This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

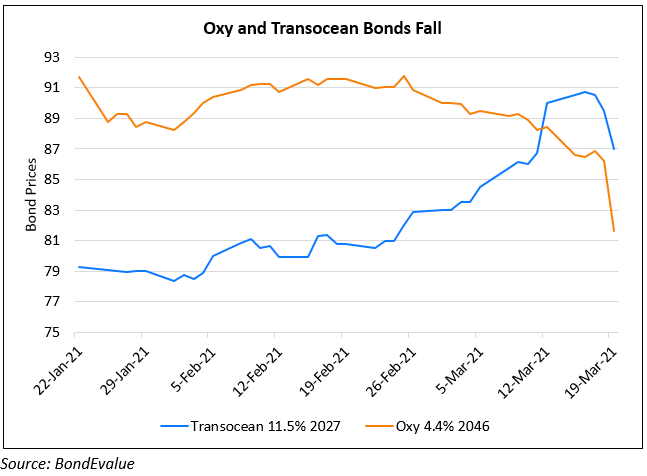

Oxy & Transocean Bonds Slump on Fall in Oil Prices

March 19, 2021

Stocks and bonds of Occidental (Oxy) and Transocean fell sharply on Thursday. Oxy’s stock was down 8.3% while Transcoean’s stock was down 10%. Among their bonds, Oxy’s 6.2% 2040s and 4.4% 2046s were down 5.2 and 4.6 points to 99.3 and 81.62 respectively. Most of their other bonds were also in the red, down 2-3 points. Similarly, Transocean’s 7.5% 2031s and 11.5% 2027s were down 2.5 points each to 52.5 and 87. The moves come after the fall in oil prices for five consecutive days as US crude inventories rose for the fourth straight week after refineries in the south were forced to shut due to severe cold weather. Brent closed at a high of $69.63/bbl on March 11 and has fallen 9% since then to $63.5/bbl. US crude inventories rose by 2.4mn barrels last week. Besides the fall in oil, the rise in US Treasury yields have also weighed on bonds across the spectrum.

Go back to Latest bond Market News

Related Posts:

Tata Motors Reports Loss on JLR Writedowns

May 19, 2021

Dalian Wanda Exits AMC Entertainment

May 24, 2021