims ending October 3 were at 840,000, which was slightly lower than the previous numbers, but higher than expectations. US IG CDS spreads tightened slightly by 0.5bp while HY was flat. European CDS spreads were flat across and Asia Ex-Japan spreads are tighter by 3bp. Asian equities are slightly higher ~0.2%.

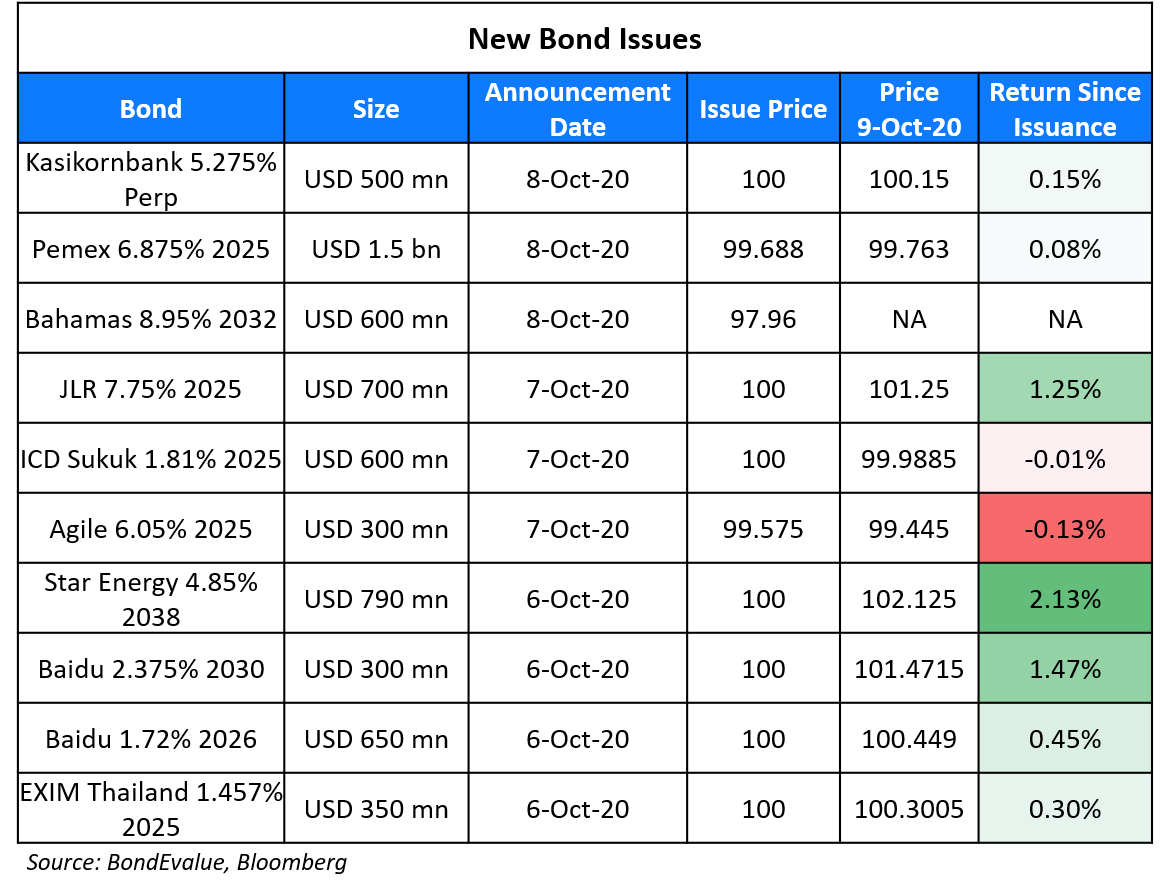

New Bond Issues

Thailand’s Kasikornbank raised $500mn via a Perpetual non-call 5Y (PerpNC5) AT1 bonds to yield 5.275%, 42.5bp inside initial guidance of 5.7% area. The bonds, with expected ratings of Ba1, received orders exceeding $2bn, 4x issue size. If not called, the bond’s coupon resets after five years and every five years thereafter to the then prevailing 5Y US Treasury yield plus the initial spread of 494bp with no step-up. The bond also has a dividend stopper. Another Thai bank, Bangkok Bank issued a PerpNC5 AT1 bond last month with the same bond rating of Ba1. Bangkok Bank’s AT1 has a reset coupon of 5Y US Treasury plus a spread of 472.9bp in year 5. The bond is currently yielding 4.88% in the secondary market, 39.5bp lower than Kasikornbank’s new issue.

Bahamas raised $600mn via 12Y amortising bond to yield 9.25%, with no tightening from initial guidance of 9.25% area.

New Bonds Pipeline

China $6bn Bond

Turkey $ 5Y bond

Goshawk Aviation $ Perp with letter of support from NWS Holdings

Shinhan Card $ 3Y or 5Y Covid-19 response bond

JSW Steel $600mn 3Y and/or 5.5Y

Rating Changes

Fitch Upgrades Owens & Minor, Inc.’s Long-Term IDR to ‘B’; Outlook Positive

PulteGroup Inc. Outlook Revised To Positive By S&P On Solid Profitability And Cash Flow

Beazer Homes USA Inc. Outlook Revised To Positive By S&P On Improved Credit Metrics

Chandra Asri Petrochemical ‘B+’ Rating Affirmed By S&P, Then Withdrawn At Company’s Request

Japan-Based Mizuho Financial Group’s Euro MTN Ratings Withdrawn By S&P

Fitch Withdraws Jain Irrigation’s Ratings

Pemex Raises $1.5bn via 5Y Bonds for Refinancing

Pemex, the debt laden Mexican oil and gas company raised $1.5bn via a 6.875% coupon 5Y bond at a yield of 6.95% for refinancing their debt. Investors gave their vote of confidence on Pemex’s creditworthiness as the new bond raked up orders worth almost $10bn, 6.7x issue size. This is the company’s first dollar issue since getting downgraded in April to junk. Moody’s, S&P and Fitch rated the new bonds Ba2, BBB and BB- respectively. The issuance, being a 100% refinancing issue, will not add any new debt to its already high debt level of ~$98bn as per Reuters’ data. Of the total debt, almost 80% is external debt mostly denominated in USD according to the Mexican Deputy Finance Minister. The refinancing would be in-line with President AMLO’s efforts to not incur net debt during his term. The state-owned Mexican company, which was reeling on the back of the crash in oil prices, had a double whammy with over MXN400bn (~$19bn) from unrealized forex losses in 1H2020. Pemex has a debt/EBITDA of 14x, interest coverage of 0.66x based on latest numbers. For comparison, Brazilian state-owned Petrobras (Ba2, BB-, BB-) has a debt of ~$35bn, Debt/EBITDA of ~4x and interest coverage of ~3x. The recent Mexican government’s $14bn investment plan has considerable focus on Pemex, which can help the company over time. “The default risk is very low…this is not an investment they will buy and sleep comfortably until maturity.” head of fixed-income sales at Bulltick said, adding that he tells clients that the government will likely honor Pemex debt, but to expect volatility.

Meanwhile a Credit Suisse survey showed that 74% of investors expected the Mexican sovereign to get downgraded to junk following the path of Pemex. Pemex’s dollar bonds were largely flat.

For the full story, click here

Evergrande Reports Sales of $21 Billion, 71% of Its Target

Chinese property developer Evergrande reported sales of RMB141.63bn ($21bn) in the last 38 days from the beginning of September. The aggregated contracted sales was 71% of their target of $29bn with overall contracted sales for 2020 now at RMB592.25bn (~$88bn), which is 91% of their full year sales target. Bloomberg reported Evergrande offering steep discounts during the recently concluded ‘Golden Week’ holiday, popular for shopping among the Chinese. Evergrande and its bonds have been in focus due to its large debt ($4.5bn due in Q4 alone), risks related to the three-red-lines regulation and recent talks with investors to avoid repayment settlement on its subsidiary Hengda real estate’s listing not going through. Analysts say the deep discounting could hurt margins, which may hurt ability to pay interest on debt over time. Chang Wi Liang, a macro strategist at DBS Bank Singapore said, “Short-term liquidity risks have been averted. But the issue of a heavy debt burden remains.” Chang said Evergrande’s short-dated debt may outperform its longer-term bonds, adding that the company’s sales will be a key determinant of its ability to reduce leverage and boost investor sentiment. Evergrande’s bonds were largely stable though the stock price fell ~2.5%.

For the full story, click here

Turkey Sees Most Foreign Investment Inflows Since 2018

Foreign investors poured in $610mn into Turkey’s bonds and stocks in the week ended on October 2, according to central bank data reported by Bloomberg. This is the largest inflow by overseas investors since 2018. Foreign investments have seen an increase after the Turkish Lira hit record low levels and the central bank raised interest rates late last month by 200bp against analysts’ predictions. Foreign investments in Turkey have been at a record low this year as the country has constantly been in the news due to its stressed economy, squabble with Greece and its involvement in the Armenia Azerbaijan conflict. On the sell-off in the currency, Nigel Rendell, a London-based analyst at Medley Global Advisors, said “Those who piled into Turkish assets in recent days may now be getting cold feet”. The lira is continuing to fall and stood at a record low of 7.9445 per dollar yesterday. Turkey’s bonds have been trending lower this week with its 7.625% 2029s down ~2 points since Tuesday to 103.2.

For the full story, click here

S&P Expects Dubai’s Debt Load to Deteriorate

S&P forecasted a 11% fall in Dubai’s economy this year given its reliance on tourism and travel industries, which took a beating due to the pandemic. S&P estimates that Dubai’s government debt will hit 77% of GDP this year amounting to $80bn and 148% of GDP after adding government-related entities’ (GRE) debt. Dubai generally doesn’t include GREs could not repay debts due to which they had to fall back to Abu Dhabi to repay. Dubai last month issued $2bn in bonds ($1bn 2.763% 10Y Sukuk and $1bn 3.9% 30Y government bond with an overall demand of ~$10bn). Both the bonds and other dollar bonds of Dubai traded stable on the secondary markets.

For the full story, click here

NMC Health Investigators to Probe Financiers Who Colluded in the Multi-Billion Fraud

Alvarez and Marsal, the consultancy overseeing NMC’s administration after the ~$4bn NMC debt fraud, released an update on the investigations. The investigators have collected more evidence since its last statement earlier in Aug and have “identified a number of financiers” who colluded with the previous management in diverting bank funds. “Claims have been identified based on factual evidence, with assessment of merits – including legal merits – now in progress,” according to the report. As per the investigators, the financial statements of the beleaguered company have been manipulated since the last eight years and the assets of NMC have been systematically misappropriated. The report states that “the perpetrators sought to make NMC liable for debt of which it never received the benefit, or sufficient benefit; and NMC’s losses are likely to be in the region of billions of dollars.”

NMC Health is the UAE’s largest private healthcare provider and was placed into administration in April after a debt of $6.6bn was uncovered against a recorded debt of $2.1bn. The administrators are confident of the company’s revival through a business plan through 2022 as they seek a lender-led restructuring or a sale of the company. “For the exit from ADGM administration, creditors will have the choice between 1) a plan of re-organisation and owning the company for two-three years before selling with the benefit of improved trading or 2) selling the core business out of the administration to the highest bidder in the circumstances,” the administrators state in the note.

NMCs bonds have been trading at stressed levels with its 5.95% and 1.875% sukuk/bond due 2023 and 2025 trading at 13.75 and 8.8 cents on the dollar respectively.

For the full story, click here

Serba Dinamik Launches Tender Offer for Its Dollar Sukuk

Malaysia-based engineering company Serba Dinamik has announced a tender offer of up to $100mn worth of its 6.3% and 6.997% sukuk due 2022 and 2025 respectively. While the tender offer price will be determined through a modified Dutch auction (Term of the day, explained below), there is a floor of $910 and $830 per $1,000 in principal for the 2022s and 2025s respectively. The BB- rated company plans to optimize financing costs via the repurchase. The $300mn 2022s and $200mn 2025s are currently trading at 89 and 84 cents on the dollar, yielding 14.3% and 11.8% respectively.

