This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Pakistan says IMF Remains the Only Hope after Bond Market Shut Out; Hikes Fuel Prices

May 30, 2022

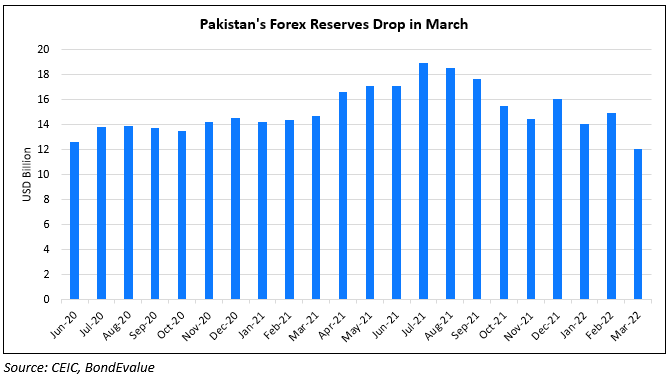

Pakistan has said that it has become unfeasible to raise funds from global bond markets and commercial banks, thus leaving it with the IMF as the only hope for raising funds. As part of Pakistan’s push to meet key benchmarks for the IMF to resume its $3bn loan program, the government raised fuel prices by PKR 30 ($0.15) on Friday. Pakistan hopes to secure a staff-level agreement with the IMF by June with the country needing $36-37bn in financing for the fiscal year starting July 2022. Pakistan has $6.4bn in dollar debt due over the next three years of which are about $3.16bn are in the form of dollar bonds and loans in 2022, $1.52bn in 2023 and $1.71bn in 2024. Besides, Pakistan has bilateral obligations of $3bn owed to Saudi Arabia in time deposits and $4 billion from China. Bloomberg notes that the country faces prospects of default after its trade deficit widened to unsustainable levels of $45bn and its forex reserves depleted to record lows of $10.1bn. Analysts note that securing the IMF loan program is key to avoiding a balance of payments crisis.

Pakistan’s dollar bonds were trading higher after the fuel price hike, with its 7.375% 2031s up over 0.44 points to 67.9 yielding 13.75%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: