This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

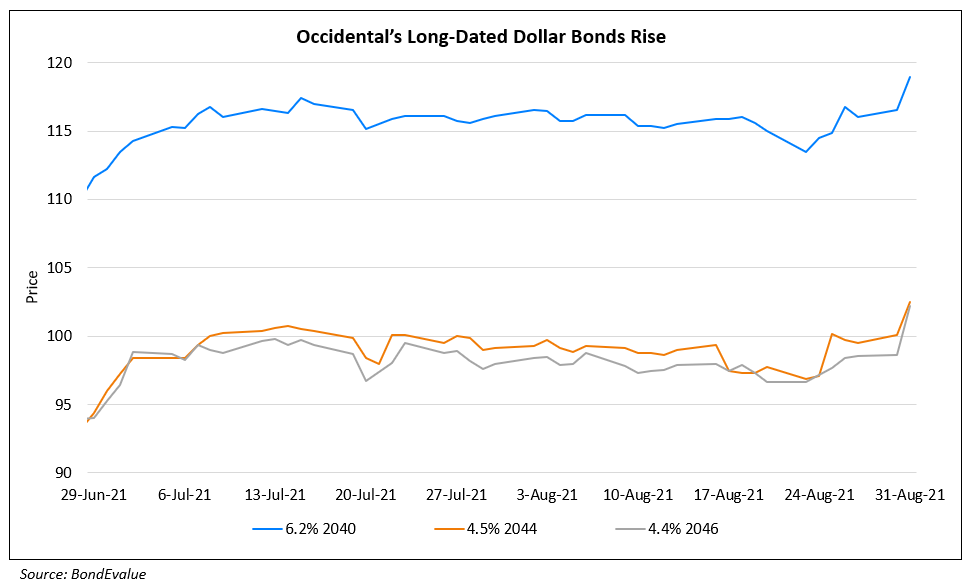

Oxy’s Long-Dated Bonds Rise As Hurricane Ida Halts Oil Production

August 31, 2021

Occidental Petroleum (Oxy) saw its long-dated dollar bonds inch up 2-4 points as hurricane Ida halts oil production across the Gulf of Mexico, which is expected to lead to a rise in oil prices. Oil prices have been trending higher, up 10.7% since August 20 with WTI currently at $68.8. Again Capital’s John Kilduff said, “The reaction is mixed because we avoided the worst-case scenario. But supplies are tight, and that could impact prices, especially since we are moving into the peak period for storms, and weather worries are going to persist around the market for the next several weeks. As for supply, the cupboard was kind of bare going into this.” Adding to the uncertainty around oil prices is the OPEC+ meeting tomorrow when production is expected to be restored to 400,000 barrels/day.

Oxy’s 4.4% 2046s rose 4 points to 102.24 while its 4.5% 2044s rose 3 points to 102.5 currently.

Go back to Latest bond Market News

Related Posts:

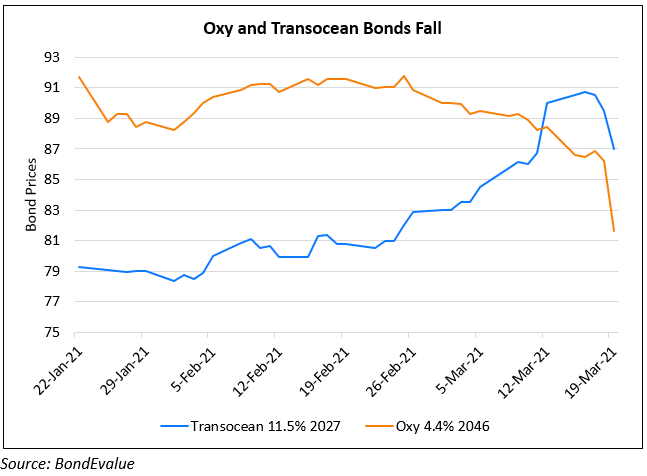

Oxy & Transocean Bonds Slump on Fall in Oil Prices

March 19, 2021