Morgan Stanley to Buy Fund Manager Eaton Vance for $7 Billion

Wall Street bank Morgan Stanley announced on Thursday that it will be buying fund manager Eaton Vance for $7bn. The bank will pay $56.5 per Eaton share, a ~40% premium to its closing price on Wednesday. The Eaton Vance deal coupled with Morgan Stanley’s recently concluded $13bn takeover of broker E*Trade Financial emphasize Morgan Stanley’s shift towards investment services and asset management.

For the full story, click here

LSE Close to Selling Borsa Italiana to Euronext for €4.5 Billion

London Stock Exchange (LSE) is close to selling Borsa Italiana to Euronext NV and two Italian institutions for about €4.5bn ($5.3bn) inclusive of debt, as reported by Bloomberg. Borsa Italiana is a strategic asset in Italy given its ownership of government bond trading platform MTS SpA. The sale by LSE is to get regulatory approval for its $27bn purchase of financial data provider Refinitiv. Euronext is bidding for Borsa Italiana along with Cassa Depositi e Prestiti SpA and Intesa Sanpaolo SpA, which would acquire stakes in the Paris and Amsterdam exchanges owner Euronext. Euronext’s EUR 1.125% 2029s traded stable at 107.2 on the secondary markets.

For the full story, click here

Term of the Day

Dutch Auction

These are public offerings where the price of the offering is determined as the highest price after all bids are taken. For example, US Treasury bond auctions are based on the same principle – the highest price (lowest yield) submitted will be accepted and then only move over to the other bidders. There are also ‘Modified Dutch Auctions’. When an issuer bids to repurchase securities for example, they can use Modified Dutch Auction Tender Offers (MDATOs) – here the issuer sets prices in a falling structure at which a holder can tender the securities. The buying price will be the highest at which the issuer can buy all securities it has offered to purchase, or a smaller amount if there isn’t a tender of all securities. With MDATOs, the issuer pays one fixed price for the tendered securities. Due to this, some holders will receive more than they bid while others will receive less.

For example, Company A may make an offer to purchase 100 securities at a maximum price of $102 and a minimum of $97. If a total of 90 securities are tendered at different prices and the lowest among these is $97 and highest is $102, Company A will determine the lowest price it could purchase all 90 securities at – let’s say it is $99. The purchase price of $99 would be higher than those who tendered between $97-$99 and once agreed upon, all securities will be purchased at $99.

Talking Heads

On limited effectiveness on more quantitative easing and more fiscal support needed

Robert Kaplan, Dallas Fed President

“I think the Fed can do more, and I’m sure we’ll look at all our options, but those aren’t substitutes for fiscal policy,” Kaplan said. “The Fed can ease financial conditions,” he said. “We can’t replace lost income, though. That’s uniquely suited to fiscal policy.”

Eric Rosengren, Boston Fed President

“There’s a limit to how far we can push the 10-year Treasury rate or the mortgage-backed rate down,” he said. “That’s not to say we shouldn’t do it. It just says the magnitude of the impact, when rates are already so low, is probably much less than what we want, which is why I think you’re hearing Federal Reserve speakers call out for more fiscal policy.” “But hopefully, whoever is elected will nonetheless argue and get through Congress a significant stimulus package.”

“We are already buying a significant amount of bonds as it is, and I’d be skeptical of doing more myself,” Kaplan said, saying that with long-term interest rates already low, there is little chance more bond purchases could help the real economy. “When the crisis starts to lapse and we’ve weathered it, I personally would be an advocate of withdrawing these programs, the 13-3 programs need to lapse, the bond-buying needs to curtail, the Fed balance sheet growth needs to curtail. I don’t think it’s healthy for the markets to be addicted, or too reliant, on Fed presence … it engenders fragilities.”

“It will be important to provide further detailed guidance on the Committee’s intentions regarding these purchases,” George said. “This is a matter of transparency and accountability, but also an important element of ensuring the effectiveness of the purchases. I look forward to discussing these issues with my colleagues.”

“I interpret the revised consensus statement as a tolerance — and less as a promise to engineer — for inflation moderately above 2% for some time,” she said. “We are signaling that the committee is unlikely to pre-emptively tighten policy at the prospect that inflation is approaching 2%, but rather a willingness to wait until the data confirms its arrival.”

“We must use policy actively and aggressively, and we have done that,” Bailey said. “We are by no means out of firepower … in terms of our policy tools, and we will use that firepower as appropriate, properly and strongly in response to second and third waves, where we think it is necessary,” he added.

“Now that the chances of a fiscal stimulus ahead of the elections appear uncertain, the case for a steepening of the UST curve in the near-term looks even weaker,” Cremonesi’s team wrote. There is potential for “further bull-flattening in the near-term,” they said.

On investor’s prediction of the start of a bond market sell-off

Zachary Squire, chief investment officer at hedge fund Tekmerion Capital Management

“If you look at where 10-year yields were going into the crisis, they were close to 2 per cent. There is no reason why we can’t get back there in a matter of months,” said Squire. “You are going to have a bounceback in the third quarter,” he said.

Priya Misra, global head of rates strategy at the TD Securities

“The market is testing the Fed,” said Misra. No action “could trigger a much bigger move higher in yields if coupled with optimism around a vaccine or much more fiscal stimulus after the election”.

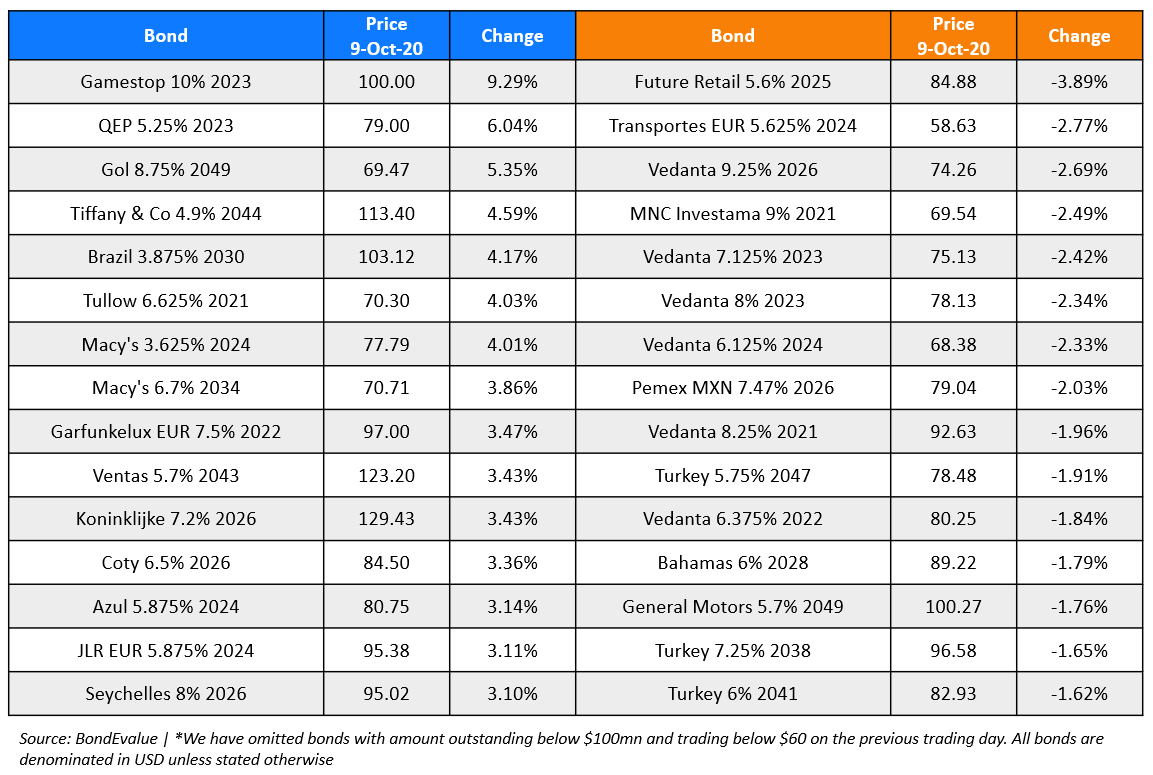

Top Gainers & Losers – 9-Oct-20*

Go back to Latest bond Market News

Related Posts: