This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Nomura, Bank Negara Launch Bonds; Macro; Rating Changes; New Bond Issuances; Talking Heads; Top Gainers & Losers

March 23, 2021

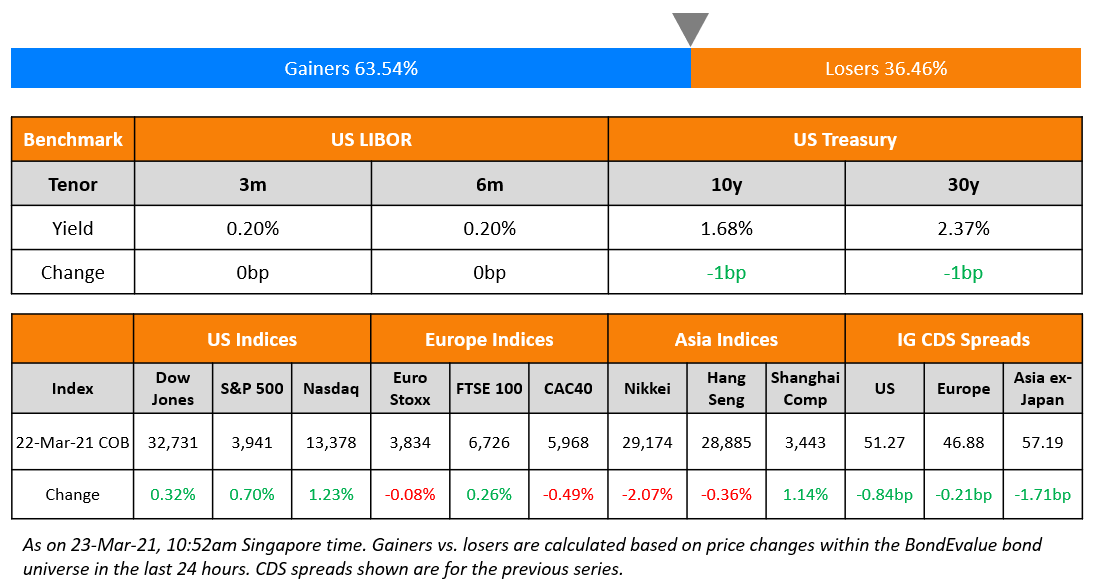

S&P ended 0.7% higher and Nasdaq was 1.2% higher with the US 10Y Treasury yield easing to 1.68%. European equities were marginally higher with the DAX, FTSE and FTSE MIB up over 0.2% while the CAC was down 0.5%. The Turkish Lira ended 8% lower – analysts said the central bank intervened to support the lira by selling foreign currencies; the lira was down over 17% at one point after President Erdogan sacked market friendly governor Naci Agbal over the weekend. With this, most Turkish dollar bonds were down over 10% on Monday. US IG CDS spreads were 0.8bp tighter and HY was 4.2bp tighter. EU main CDS spreads were 0.2bp tighter and crossover spreads tightened 4.2bp. Asian equity markets have opened flat and Asia ex-Japan CDS spreads are tighter 1.7bp. Asian primary markets are set for a busy week with five new dollar deals launched today and a strong pipeline of bonds from AVIC, CAR Inc, Maldives and IRFC among others.

Bond Traders’ Masterclass | 25% Discount on a Bundle of Five Sessions

Keen to learn bond market fundamentals from industry professionals? Sign up for our Bond Traders’ Masterclass that consists of five modules starting with A Practical Introduction to Bonds tomorrow at 6pm SG/HK. Avail a 25% discount on a bundle of five sessions!

The modules are specially curated for private bond investors and wealth managers to develop a strong fundamental and practical understanding of bonds. Given the ultra-low interest rate environment, flurry of new bond deals particularly from junk-rated issuers and tightening credit spreads, it is now more important than ever for investors to understand bond valuation, portfolio construction and new bond issues to help them get better return for risk. The sessions will be conducted by debt capital market bankers who have previously worked at premier global banks such as Credit Suisse, Citi and Standard Chartered.

New Bond Issues

- Nomura $ 5Y/7Y/10Y at T+130/T+145/T+160 areas

- Bank Negara Indonesia $ 5Y tier 2 at 4.2%

- China SCE Group Holdings $ 3.5NC2.5 at 6.4%; books over $1bn

- GLP China Holdings $ 5Y at T+275bp area

- Science City (Guangzhou) Investment Group $ 3Y/5Y at 3.3%/4% areas

South Korean search engine Naver raised $500mn via a debut 5Y sustainability bond at a yield of 1.543%, or T+68bp, 22bp inside initial guidance of T+90bp area. The bonds have expected ratings of A3/A-. Proceeds will be used for financing or refinancing eligible projects under the company’s sustainable finance framework. Naver also operates in commerce, fintech, content and cloud businesses.

Hong Kong JunFa Property raised $116mn via a tap of its 11% 2022s at a yield of 11%. The bonds have expected ratings of B+. Power Best Global Investments is the issuer and Hong Kong JunFa Property is the guarantor.

Oracle raised $15bn via a 6-part deal:

The bonds have expected ratings of Baa2/A. Proceeds will be used for general corporate purposes, including to repay its 2.80% 2021s, 1.90% 2021s, 2.50% 2022s and to pay accrued interest, and any related premiums, fees and expenses. General corporate purposes may also include stock buybacks, payment of cash dividends, debt repayment and future acquisitions.

New Bond Pipeline

- AVIC International Leasing $ bond

- CAR Inc $ bond

- Goho Asset Management $ SBLC-backed bond

- Maldives $ 5Y sukuk

- IRFC $ 5Y bond

- Doha Bank bond

- Tunas Baru Lampung $ bond

- Pakistan sovereign bond

- Nickel Mines $ 3NC2 bond

- Merck $10.5bn offering

- Meinian Onehealth Healthcare $ bond

Rating Changes

- Moody’s upgrades SM Energy’s CFR to B3; outlook is positive

- Moody’s upgrades Maersk’s rating to Baa2; outlook stable

- Moody’s changes Mali’s outlook to stable, affirms Caa1 ratings

- Moody’s affirms Toyota Industries’ A2 ratings; revises outlook to stable

- Moody’s downgrades Oracle’s rating to Baa2; outlook stable

- Moody’s downgrades Sritex to B3; ratings remain on review for further downgrade

- Bolivia Outlook Revised To Negative By S&P On Increasing Debt And External Vulnerabilities; ‘B+’ Long-Term Ratings Affirmed

- Murphy Oil Corp. Outlook Revised To Stable By S&P From Negative On Improved Credit Measures; Ratings Affirmed

- Aston Martin Holdings (UK) Outlook To Stable By S&P Following Measures To Bolster Liquidity; ‘CCC’ Ratings Affirmed

- Fitch Downgrades Oracle’s IDR to ‘BBB+’; Outlook Negative; Rates Notes ‘BBB+’

Term of the Day

Volcano Bonds

Volcano bonds are a type of catastrophe bonds that offer dedicated insurance against volcanic eruptions. A bond sponsored by the Danish Red Cross will be the first to offer dedicated insurance against volcanic eruptions with a plan to raise $3mn. Bloomberg reports that “the payout uses a quantitative model to predict where funds will be needed based on the height of an ash cloud and prevailing winds after a volcanic eruption, but before the dust settles.” The bond will cover 10 volcanoes in Cameroon, Chile, Colombia, Ecuador, Guatemala, Indonesia and Mexico.

Talking Heads

On economic recovery far from complete – Jerome Powell, Federal Reserve Chairman

“The recovery has progressed more quickly than generally expected and looks to be strengthening,” Powell said. “But the recovery is far from complete, so, at the Fed, we will continue to provide the economy the support that it needs for as long as it takes.”

“I don’t think right now we are at substantial forward progress,” Barkin said. “I want to get a good part of the way there before having the conversation about whether we’ve made substantial forward progress,” Barkin said. “Inflation expectations have been firming,” Barkin said. “That’s a good thing, not a bad thing, so long as they don’t get out of whack.”

On bond dip buyers emerging after Treasury selloff hit record speed

Matt Maley, Miller Tabak + Co

“There isn’t any big fundamental news to account for the move,” Maley said. “Instead, I think it’s merely that bonds have become very oversold on a short-term basis.”

Elliot Savage, portfolio manager at YCG Investments

“The way these macro narratives work is that they go to extremes,” said Savage. “When everyone is talking about inflation, inflation, inflation, it’s probably a good idea to fade that and rebalance into things that are contrary to that narrative so I think that’s probably what’s going on.”

Quincy Krosby, chief market strategist at Prudential Financial

“This week will be a test I think for the market because we’ll revisit the seven-year auction,” said Krosby. “But given that this is the end of March, given that this is the end of the quarter, you may see pension funds, particularly pension funds that re-balance their portfolios, perhaps take profit from their equity holdings and begin a bit of buying in Treasuries.

On Risk of China Outflows Along With Other EMs

Li Daokui, a former member of the People’s Bank of China’s monetary policy committee

“It’s just like drinking alcohol: you feel comfortable, but people worry about the after-effect,” he said. “When the stimulus is gone and the U.S. is back to normal, the aftermath will be very damaging to emerging market economies…it’s likely for the second half of this year to see a capital outflow…A lot of the investors are moving out of emerging market economies. China has emerging market characteristics, even though for the time being it is perceived as a stable market because of its relatively better performance in fighting Covid-19″

On China Faces Bond Market Test After Acting as Bastion in Rout

Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd

“Banks are under even greater pressure than last year to digest the bond issuance. The key issue here is that local governments lack funds, and the central government can’t let them be starved of it, therefore it can only let them roll the debt over”.

Hayden Briscoe, head of fixed income for Asia Pacific at UBS Asset Management in Hong Kong

“You should see it (issuance) as a bullish sign for bonds this year, but bearish from a sector perspective on the supply in local governments versus sovereign.”

Top Gainers & Losers – 23-Mar-21*

Other Stories

Boeing enters into $5.28 billion revolving credit agreement

Go back to Latest bond Market News

Related Posts: